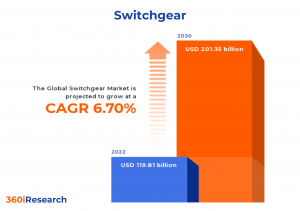

Switchgear Market worth $201.35 billion by 2030, growing at a CAGR of 6.70% - Exclusive Report by 360iResearch

The Global Switchgear Market to grow from USD 119.81 billion in 2022 to USD 201.35 billion by 2030, at a CAGR of 6.70%.

PUNE, MAHARASHTRA, INDIA, November 9, 2023 /EINPresswire.com/ -- The "Switchgear Market by Voltage (1–36 kV, 36–72.5 kV, < 1 kV), Equipment (Circuit Breakers, Fuses, Isolators), Insulation Media, End-User, Installation - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Switchgear Market to grow from USD 119.81 billion in 2022 to USD 201.35 billion by 2030, at a CAGR of 6.70%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/switchgear?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

A switchgear is an electrical device that ensures safety, control, and reliability in the transmission and distribution of electric power by protecting, controlling, and isolating various electrical system elements. It is employed for applications encompassing voltage levels ranging from low to high, including residential, industrial, and utility sectors. The primary purpose of a switchgear is to safeguard electronic equipment by preventing electrical overloads and short circuits. Rising demand for electricity owing to rapid urbanization and industrialization in developing countries, expansion of smart grids, and increasing investments in renewable energy sources are leading to increased demand for switchgear. However, high initial costs associated with developing and installing advanced switchgear, complex manufacturing processes requiring skilled labor, and fluctuating raw material prices affecting overall production costs may adversely impact the production and usage of switchgear by the end-use sectors worldwide. Moreover, the integration of advanced communication and automation technologies into modern devices and the ongoing deployment of microgrids in remote locations is expected to increase the deployment of switchgear in the end-use applications globally.

Insulation Media: Extensive demand for switchgear with air-based insulation media

Air-insulated switchgear (AIS) utilizes atmospheric air as the insulating medium and is preferred due to its simplicity, cost-effectiveness, and ease of maintenance. It is well-suited for medium voltage applications where space constraints are not significant concerns. Fluid-insulated switchgear (FIS) uses dielectric fluids such as mineral oil or synthetic esters as insulating media. They are used in high-voltage applications requiring robust insulation properties, compact design, and reduced fire hazards. Fluid insulation is preferred in environments where high levels of moisture or contamination pose challenges to air insulation. Gas-insulated switchgear (GIS) uses sulfur hexafluoride (SF6) gas as the insulating medium and exhibits excellent electrical properties, including high dielectric strength and arc quenching ability, making it suitable for high-voltage applications. It also offers significant advantages, including reduced space requirements, increased reliability, minimal maintenance needs, and improved safety features compared to its air and fluid counterparts. AIS systems are economical, simple, and easy to maintain; FIS offers compact high-voltage solutions with reduced fire hazards, and GIS systems provide a reliable and safe solution for high-voltage applications with minimal space requirements.

Equipment: Significant penetration of circuit breakers in switchgear

Circuit breakers are essential components in switchgear systems, designed to interrupt high currents and protect electrical equipment from damage caused due to overload or short circuits. Need-based preferences for circuit breakers include low-voltage applications for residential and commercial buildings, medium-voltage applications for industrial plants, and high-voltage applications for power transmission and distribution. Fuses offer overcurrent protection similar to circuit breakers but with different design principles. They consist of a metal wire that melts when excessive current flows through it, disconnecting the circuit to prevent potential damage. Isolators are safety devices used in switchgear systems to ensure that electrical circuits can be effectively isolated from the primary power source during maintenance or repair work without causing any harm to the personnel or equipment involved. Relays are electromechanical or electronic devices that control the flow of electricity in a circuit by opening or closing contacts in response to input voltage or current changes. Based on specific needs, users prefer relays according to their types, functions, and applications. Switches play a vital role in controlling the flow of electrical power within a circuit by making or breaking connections between conductors. Preferences for switches vary based on factors such as type, functionality, application, and voltage levels.

Voltage: Substantial usage of > 72.5 kV in large electrical infrastructures

Switchgear, the range of 1 to 36 kV, is used in various applications such as power distribution, industrial plants, and infrastructure projects where high reliability is critical. The switchgear has voltage levels between 36 and 72.5 kV, primarily used in transmission systems for power generation facilities and large-scale renewable energy projects such as wind farms and solar parks. Switchgears below 1 kV are used for low-voltage applications, including residential and commercial buildings, data centers, and small-scale industrial plants. These switchgear are preferred for compact size, safety features, and cost-effectiveness. The high-voltage switchgear includes voltage levels above 72.5 kV and is widely used in extra-high voltage (EHV) and ultra-high voltage (UHV) transmission networks. Each type of switchgear caters to different needs based on the scale of operations and application requirements.

Installation: Expanding applications of outdoor switchgear in energy distribution systems

Indoor switchgear is primarily designed for installations within enclosed spaces such as industrial plants, commercial buildings, or substations due to its compact design and efficient protection against external factors such as weather conditions, dust accumulation, or air pollution. Switchgear provides improved safety for personnel with reduced exposure to live electrical components and better control over internal environmental conditions, including humidity. Outdoor switchgear is designed to withstand external environmental factors such as extreme temperatures, humidity, or precipitation. These installations are primarily used in power generation plants, transmission and distribution substations, or other large-scale commercial and industrial projects. The ability to accommodate larger equipment sizes with higher voltage capacities and easier access for maintenance or inspection due to open-air installation setups fuel the use of outdoor switchgear across end-use applications. Indoor switchgears provide better protection against environmental factors and improved safety conditions for personnel, while outdoor switchgears offer advantages such as larger equipment capacities and easier maintenance access.

