Harris County Commercial Property Tax Assessments Soar as Values Tumble

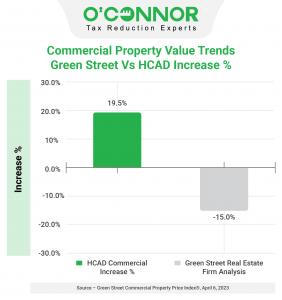

Rising interest rates have hit the entire commercial real estate sector hard. Higher mortgage costs eat into landlords’ earnings and make it harder to refinance expiring loans. Rising yields on bonds and other securities also make real estate look less profitable in comparison, making buyers more reluctant to pay high prices and pushing down property values. Real-estate analytics firm Green Street recently estimated that U.S. property values are down 15% since March 2022.

Property tax assessments soared by 13 to 24% depending on property type. All types of commercial property incurred substantial increases, averaging about 20% overall. Apartments and warehouses incurred the highest levels of tax assessment increases in Harris County in 2023.

Apartments of all vintages again saw staggering increases in assessed value while market values tumbled due to higher cap rates and operating expenses (insurance, labor, and property taxes).

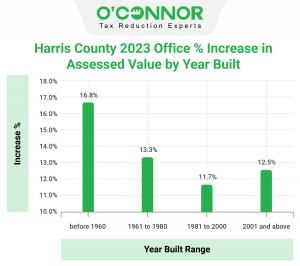

Office buildings built prior to 1960 incurred the largest tax assessment increase in 2023 in Harris County.

Subsidized apartments had property tax assessment increases of 37% versus 17% for high-rise apartments in Harris County.

Masonry warehouse property tax assessments rose by an eye-popping 35% while values for office warehouse buildings in Harris County rose by 10%.

The deadline to file a property tax protest is May 15th. Record levels of property tax protests are expected to follow the massive increases in property tax assessment in Harris County.

About O'Connor:

O’Connor is among the largest property tax consulting firms in the United States, providing residential property tax reduction services in Texas, Illinois, and Georgia, as well as commercial property tax reduction services across the United States. O’Connor’s team of professionals possess the resources and market expertise in the areas of property tax, cost segregation, commercial and residential real estate appraisals. The firm was founded in 1974 and employs more than 600 professionals worldwide. O’Connor’s core focus is enriching the lives of property owners through cost effective tax reduction.

Property owners interested in assistance appealing their assessment can enroll in O’Connor’s Property Tax Protection Program ™ . There is no upfront fee, or any fee unless we reduce your property taxes, and easy online enrollment only takes 2 to 3 minutes.

Visit O’Connor at www.poconnor.com or call 713-290-9700.

Patrick O'Connor, President

O'Connor

+1 713-290-9700

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.