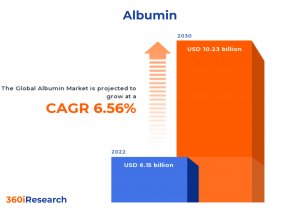

Albumin Market worth $10.23 billion by 2030, growing at a CAGR of 6.56% - Exclusive Report by 360iResearch

The Global Albumin Market to grow from USD 6.15 billion in 2022 to USD 10.23 billion by 2030, at a CAGR of 6.56%.

PUNE, MAHARASHTRA, INDIA, November 8, 2023 /EINPresswire.com/ -- The "Albumin Market by Source (Animal Sources, Plant Sources), Type (Non-Recombinant, Recombinant), Application, End User - Global Forecast 2023-2030" report has been added to 360iResearch.com's offering.The Global Albumin Market to grow from USD 6.15 billion in 2022 to USD 10.23 billion by 2030, at a CAGR of 6.56%.

Request a Free Sample Report @ https://www.360iresearch.com/library/intelligence/albumin?utm_source=einpresswire&utm_medium=referral&utm_campaign=sample

Albumin is a complex and versatile protein that constitutes approximately 50%-60% of the total protein content in human blood plasma. It is synthesized predominantly by the liver and plays an essential role in physiological functions, such as maintaining osmotic pressure, binding and transporting various molecules, and acting as an antioxidant. Albumin's importance lies in its multifaceted contributions to overall health and well-being, making it a significant biomarker for assessing an individual's disease risk and clinical status. The growing usage of albumin in clinical settings for the treatment of burns and the rising prevalence of liver diseases where patients require a regular supply of HSA to maintain proper health functions has accelerated the use of albumin worldwide. However, risks associated with contamination and transmission of infectious agents in HSA products sourced from pooled human plasma donations impact albumin usage. Stringent regulatory guidelines for product approvals in different regions also affect the commercialization of albumin. Market players are investing in research and development initiatives that explore innovative production methods, such as plant-based expression systems or microbial fermentation processes capable of yielding high-quality albumin products at lower costs. New opportunities are emerging with the evolution of biotechnological advancements that enable the production of recombinant human albumins (rHA) through genetic engineering techniques.

End-User: Extensive end-users of the albumin in hospitals and blood banks

The major end-users of albumin can be categorized into primary sectors including, hospitals & clinics, pharmaceutical & biotechnology companies, academic research institutes, and blood banks. These establishments utilize albumin products for various purposes such as drug formulation, diagnostics, vaccine manufacturing, clinical nutrition support, cell culture growth media supplementation, and blood volume expansion. In hospitals & clinics Albumin is often employed to treat patients suffering from hypoalbuminemia – a condition characterized by low levels of albumin in the blood – caused by critical illness or injury. Additionally, it is utilized for fluid resuscitation during surgeries or trauma cases where blood loss has occurred. In recent years, albumin has also gained popularity as a component of parenteral nutrition formulas providing essential proteins needed for patients who are unable to consume food orally. Moreover, blood banks utilize it as a plasma expander to increase blood volume in patients undergoing blood transfusion or those with severe blood loss due to trauma, surgery, or other conditions. Albumin solutions can help maintain osmotic pressure, stabilize hemodynamic parameters, and improve overall circulatory function during such critical situations.

Type: Enhanced emphasis on the research and development of recombinant albumin as a synthetic protein to promote recombinant DNA technology

Non-recombinant albumin is derived from natural sources, primarily human and bovine serum. It is widely used in pharmaceutical formulations, diagnostics, cell culture media, and medical devices due to its stabilizing properties for proteins and enzymes. The need-based preference for non-recombinant albumin arises from its availability in large quantities as a byproduct of blood fractionation processes. Recombinant albumin is produced using genetically engineered expression systems such as yeast and mammalian cells. It eliminates the risk of contamination with pathogens and offers a more consistent and sustainable supply compared to non-recombinant albumin. Recombinant albumin is mainly used in drug delivery systems, vaccines, cell therapy applications, and regenerative medicine. The preference for recombinant albumin is driven by its safety profile, as it is free from human or animal-derived components which may carry potential risks of transmitting infectious agents.