End-User: Proliferating use of switchgear in transmission & distribution utilities

In commercial and residential infrastructure, switchgear components are essential for power distribution and network protection. The rising demand for reliable electricity supply, along with rapid urbanization and construction activities, necessitates the installation of advanced switchgear systems in commercial and residential buildings. Switchgears are crucial for manufacturing and process industries as they ensure consistent power supply while protecting electrical equipment from potential faults or short circuits. Industries such as oil & gas, chemicals, steel production, and automotive manufacturing require high-capacity switchgear to accommodate their heavy-duty operations. The switchgears with enhanced durability, ease of maintenance, arc-resistant designs, and integration with industrial automation systems are preferred for installation in manufacturing and process industries. Switchgear systems are vital for transmission & distribution utilities in maintaining grid stability, managing power flow, and preventing equipment damage from overloads or faults. Utilities prioritize reliability, safety, cost-effectiveness, and low environmental impact when choosing switchgear solutions. Commercial & residential infrastructure users demand energy efficiency and smart control capabilities; manufacturing & process industries require durability and seamless integration with existing processes, whereas transmission & distribution utilities prioritize safety and grid stability.

Regional Insights:

The switchgear market represents a developing landscape in the Americas due to its well-established power infrastructure, continuous upgrades of aging electrical infrastructure, and requirements for renewable energy integration into existing grids. South America experiences a similar trend due to rapid urbanization leading to higher electricity consumption levels across major cities, driving demand for efficient electrical components, including switchgear. The APAC region represents growing markets for switchgear attributed to economic development resulting in rapid urbanization & industrialization investments in smart grid technology development, renewable energy projects, and infrastructure upgrades to improve their power distribution networks. Moreover, governments in the APAC region promote rural electrification initiatives, further fueling the demand for electrical components such as switchgear. The EMEA region's switchgear market is primarily driven by the need to modernize existing European infrastructure and address growing energy demands in emerging economies within the Middle East and Africa and stringent government regulations. In addition to this push for green energy transition in Europe, Middle Eastern countries invest heavily in developing robust power infrastructures to support their economic growth. However, the growing emphasis of the switchgear manufacturers on R&D and securing patents for cutting-edge switchgear are anticipated to increase their deployment in the electrical grid infrastructure across the globe.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Switchgear Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Switchgear Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Switchgear Market, highlighting leading vendors and their innovative profiles. These include ABB Ltd., Abunayyan Holding, ACTOM (Pty) Ltd, ALSTOM SA, Bharat Heavy Electricals Limited, CG Power and Industrial Solutions Limited, China Transpowers Electric Co., Limited, CHINT Group Corporation, E-Abel, Eaton Corporation PLC, ELEKTROBUDOWA Sp. z o. o., Fuji Electric Co., Ltd., Gelpag Advanced Technology GmbH, General Electric Company, Havells India Limited, Hitachi, Ltd., Hubbell Incorporated, Hyosung Heavy Industries Corporation, Hyundai Electric & Energy Systems Co., Ltd., Industrial Electric Mfg., Kirloskar Electric Co. Ltd., Larsen & Toubro Limited, Legrand SA, Lucy Group Ltd., Meidensha Corporation, Mitsubishi Electric Corporation, NOJA Power Switchgear Pty Ltd, nuventura GmbH, OMRON Corporation, Orecco Electric, Panasonic Holdings Corporation, Peco Industries, Powell Industries, Inc., Power Grid Components, Inc., Regal Rexnord Corporation, Schneider Electric SE, Siemens AG, Switchgear Power Systems LLC, Tavrida Electric AG, Toshiba Corporation, Vertiv Holdings Co, WEG S.A., and ZPUE SA.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/switchgear?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Switchgear Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Voltage, market is studied across 1–36 kV, 36–72.5 kV, < 1 kV, and > 72.5. The 36–72.5 kV commanded largest market share of 34.24% in 2022, followed by > 72.5.

Based on Equipment, market is studied across Circuit Breakers, Fuses, Isolators, Relays, and Switches. The Circuit Breakers commanded largest market share of 23.97% in 2022, followed by Switches.

Based on Insulation Media, market is studied across Air, Fluid, and Gas. The Air commanded largest market share of 63.89% in 2022, followed by Gas.

Based on End-User, market is studied across Commercial & Residential Infrastructure, Manufacturing & Process Industries, and Transmission & Distribution Utilities. The Transmission & Distribution Utilities commanded largest market share of 53.65% in 2022, followed by Manufacturing & Process Industries.

Based on Installation, market is studied across Indoor and Outdoor. The Indoor commanded largest market share of 62.77% in 2022, followed by Outdoor.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Asia-Pacific commanded largest market share of 38.22% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Switchgear Market, by Voltage

7. Switchgear Market, by Equipment

8. Switchgear Market, by Insulation Media

9. Switchgear Market, by End-User

10. Switchgear Market, by Installation

11. Americas Switchgear Market

12. Asia-Pacific Switchgear Market

13. Europe, Middle East & Africa Switchgear Market

14. Competitive Landscape

15. Competitive Portfolio

16. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Switchgear Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Switchgear Market?

3. What is the competitive strategic window for opportunities in the Switchgear Market?

4. What are the technology trends and regulatory frameworks in the Switchgear Market?

5. What is the market share of the leading vendors in the Switchgear Market?

6. What modes and strategic moves are considered suitable for entering the Switchgear Market?

Read More @ https://www.360iresearch.com/library/intelligence/switchgear?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.