Fuel Card Market Is Anticipated To Reach a Transaction Value of US$ 2,725.3 Billion By 2032

Influential Factors Driving Global Fuel Card Market Growth: Urbanization, Digital Payments, and Fleet Efficiency

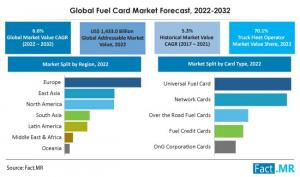

ROCKVILLE, MD, UNITED STATES, October 2, 2023 /EINPresswire.com/ -- In 2022, the worldwide fuel card market size achieved a transactional value of US$ 1,433.0 billion, and it is projected to advance at a compound annual growth rate (CAGR) of 6.6%, ultimately reaching a transaction value of US$ 2,725.3 billion by the conclusion of 2032.By the close of 2022, the adoption of universal fuel cards constituted approximately one-third of the total global fuel card market.

The global fuel card market remains under the influence of various macroeconomic and microeconomic factors. These include the growing trend towards urbanization and increased transportation, the adoption of digital payment methods, and the growing demand for efficient fleet management. This surge in the need to reduce fuel expenses and enhance fraud prevention mechanisms is driving advancements in the global fuel card market.

For more insights into the Market, Request a Sample of this Report:

https://www.factmr.com/connectus/sample?flag=S&rep_id=265

A fuel card is a payment card, much like a credit card, designed exclusively for the purpose of buying gasoline, diesel, petrol, or any other fuel type. These cards are primarily used by businesses and fleet managers to authorize their drivers to charge fuel costs to the company's account, facilitating seamless tracking and monitoring of monthly and yearly fuel expenditures.

- Short-Term (2022 to 2025): In response to the ongoing digitization wave, businesses are racing to integrate digital financial services into their operations, primarily driven by the expanding fuel card market.

- Medium-Term (2025-2028): Europe is anticipated to experience a substantial surge in demand for fuel cards, primarily due to the attractive features offered by European fuel card providers.

- Long-Term (2028-2032): As broader trends within the parent card and payment industry continue to align with market growth, leading vendors are gearing up to deliver advanced telematics services. These innovations are poised to empower end-users with enhanced fuel cost control and greater operational efficiency.

As the world embraces digital transformation, there will be a surge in fuel card sales.

The convergence of the banking and IT industries has ushered in a digital revolution, fundamentally reshaping the global operations of individual banks. In the realm of financial transactions, multinational corporations and large commercial enterprises are wholeheartedly embracing the digitalization wave. The increasing inclination toward digital banking in North America and Europe is indicative of the enhanced speed and precision in financial processes for companies.

As businesses and employer groups persist in adopting digital banking practices, the utilization of fuel cards in North America has propelled the region into the next phase of digitalization. Fleet management teams at larger organizations have recognized the convenience, profitability, and efficiency of using fuel cards to estimate their fuel expenses. With continuous advancements and transformations in the card and payment industry, the global fuel card market is poised to experience significant growth.

Key Companies Profiled

- FleetCor Technologies, Inc.

- WEX Inc.

- Voyager Fleet Card

- Fuel Genie (Worldline IT Services Ltd.)

- H24 (Ingenico Group)

- Valero Energy Corporation

- Eurowag (W.A.G. payment solutions, a.s.)

- Hoyer GmbH

- 360Fuelcard

- Exxon Mobil Corporation

- BP Plc.

- Royal Dutch Shell Plc.

- Total S.A.

- Marathon Petroleum Corporation

- Repsol, S.A.

- Petro-Canada Superpass (Suncor Energy Inc.)

- Radius Payment Solutions

- DKV Euro Service (DKV Mobility Services Group)

- Edenred

Balancing Convenience and Security: Fuel Card Industry's Strategic Focus

Fuel card providers are striving to strike a balance between convenience and payment security in response to the multi-billion-dollar value of the gasoline card industry. Leading companies in the global fuel card market are prioritizing intelligent transactions and providing fleet managers with greater oversight of their fuel expenditures.

