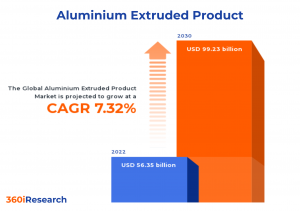

Aluminium Extruded Product Market worth $99.23 billion by 2030 - Exclusive Report by 360iResearch

The Global Aluminium Extruded Product Market to grow from USD 56.35 billion in 2022 to USD 99.23 billion by 2030, at a CAGR of 7.32%.

PUNE, MAHARASHTRA, INDIA , November 8, 2023 /EINPresswire.com/ -- The "Aluminium Extruded Product Market by Product (Anodized, Mill-Finished, Powder-Coated), Alloy (1000 Series Aluminum, 2000 Series Aluminum Alloy, 3000 Series Aluminum Alloy), End-User - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Aluminium Extruded Product Market to grow from USD 56.35 billion in 2022 to USD 99.23 billion by 2030, at a CAGR of 7.32%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/aluminium-extruded-product?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Aluminum extrusion is a well-established technique for making intricate forms and designs with aluminum alloys. This extrusion procedure includes forcing molten aluminum through a die to create a particular shape, which is then cooled and solidified. Aluminum extruded products have various shapes, including standard & custom shapes, structural & decorative shapes, and hollow & solid shapes. In recent years, rising construction activities and expanding automotive manufacturing are driving the demand for aluminum extruded products. Aluminum plays an essential role in the automotive industry owing to its reduced weight, which provides fuel efficiency. However, the high cost of an aluminum extrusion facility setup and certain limitations related to the aluminum extrusion process can hamper the market development. Aluminum extruded processes and products have undergone numerous advances and developments over the years, offering more efficient and cost-effective end products. In recent years the market has witnessed new technologies, such as 3D printing technology, nanostructured aluminum, and robotic technology, that enhance the extrusion process and produce improved extruded products.

Alloy: Accelerating use of 7000 series aluminum alloy in automotive and aerospace industries

1000 series aluminum, also known as pure aluminum, contains at least 99% aluminum content and is used in applications requiring improved corrosion resistance and high thermal and electrical conductivity. Common products made of this alloy include electrical conductors, chemical equipment, and heat exchangers. 2000 series aluminum alloy is primarily composed of copper as the major alloying element. This series provides high strength while maintaining good machinability and is widely used in the aerospace industry for aircraft structures and fittings. The 3000 series aluminum alloy contains manganese as the primary alloying element, offering moderate strength and excellent formability compared to other alloys. This series is primarily used in cooking utensils, radiators, air conditioning systems, and architectural panels. 4000 series aluminum alloy, with silicon as its primary alloying element, is known for its improved castability and good resistance to high temperatures. This series is primarily used in welding wire, automotive components, and heat exchanger applications. The 5000 series aluminum alloy contains magnesium as the primary alloying element, providing excellent corrosion resistance, medium to high strength, and good weldability. It is widely used in marine applications and transportation industries such as shipbuilding and automotive manufacturing. 6000 series aluminum alloy contains magnesium and silicon as the major alloying elements that balance strength, corrosion resistance, formability, and machinability. This series is commonly used in construction for structural applications, including window frames and door panels. The 7000 series aluminum alloy is characterized by its high strength and excellent fatigue resistance due to zinc as the primary alloying element. This series is widely used in aircraft components, automotive performance parts, and military equipment applications.

Product: Significant penetration of anodized aluminum extrusion products

Anodized aluminum extrusion products undergo an electrochemical process, which creates a protective layer on the surface, enhancing durability and resistance to corrosion. This finish is popular for its aesthetic qualities, as it provides a consistent color and texture on the surface, making it ideal for architectural applications such as window frames, building facades, and railings. Moreover, anodized aluminum is preferred in electronic enclosures and automotive components due to its electrical insulation properties. Mill-finished aluminum extrusions are products with no additional treatment after being extruded from the die. They possess a naturally occurring oxide layer on their surface, which offers essential protection against corrosion, which is often used for applications where appearance is not crucial. Mill-finished extrusions find extensive use in structural components of industrial machinery, heavy-duty frameworks, and marine construction. Powder-coated aluminum extrusions are coated with a dry powder cured at high temperatures, forming a durable and visually appealing finish. This coating provides better resistance to corrosion than mill-finished products and offers a wide range of colors for architectural and decorative applications such as storefronts, curtain walls, and outdoor furniture. Powder-coated aluminum extrusions are preferred for their low environmental impact since they emit negligible volatile organic compounds (VOCs) during application. Anodized aluminum offers superior durability and corrosion resistance compared to mill-finished products, making it suitable for harsh environments or applications where aesthetics are essential. Powder-coating provides similar benefits in terms of appearance with the added advantage of lower environmental impact during production. However, both anodizing and powder-coating involve additional processing costs compared to mill-finished extrusions, which might make them less preferable in cost-sensitive applications where essential protection against corrosion is needed.

