Dallas County Commercial Property – Assessments Soar while Values Plummet

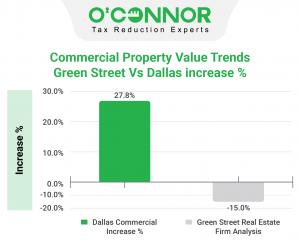

Commercial property tax assessments are up by 27.8% in 2023 for Dallas County property owners.

DALLAS, TEXAS, UNITED STATES, May 2, 2023/EINPresswire.com/ -- Dallas Central Appraisal District increased commercial tax assessments by 27.8%. Increases were highest for hotels (53.6%) and apartments (35.4%). Office buildings are going through a long-term repricing, in part because debt available for office is scarce and underwriting meticulously. However, office tax assessment increased 19.2%.Commercial real estate brokers report activity is down 70 to 80% and mostly distressed properties. Owners not forced to sell are waiting to see if prices rise as interest rates and cap rates fall. It is uncertain whether and when interest rates will decline.

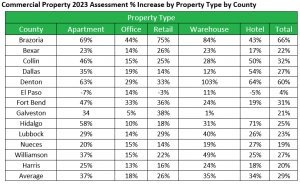

Appraisal Districts are increasing commercial values across Texas:

Appraisal districts are increasing commercial values by 29% during a time period when commercial values fell by 20 to 30%. Apartments (37%), warehouse (35%) and hotel have the largest level of increase. El Paso is the only appraisal district so far (including only those below for which we have and have processed data) to increase commercial property tax assessments by less than ~20%.

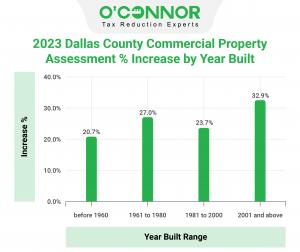

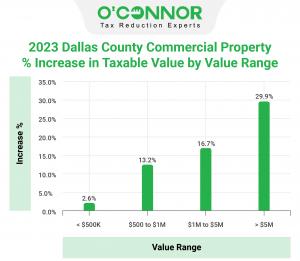

2023 assessments for Dallas County commercial property are up over 32% for properties constructed since 2001. The steepest increase in assessments for commercial property in Dallas County are properties valued over $5M, with an increase of almost 30% for 2023. Highest increases in assessed value for apartments in Dallas County are those properties constructed since 2001 at 38.2% and those constructed between 1961 and 1980, at 37.3%. Office properties in Dallas County built in 2001 and later are feeling the most sting with assessed value increases over 26%. Dallas county owners of retail property are not immune from rising assessments. Depending on year built, they range from 11.2 to 16.3% up for 2023. Commercial warehouse properties with the highest increase in assessed value for 2023 are those constructed prior to 1960.

When comparing medical and office commercial property in Dallas County, the sharpest swing in assessed value is for offices with a 20% increase for 2023.

Brick exterior apartments in Dallas County rose over 35% for 2023, but frame exterior apartments surged upward with 42.1% increases for 2023. Retail Dallas County commercial property assessments reached equal elevation for strip center and single tenant property owners with increases of 15.2%. Warehouse property owners are looking at value assessments up as high as 13.8% for 2023.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless you receive a reduction on your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

713-375-4128

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.