Application: Rising focus on vaccine manufacturing and drug delivery applications

Albumin is widely used as a cosmetic ingredient due to its excellent water-binding properties, enhancing skin hydration and elasticity. In the biotechnology industry, albumin serves as an essential component of culture media to support cell growth and proliferation. Albumin's drug delivery application capitalizes on its ability to bind various molecules while maintaining stability in different conditions. Albumin is employed in various products as a food ingredient due to its functional properties, such as emulsification and foaming. Albumin-based therapeutics are employed in treatments for conditions such as hypoalbuminemia and burns. Moreover, vaccine manufacturers use albumins as stabilizers or preservatives to enhance vaccine stability during storage and transportation.

Source: Consumer shift toward the plant-based albumins due to enhanced sustainability for specific therapeutic purposes.

Albumin, an important protein in the blood, plays essential role in maintaining fluid balance and transporting hormones, fatty acids, and drugs. The two primary albumin sources are animal-based and plant-based. Animal-derived albumin is obtained from bovine serum (BSA), human plasma (HSA), and ovalbumin. Bovine serum albumin (BSA) is a vital ingredient in various applications, such as diagnostic reagents, vaccines, and cell culture media. BSA is widely utilized in diagnostics and research due to its affordability and accessibility. Human serum albumin (HSA) is preferred for certain clinical situations, such as drug delivery systems or volume expansion therapies, due to its biocompatibility with humans. HSA is used in medical emergencies such as burns treatment and cardiopulmonary bypass surgery. In recent years, plant-based alternatives have emerged as a sustainable option for albumin production due to their reduced environmental impact and potential allergen risks. Plant-derived albumins, including rice and soy protein, are gaining popularity as alternatives to animal-derived counterparts for applications in food & beverage production, pharmaceuticals, and cosmetics. Comparatively, animal-derived albumins have established medical applications, although they pose a risk of disease transmission. In contrast, plant-based albumins offer sustainability with minimal contamination risk but may lack compatibility for specific therapeutic purposes. However, consumer trends to preferences to choose products between animal or plant-based albumins depend on factors such as application purpose, purity requirements, sustainability concerns, and potential risks associated with animal proteins.

Regional Insights:

The Americas albumin market is advancing, driven by investments by pharmaceutical companies investing heavily in research and technology to develop advanced albumin formulations. Regulatory bodies such as the Food and Drug Administration (FDA) in the U.S. enforce strict quality control measures to assure safety standards of albumin. The FDA has also given approval for certain albumin products in recent years. Technological advancements such as recombinant HSA production are being researched across the U.S. and Canada to potentially reduce dependency on human plasma donations for albumin supply. The Asian albumin market is experiencing rapid expansion fueled by increasing healthcare expenditure and improving medical infrastructure in emerging countries demanding plasma-derived products for therapeutic purposes, including liver disease treatment, surgeries, and intensive care support. Europe is a potential contributor to the global albumin market, with an established consumption base and robust manufacturing capabilities. The use of albumin in Europe is primarily focused on critical care applications such as sepsis management, volume replacement therapies, and therapeutic plasma exchange procedures. The European Medicines Agency (EMA) regulates the production and distribution of albumin within the European Union (EU).

FPNV Positioning Matrix:

The FPNV Positioning Matrix is essential for assessing the Albumin Market. It provides a comprehensive evaluation of vendors by examining key metrics within Business Strategy and Product Satisfaction, allowing users to make informed decisions based on their specific needs. This advanced analysis then organizes these vendors into four distinct quadrants, which represent varying levels of success: Forefront (F), Pathfinder (P), Niche (N), or Vital(V).

Market Share Analysis:

The Market Share Analysis offers an insightful look at the current state of vendors in the Albumin Market. By comparing vendor contributions to overall revenue, customer base, and other key metrics, we can give companies a greater understanding of their performance and what they are up against when competing for market share. The analysis also sheds light on just how competitive any given sector is about accumulation, fragmentation dominance, and amalgamation traits over the base year period studied.

Key Company Profiles:

The report delves into recent significant developments in the Albumin Market, highlighting leading vendors and their innovative profiles. These include Aadi Bioscience, Inc., Agilent Technologies, Inc., Akron Biotech, Atlantis Bioscience Pte Ltd., Avantor Inc., Baxter International Inc., Becton, Dickinson and Company, Bio Products Laboratory Ltd., Bio-Rad Laboratories, Inc., Bio-Techne Corporation, Biogenix Inc. Pvt. Ltd., Biophyll GmbH, Biorbyt Ltd., Biowest SAS, Boston BioProducts Inc., Bristol-Myers Squibb Company, CENTURION PHARMA İlaç Sanayi ve Ticaret A.Ş., China Biologic Products Holdings, Inc. by Taibang Biologic Group, CSL Limited, Dem İlaç, F. Hoffmann-La Roche AG, GC Biopharma Corp., Glentham Life Sciences Limited, Grifols SA, InVitria, InVitroCare Inc., Kedrion S.p.A, Kraeber & Co. GmbH, Lazuline Biotech Private Limited, LGC Science Group Holdings Limited, Merck KGaA, Midas Pharma GmbH, Octapharma AG, Promega Corporation, Prospec-Tany Technogene Ltd., Rockland Immunochemicals Inc., Rocky Mountain Biologicals, LLC, Sartorius AG, Serion GmbH, SK Plasma, Takeda Pharmaceuticals Company Limited, Thermo Fisher Scientific Inc., Ventria Bioscience Inc., and VitroScient.

