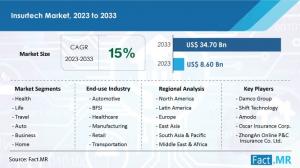

InsurTech Market Is Expected to Reach a Valuation of US$ 34.7 Billion by 2033

The US Insurtech Market Is a Hub of Innovation with Startups and Established Players Driving Change

ROCKVILLE, MARYLAND, UNITED STATES, October 10, 2023 /EINPresswire.com/ -- The insurance sector, traditionally characterized by well-established practices, has experienced a surge of innovation in recent years, driven by the emergence of insurtech companies in the United States. Within this dynamic landscape, the U.S. insurtech market has become a hub of innovation, where both startups and established industry players are catalyzing change and reshaping the field.Globally, the insurtech market size is on a trajectory of significant expansion, projected to grow from a value of US$ 8.6 billion in 2023 to a substantial US$ 34.7 billion by the end of 2033. This rapid growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 15%. A pivotal factor contributing to the increasing size of the insurtech market is the escalating volume of insurance claims worldwide.

For more insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=6191

Changing consumer expectations stand as a paramount catalyst in propelling the insurtech market forward. Modern consumers now demand seamless and convenient experiences, and they hold similar expectations from their insurance providers. Insurtech firms leverage digital channels to provide online access to information, facilitate policy purchases, and streamline claims management, thereby enhancing the accessibility and convenience of insurance services for customers.

Furthermore, the growth of the insurtech market is significantly influenced by the Internet of Things (IoT). The proliferation of connected devices, such as wearables, telematics devices, and smart home gadgets, generates vast volumes of data that hold immense potential for assessing risks, preventing losses, and tailoring personalized insurance solutions. Insurtech service providers harness this data to create innovative offerings such as usage-based insurance, pay-as-you-go policies, and preventive insurance. These innovations lead to more precise pricing structures and customized coverage options, aligning insurance solutions more closely with individual needs and preferences.

Key Takeaways from Market Study:

-Sales of insurtech services are predicted to increase at a CAGR of 15% from 2023 to 2033.

-The United Kingdom is a prominent insurtech market in the European region due to the introduction of value-added customer services.

-With a high number of insurtech companies, Singapore leads the insurtech market in the Asia Pacific region.

-Key market players and start-ups are reshaping the insurance sector in the United States.

“Blockchain technology is effective in simplifying claim process, and enhancing trust and security in the insurance value chain,” says a Fact.MR analyst.

Competitive Landscape:

Insurtech start-ups are entering the market and using cutting-edge innovations to offer coverage to a more technologically savvy clientele. Technology can streamline and automate various processes in the insurance value chain, leading to high operational efficiency and cost savings. Insurtech start-ups may employ technologies such as AI, data analytics, and automation to optimize underwriting, claims processing, customer service, and other areas, which can result in improved profitability and scalability.

Regulatory restrictions have been lowered in some places. For instance, insurtech companies have been encouraged to test their novel business ideas on particular client groups in Australia, Singapore, and the United Kingdom without being required to adhere to the entire regulatory framework that applies to incumbents.

Top 3 Insurtech Start-ups :

Lemonade: Lemonade is a New York-based insurtech start-up that has gained widespread attention for its innovative approach to home and renters insurance. Using artificial intelligence (AI) and machine learning (ML), Lemonade offers a simple and transparent insurance experience through its mobile app. Customers can get quotes, purchase policies, file claims, and receive payouts in a matter of minutes, all with a focus on a seamless, digital-first customer experience.

Root Insurance: Root Insurance is an insurtech company that offers personalized auto insurance based on telematics data collected from a mobile app. By using data-driven insights, Root Insurance aims to provide fair and transparent pricing for auto insurance, rewarding safe driving behaviour with lower premiums. Root Insurance has gained traction in the industry for its innovative approach to auto insurance and has expanded its offerings to include home insurance as well.

Hippo Insurance: Hippo Insurance is a California-based insurtech company that specializes in home insurance. Hippo uses data analytics and AI to provide homeowners with more comprehensive coverage and proactive risk management. Its online platform allows homeowners to get information, purchase a policy, and manage their insurance needs with ease. Hippo Insurance has also expanded its offerings to include smart home devices that can help prevent damages and losses.

Key Companies Profiled:

-Alan SA

-Shift Technology

-Clover Health

-Cytora Ltd.

-simplesurance GmbH

-Haven Life Insurance Agency LLC

-Quantemplate Technologies Inc.

-Oscar Insurance Corp.

-Trov Insurance Solutions LLC

-ZhongAn Online P&C Insurance Co. Ltd.

-Damco Group

-Amodo

Country-specific Examination:

Insurtech Innovators Transforming the Conventional Insurance Landscape in the United States:

In recent years, the insurance sector, long characterized by its adherence to traditional practices, has witnessed a remarkable surge in innovation, thanks to the proliferation of insurtech companies in the United States. The U.S. insurtech market has rapidly evolved into a dynamic innovation hub, where a multitude of startups and established firms are spearheading transformative change, reshaping the industry as we know it.

Rapid Advancements by Insurtech Companies in the United Kingdom:

In the realm of insurtech, European countries are poised to become the most lucrative marketplaces. Between 2010 and September 2021, a total of 293 new insurtech ventures emerged in Europe. Remarkably, 201 of these enterprises originated in the United Kingdom, Germany, and France alone. These three nations are home to nearly 70% of the insurtech companies thriving in the European region.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=RC&rep_id=6191

Check out more related studies published by Fact.MR Research:

Big Data Technology and Services Market: The global big data technology and services market is estimated to propel at a CAGR of 18% from 2023 to 2033. The market is valued at US$ 40 billion in 2023 and is thus expected to jump to a valuation of US$ 210 billion by 2033-end.

G Suite Technology Services Market: The global G Suite technology services market is estimated at USD 449 Million in 2022 and is forecast to surpass USD 2,723 Million by 2032, growing at a CAGR of 19.7% during 2022-2032.

About Us:

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client’s satisfaction.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

S. N. Jha

Fact.MR

+1 628-251-1583

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.