Over $27 Million Was Saved Through Property Tax Protests In Brazos County

With the latest Brazos County hearing statistics, O'Connor was able to reassess the benefits of appealing county assessments.

HOUSTON, TEXAS, UNITED STATES, November 14, 2023 /EINPresswire.com/ -- The previous update on Brazos County property taxes, which was released in July, indicated that the county had saved $7 million. However, the most recent update reveals that the total savings in property taxes for 2023 have now exceeded $27 million. This increased savings of $10 million can be attributed to property owners exercising their right to appeal assessed property values. The Brazos Central Appraisal District is responsible for annually estimating the market value of real and personal property in Brazos County. The data used in this report has been gathered by O’Connor from the initial and current tax rolls provided by the Brazos Appraisal District.In response to Brazos County property tax appeals, O’Connor calculated that the overall savings in 2023 would be $12 million based on data from the Brazos County Property Tax Trends. The projection is based on information on property tax savings from earlier years, however, it falls short of the actual savings realized by Brazos County property owners for 2023.

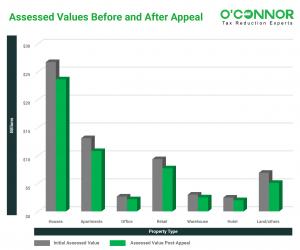

Homeowners have successfully saved a total of $8.3 million in property tax protests for the 2023 tax year. According to the data provided by Brazos Central Appraisal District, a significant number of 9,114 homes protested their assessed values in 2023. On average, both residential and commercial property owners received $33,811 in value reduction, resulting in an average property tax savings of over $913. These calculations are based on a 2.7% tax rate and do not take into account any homestead exemptions.

In Brazos County, where more than 140 multi-family property accounts have been settled via hearings this year, the initial valuation of the apartment property type was $1.3 billion; this value has since been reduced by $230 million, leaving a current assessment of around $1.07 billion. These assessment reductions result in property tax savings for apartment owners of close to $6.2 million based on a 2.7% tax rate. These apartment building owners also have the largest protest savings. In Brazos County, the average reduction in apartment tax objections was 17.60%, with an estimated $42,366 in property tax savings per protest.

The largest decline in assessed value among the 9,123 accounts belongs to land and other property owners in Brazos County (26.15%). With a tax rate of 2.7%, this translates to a hefty tax savings of over $4.8 million for these owners, or about $535 per account. $510 million has been deducted from the initial $690 million valuation.

Based on the completed results, Brazos County hotel owners have decreased their projected value of challenged and settled properties from $247 million to $201 million. This has resulted in a $46 million drop in tax assessments, resulting in a $1.24 million tax savings based on a 2.7% tax rate. As of September 2023, these decisive results apply to a total of 53 hotel establishments. Hotels have enjoyed an average drop of 18.61% since the beginning of the year, resulting in tax savings of $23,479 for the 2023 tax year.

This tax year in Brazos County, the owners of office buildings reached a collective property tax savings totaling $1.3 million for 199 office building tax disputes settled in 2023. The initial valuation of $265 million was subsequently cut to $216 million, resulting in a $49 million reduction in tax assessment. Based on a 2.7% tax rate, the average property tax savings as of September 2023 were $6,664.

The Brazos Central Appraisal District’s original value of $6.42 billion has been reduced to $5.39 billion after 19,262 property owners finished their appeal hearings and emerged from the process with lower valuations. These final values represent an average drop of 16% across all Brazos County property categories whose finished 2023 hearings resulted in reduced property values.

The conclusion of the 2023 property tax hearings marks the end of the evaluation process, shedding light on the potential financial gain property owners can achieve by exercising their right to appeal and subsequently reducing their assessed value. Currently, the Brazos Central Appraisal District has a staff of 29 individuals responsible for assessing all properties in Brazos County. Considering the sheer volume of houses to evaluate, it is challenging to believe that the assessments made by these 29 staff members can be entirely accurate.

This article includes only information about accounts that result in a reduction. On average, about 40 to 60% of tax parcels in Brazos County are successful in protesting their property taxes each year. O’Connor has had the opportunity to compare the initial tax assessments released by the Brazos County appraisal district in September 2023 with the property values released after the protest hearings were completed. Observing the significant amount of tax dollars that property owners can save by challenging their values should motivate others to carefully review their annual assessments and utilize the appeal process, either by themselves or with the help of a property tax consultant.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.