Inquire Before Buying @ https://www.360iresearch.com/library/intelligence/albumin?utm_source=einpresswire&utm_medium=referral&utm_campaign=inquire

Market Segmentation & Coverage:

This research report categorizes the Albumin Market in order to forecast the revenues and analyze trends in each of following sub-markets:

Based on Source, market is studied across Animal Sources and Plant Sources. The Animal Sources is further studied across Bovine Serum Albumin, Human Serum Albumin, and Ovalbumin. The Animal Sources commanded largest market share of 95.46% in 2022, followed by Plant Sources.

Based on Type, market is studied across Non-Recombinant and Recombinant. The Non-Recombinant commanded largest market share of 58.46% in 2022, followed by Recombinant.

Based on Application, market is studied across Cosmetic Ingredient, Culture Media, Drug Delivery, Food Ingredient, Therapeutic, and Vaccine Ingredient. The Therapeutic commanded largest market share of 34.47% in 2022, followed by Drug Delivery.

Based on End User, market is studied across Pharmaceutical & Biotechnology and Research Institutes. The Pharmaceutical & Biotechnology commanded largest market share of 63.25% in 2022, followed by Research Institutes.

Based on Region, market is studied across Americas, Asia-Pacific, and Europe, Middle East & Africa. The Americas is further studied across Argentina, Brazil, Canada, Mexico, and United States. The United States is further studied across California, Florida, Illinois, New York, Ohio, Pennsylvania, and Texas. The Asia-Pacific is further studied across Australia, China, India, Indonesia, Japan, Malaysia, Philippines, Singapore, South Korea, Taiwan, Thailand, and Vietnam. The Europe, Middle East & Africa is further studied across Denmark, Egypt, Finland, France, Germany, Israel, Italy, Netherlands, Nigeria, Norway, Poland, Qatar, Russia, Saudi Arabia, South Africa, Spain, Sweden, Switzerland, Turkey, United Arab Emirates, and United Kingdom. The Americas commanded largest market share of 39.35% in 2022, followed by Europe, Middle East & Africa.

Key Topics Covered:

1. Preface

2. Research Methodology

3. Executive Summary

4. Market Overview

5. Market Insights

6. Albumin Market, by Source

7. Albumin Market, by Type

8. Albumin Market, by Application

9. Albumin Market, by End User

10. Americas Albumin Market

11. Asia-Pacific Albumin Market

12. Europe, Middle East & Africa Albumin Market

13. Competitive Landscape

14. Competitive Portfolio

15. Appendix

The report provides insights on the following pointers:

1. Market Penetration: Provides comprehensive information on the market offered by the key players

2. Market Development: Provides in-depth information about lucrative emerging markets and analyzes penetration across mature segments of the markets

3. Market Diversification: Provides detailed information about new product launches, untapped geographies, recent developments, and investments

4. Competitive Assessment & Intelligence: Provides an exhaustive assessment of market shares, strategies, products, certification, regulatory approvals, patent landscape, and manufacturing capabilities of the leading players

5. Product Development & Innovation: Provides intelligent insights on future technologies, R&D activities, and breakthrough product developments

The report answers questions such as:

1. What is the market size and forecast of the Albumin Market?

2. Which are the products/segments/applications/areas to invest in over the forecast period in the Albumin Market?

3. What is the competitive strategic window for opportunities in the Albumin Market?

4. What are the technology trends and regulatory frameworks in the Albumin Market?

5. What is the market share of the leading vendors in the Albumin Market?

6. What modes and strategic moves are considered suitable for entering the Albumin Market?

Read More @ https://www.360iresearch.com/library/intelligence/albumin?utm_source=einpresswire&utm_medium=referral&utm_campaign=analyst

Mr. Ketan Rohom

360iResearch

+1 530-264-8485

ketan@360iresearch.com

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.