Recent technological advancements are making it easier to enhance payment security, despite the ongoing challenge of ensuring the simplicity of fuel card usage, which is a shared concern among both providers and users. To address this issue and maintain the equilibrium between user-friendly features and security, market participants are introducing more robust security assistance and additional services.

Insights by Country

The Shift Towards Digital Payments and the Rise of European Gasoline Cards in 2032

When individuals contemplate embracing a novel digital payment method, they tend to prioritize functional attributes and features over the identity of the service provider. In almost all cases, participants express a preference for financial institutions such as banks, central banks, or European regulatory bodies over large technology corporations. This preference stems from the perception that banks and central banks are more dependable, trustworthy, and secure providers.

The anticipated growth in demand for European gasoline cards is driven by the advantages they offer. Multinational companies can effectively manage their travel expenses by utilizing these European fuel cards, facilitating convenient refueling across Europe and allowing businesses to maintain their operations seamlessly. Key benefits associated with the European Gasoline Card include access to fuel discounts, simplified payment of road tolls, streamlined account management, assistance with HMRC account submissions, and support for corporate sustainability initiatives. Due to these factors, it is expected that the European market will capture a substantial 32.3% share of the market in 2032.

Insights by Category

In contrast to the over-the-road category, the global market for fuel cards is predominantly dominated by the commercial fleet segment. It is projected that by the year 2032, the commercial fleet segment will create an additional transactional value opportunity exceeding US$ 2,725.3 billion. In contrast, the over-the-road fleet segment is experiencing a slower rate of growth. This deceleration is attributed to a lack of awareness regarding the advantages of going digital and increasing concerns about card skimming among end-users worldwide.

In 2021, the commercial fleet segment, which primarily comprises truck fleet operators on the road and boasts a significant growth rate, held over 85% of the market share in terms of value.

The expanding logistics industry plays a pivotal role in driving the increased adoption of fuel cards. As the demand for petrol and gasoline continues to rise within the logistics sector, particularly due to the growth of the e-commerce industry, the fuel card market is expected to see continued growth. Furthermore, the integration of digital technologies and culture is leading to the emergence of new applications, such as enhanced truck and trailer telematics. Additionally, AI-based optimization techniques are helping to reduce expenses, minimize underutilization, and alleviate congestion within the industry.

Get Customization on this Report for Specific Research Solutions:

https://www.factmr.com/connectus/sample?flag=RC&rep_id=265

Market Overview

The cards and payments industry is currently experiencing rapid transformation, driven by both technological advancements and evolving customer expectations and behaviors. These changes can be attributed to the innovative approaches employed by fintech companies, the transformation of customer experiences through mobile devices, the adoption of social media by millennial customers, and legislative developments influencing business practices. While payment methods and card products in the fuel card sector have lagged behind other offerings, this is on the verge of changing due to the increasing shift towards digital payments and the impact of the Internet of Things (IoT).

In a recently published report, Fact.MR has provided comprehensive information on key market players in the fuel card industry, including details on their pricing strategies in different regions, sales growth, service capabilities, and potential technological advancements.

Check out more related studies published by Fact.MR Research:

Recurring Payments Market: Newly-released Recurring Payments Market analysis report by Fact.MR reveals that the global value of recurring payments, with 6.9% projected growth during 2023 – 2033, is expected to reach a valuation of US$ 268.7 Billion by the end of the forecast period.

Insoles Market: The global insoles market has reached US$ 39.22 billion in 2023 and is predicted to climb to US$ 77.88 billion by the end of 2033, expanding rapidly at a CAGR of 7.1% from 2023 to 2033.

About Us:

We are a trusted research partner of 80% of fortune 1000 companies across the globe. We are consistently growing in the field of market research with more than 1000 reports published every year. The dedicated team of 400-plus analysts and consultants is committed to achieving the utmost level of our client’s satisfaction.

Contact:

US Sales Office:

11140 Rockville Pike

Suite 400

Rockville, MD 20852

United States

Tel: +1 (628) 251-1583

Sales Team : sales@factmr.com

Follow Us: LinkedIn | Twitter | Blog

S. N. Jha

Fact.MR

+1 628-251-1583

email us here

Visit us on social media:

Twitter

LinkedIn

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.