My Perfect Mortgage Finds the Best Time for Homeowners to Refinance

The decision to refinance is influenced by multiple factors, including your loan size, the costs, and the potential savings.

ODENTON, MD, UNITED STATES, November 9, 2023 /EINPresswire.com/ -- MyPerfectMortgage.com, an industry-leading mortgage and real estate resource, has created a step-by-step approach homeowners can use to decide the right time to refinance.To help homeowners determine the right outcome, MyPerfectMortgage.com examines the fixed costs associated with refinancing and compares them to example loan scenarios.

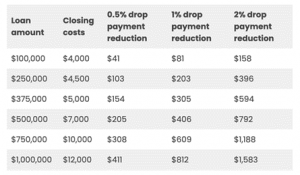

The guide compares a 0.5%, 1%, and 2% drop payment reduction with various loan amounts and closing costs, and examines the number of years it would take to recoup the refinance costs.

While the answer is not one-size-fits-all, the company explains that homeowners can generally expect that the larger their current loan, the more it makes financial sense to refinance.

According to MyPerfectMortage.com, at the national average home price, it would only take three years to break even on refinance costs with a 0.50% rate reduction.

The company also dives into the other reasons refinancing a mortgage may make sense, including:

● Adjusting loan terms

● Consolidating debt

● Accessing home equity

● Repaying the mortgage faster

● Eliminating private mortgage insurance

A 2% rate drop has long been considered the “golden rule” for refinancing, but it’s not right for everyone. A drop as low as 0.5% can make sense for certain borrowers.

It’s more important for homeowners to evaluate their loan size, the fixed costs including an appraisal, title, and credit report, and the potential savings.

Read the full article.

About MyPerfectMortgage: MyPerfectMortgage.com is a leading online mortgage and real estate platform that helps borrowers find the best mortgage products for any situation. With a network of lenders and a team of experienced mortgage professionals, MyPerfectMortgage.com provides a simple and convenient way to compare mortgage options for a new home, investment home, or refinance. For more information, visit the My Perfect Mortgage website.

Contact:

MyPerfectMortgage.com

844-438-5378

help@myperfectmortgage.com

Ken Gemmell

MyPerfectMortgage

+1 301-938-8581

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.