End-User: Increasing applications of aluminum extruded products with the burgeoning construction sector

In the aerospace industry, aluminum extruded products are preferred due to their lightweight nature, high tensile strength, and corrosion resistance. The automotive sector demands aluminum extruded products attributed to their weight reduction potential that aids in fuel efficiency improvements while maintaining structural integrity. In construction projects, including commercial and residential, aluminum extruded products are favored for their durability against environmental conditions and their versatility in design possibilities such as facade cladding systems or curtain wall supports. The electrical & electronic segment relies on aluminum extruded products for their excellent thermal conductivity, electric current carrying capacity, and compatibility with various connectors, including bus bars or heat sinks. Aluminum extruded products find extensive usage within the transportation & logistic sector due to their lightweight characteristics, contributing to reduced fuel consumption and enhanced load-carrying capabilities for rail cars, truck trailers, marine vessels, or cargo containers.

Regional Insights:

The Americas showcase the significant landscape for the aluminum extruded product market owing to the large-scale end-user industries, such as aerospace and construction. In addition, the increasing trade of raw aluminum from Canada supports the growth of the aluminum extruded product market in the Americas. In Asia-Pacific, particularly in China and India, the substantial manufacturers of aluminum extruded products provide a positive landscape for market growth. The expanding automotive industries, rising electric vehicle manufacturing, and development in the electronics industry in the Asia-Pacific region increase the penetration potential for aluminum extruded products. The European government's support for lightweight, high-performance, and sustainable aluminum products propels the demand for aluminum extruded products.

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Aluminium Extruded Product Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Aluminium Extruded Product Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Aluminium Extruded Product Market, highlighting leading vendors and their innovative profiles. These include Akzo Nobel N.V., Alom Group, AluFab, Inc., Arconic Corp., Bahrain Aluminum Extrusion Company, BRT Extrusions, Inc., Capalex by Capital Aluminium Extrusions Limited, Central Aluminum Company, Century Extrusions Limited, China Zhongwang Holdings Limited, Constellium SE, Gabrian International Ltd., Global Aluminium Pvt. Ltd., GSH Industries, Gulf Extrusions Co. LLC, Hindalco Industries Limited, Impol 2000, d. d., Integrated Extrusion by United Integration, Jindal Aluminium Limited, Kaiser Aluminum Corporation, Maan Aluminium Ltd., Momentum Manufacturing Group, LLC, Norsk Hydro ASA, Padmawati Extrusion Pvt. Ltd., Penn Aluminum International LLC, PSI Industries, Inc., Qatar Industrial Manufacturing Company, Rio Tinto PLC, RusAL, Simmal Ltd., Source International, Superfine Group, Taber Extrusions LLC, Talan Products Inc., Talco Extrusion LLP, Tredegar Corporation, Wellste Aluminum, and Zahit Aluminium.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/aluminium-extruded-product?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Aluminium Extruded Product Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Product, market is studied across Anodized, Mill-Finished, and Powder-Coated. The Anodized commanded largest market share of 39.21% in 2022, followed by Mill-Finished.

Based on Alloy, market is studied across 1000 Series Aluminum, 2000 Series Aluminum Alloy, 3000 Series Aluminum Alloy, 4000 Series Aluminum Alloy, 5000 Series Aluminum Alloy, 6000 Series Aluminum Alloy, and 7000 Series Aluminum Alloy. The 4000 Series Aluminum Alloy commanded largest market share of 21.23% in 2022, followed by 5000 Series Aluminum Alloy.

Based on End-User, market is studied across Aerospace, Automotive, Construction, Electrical & Electronic, and Transportation & Logistic. The Electrical & Electronic commanded largest market share of 30.57% in 2022, followed by Transportation & Logistic.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Asia-Pacific commanded largest market share of 36.97% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Aluminium Extruded Product Market, by Product

7. Aluminium Extruded Product Market, by Alloy

8. Aluminium Extruded Product Market, by End-User

9. Americas Aluminium Extruded Product Market

10. Asia-Pacific Aluminium Extruded Product Market

11. Europe, Middle East & Africa Aluminium Extruded Product Market

12. Competitive Landscape

13. Competitive Portfolio

14. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Aluminium Extruded Product Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Aluminium Extruded Product Market?

3. What is the competitive strategic window for opportunities in the Aluminium Extruded Product Market?

4. What are the technology trends and regulatory frameworks in the Aluminium Extruded Product Market?

5. What is the market share of the leading vendors in the Aluminium Extruded Product Market?

6. What modes and strategic moves are considered suitable for entering the Aluminium Extruded Product Market?

Read More @ https://www.360iresearch.com/library/intelligence/aluminium-extruded-product?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.