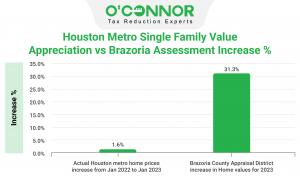

Brazoria County homeowners face extra assessment of $1,453 in property taxes in 2023

There is a gap of 29.7% between Houston metro area sales price increases from January 2022 to January 2023 and the increase in 2023 Brazoria County Appraisals

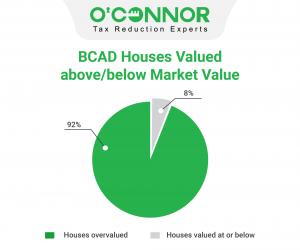

HOUSTON, TEXAS, UNITED STATES, May 5, 2023/EINPresswire.com/ -- Brazoria County property owners are flabbergasted and dumbstruck by the 2023 notices of assessed value. Houston metro area sale prices only increased by 1.6% and home sale prices fell 4.2% in Brazoria County from January 2022 to January 2023, but 2023 property tax assessment are up 31.3%. The typical Brazoria County home has a tax assessment 18.8% higher than market value. Because the typical Brazoria County home is assessed 18.8% higher than market value, home owners face property taxes $1,452 higher than if their home was assessed at market value. Property tax assessments for owners of homes and commercial properties are generated by Brazoria County Appraisal District.Home Price / Assessment Summary

The Brazoria County median home price fell from $292,319 in January 2022 to 280,000 in January 2023, a 4.2% decline based on a study of 6,143 Brazoria County homes conducted by O’Connor. The sales occurred from January 2022 to March 2023. The median time adjusted sales price was $280,000 but the median 2023 property tax assessment from Brazoria County Appraisal District is $333,830. Based on an assessment of $53,830 ($333,830 - $280,000) in excess of market value and a 2.7% tax rate, homeowners will be paying an extra $1,453 in 2023 property taxes. The estimate of an additional $1,453 in property taxes is before property tax protests, homestead exemptions and tax rate compression.

How Can Tax Assessments be Off by 18.8%?

Brazoria County home sale price trends in 2023 included a 15% rise during January 2022 to May followed by a 16% decline from May to January 2023.

Effective Date of Tax Assessment is January 1 of Each Year

The effective date for 2023 property taxes is January 1, 2023. Taxes are paid in arrears in Texas, so this assessment is for taxes due in January 2024. There is no ambiguity regarding the effective date. Texas Tax Code 23.01: Except as otherwise provided by this chapter, all taxable property is appraised at its market value as of January 1.

2022 Sales Price Trends Atypical and Do Not Fit Appraisal District Modeling Tools

Never since Texas became a state in 1845 have tax assessments for houses grossly exceeded market value, until 2023. Prior to 1980, each tax entity did their own assessment and values were well below market value. Appraisal districts were created in 1980 and have typically valued houses at 93 to 99% of market value. Excess tax assessments for homes are setting all-time Texas records for excess taxation. Ten of twelve appraisal districts who have released data further analyzed by O’Connor present a stark outlook for 2023 home property taxes. Systemic flaws in valuation methodology led to record extra taxes.

Every homeowner in Brazoria County should protest in 2023. Protesting is the only option to reduce the BCAD tax assessment to market value or lower. O’Connor believes 92% of Brazoria County homes are assessed at more than market value. The protest deadline is May 15th. Homeowners who file a protest can obtain a free hearing evidence package upon request; simply send a note to your appraisal district asking that it be mailed to you.

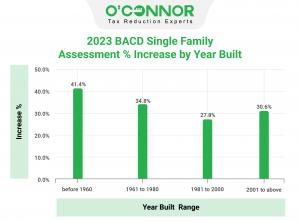

Brazoria County residential property assessments are up across all value ranges, with the most substantial increases for properties valued $750K to $1M at almost 46%, properties $1M to $1.5M up more than 47%, and properties over $1.5M with shocking increases of over 50%. Homeowners in Brazoria County properties in the 6,000 to 7,999 sq. ft. range are hit with the highest assessment spike when comparing living area size increases. Older homes in Brazoria County constructed prior to 1960 are receiving 2023 assessments with increases over 41%.

The protest deadline is May 15, 2023. Protest now to be certain you don’t miss the deadline. There are three steps to the appeal process: informal, formal or appraisal review board, and judicial. O’Connor expects record reduction in Brazoria County tax assessments for 2023.

If you are a property owner in Brazoria County and your assessment has increased, you do not have to accept the new appraisal value, it is your right to appeal. Don’t pay more than your fair share. Record levels of property tax protest are expected to follow. The deadline to file a property tax protest is May 15th.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.