Simplified Tax Filing with the 1040A Tax Form for 2023

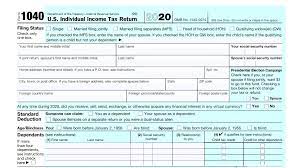

Tax season is coming, and taxpayers seeking simplified tax filing will be pleased to know that the 1040A tax form for 2023 offers a user-friendly solution.

TRAVERSE CITY, MI, US, July 17, 2023/EINPresswire.com/ -- Tax season is coming, and taxpayers seeking a simplified tax filing experience will be pleased to know that the 1040A tax form for 2023 offers a user-friendly solution.

The Internal Revenue Service (IRS) has designed the 1040A form to simplify the tax preparation process for individuals with straightforward tax situations. By utilizing this form, taxpayers can efficiently report their income, claim deductions, and ensure accurate tax filing.

Key highlights of the 1040A tax form for 2023 include:

Eligibility: The 1040A form is suitable for taxpayers with less complex tax situations, including those who do not have itemized deductions and who have taxable income below a certain threshold.

The form allows for reporting various types of income, including wages, salaries, dividends, and interest.

Simplified Filing: The 1040A form eliminates the need for complex calculations and extensive documentation typically associated with the standard 1040 form. Taxpayers can complete the form by providing the necessary information in a concise and straightforward manner.

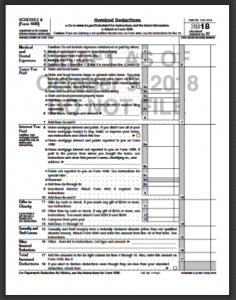

Common Deductions: The 1040A form allows taxpayers to claim common deductions, such as the standard deduction, certain education-related deductions, and retirement savings contributions, among others.

By taking advantage of these deductions, taxpayers can potentially reduce their taxable income and lower their overall tax liability.

E-filing Option: The IRS encourages taxpayers to file their tax returns electronically, and the 1040A form can be easily filed online. Electronic filing offers benefits such as faster processing, increased accuracy, and direct deposit options for refunds.

By utilizing the 1040A tax form for 2023, taxpayers can streamline their tax preparation process, save time, and ensure accurate reporting.

It is important to note that taxpayers should review the IRS guidelines and instructions for the 1040A form to determine their eligibility and understand the specific requirements.

To access the 1040A tax form and obtain instructions for 2023, taxpayers can visit https://filemytaxesonline.org/

Frank Ellis

Harbor Financial

+1 231-313-6079

email us here

Visit us on social media:

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.