Commercial Values in Collin County up Shocking 31.7%

Higher commercial property tax assessments in Collin County contradict market trends.

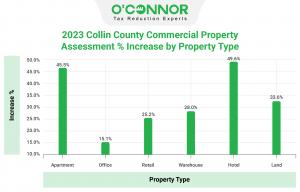

DALLAS, TEXAS, UNITED STATES, April 26, 2023/EINPresswire.com/ -- The 17.4% increase in tax assessments for houses is certainly noteworthy, but it pales in comparison to the 31.7% increase for commercial property. Hotel owners are shocked at the close to 50% increase in assessments and apartment owners are apoplectic regarding a more than 45% increase in tax assessments for 2023.Higher Assessments Contra Market Trends

The 31.7% increase in commercial property assessments inconsistent with the 15 to 30% reduction in value of commercial properties in 2022. Higher interest rates led to higher cap rates which caused values and transactions to tank. Commercial property sales are off 70 to 80% and concentrated on distressed property sales with no other options.

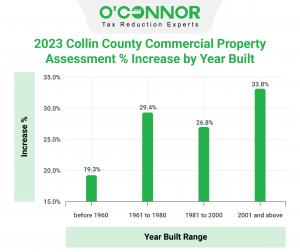

Office property assessments increased by 15%, but office owners are in a long-term adjustment to demand for office usage due to COVID. Most lenders are shunning new loans for office. Commercial property built after 2001 has assessments increases north of 33% for 2023. Substantial increases are evident across all commercial property value ranges in Collin County, with the heftiest elevation in taxable value for property over $5M, at a massive 32% increase.

Assessment Analysis by Property Type

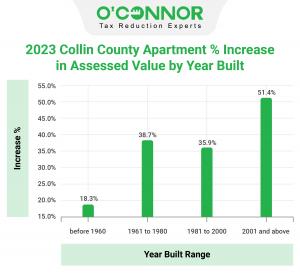

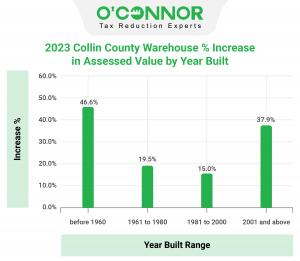

Collin County owners of apartments built since 2001 are feeling the most pain with increases in assessed value over 51%. Collin County office buildings constructed since 2001 suffer the most severe increases in assessed value for 2023 at 15.7%. Similarly, retail commercial property is also heavily hit with assessed value increases over 25%. Both older and newer warehouse owners are agonizing over increases with a more than 46% jump in assessed value for property built prior to 1960 and a still harrowing rise of nearly 40% for warehouse property constructed 2001 and after.

High rise properties show the sharpest increase among Collin County offices in 2023, with assessment values going up almost 20%. Both multi-family and subsidized apartment assessed values in Collin County shot up by 45.7% and 39.4%, respectively for 2023. Collin County strip centers and neighborhood shopping centers are the sub-types of retail commercial property with the largest increase in assessed value percentage for 2023. All Collin County sub-types of warehouse owners are feeling distress with assessed values increasing, with multi-tenant warehouses up a stunning 47.1%

Commercial property owners in Collin County do not have to accept the new appraisal value, it is your right to appeal. Don’t pay more than your fair share. Record levels of property tax protest are expected to follow. The deadline to file a property tax protest is May 15th.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Patrick O'Connor, President

O'Connor

+1 713-375-4128

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.