OpenCover: The First DeFi Insurance Analytics Platform to help Protect Investors from DeFi Risk and Exchange Hacks

OpenCover is the leading source for DeFi insurance and cover data, news, and insights to help crypto investors protect their portfolios.

LONDON, UK, January 30, 2023 /EINPresswire.com/ -- Today OpenCover emerges from stealth with the first data analytics platform tracking the rapidly emerging decentralized finance (DeFi) insurance alternatives industry. With billions of crypto investor dollars frozen or lost to the recent string of failures in centralized finance (e.g. Celsius, BlockFi and FTX), investors are rapidly turning to DeFi insurance alternatives — commonly referred to as DeFi cover — to protect their investments. OpenCover’s platform is the first to provide investors with standardized, unbiased, and real-time data to understand and compare their risk mitigation options.

While DeFi solves the fundamental custody, transparency and auditability issues found in centralized crypto services, it is not risk free.

“The "centralized anything is evil by default, use defi and self-custody" ethos did very well this week, but remember that it too has risks” warns Ethereum founder Vitalik Buterin.

DeFi technical exploits have cost investors over $3.2 billion in 2022 alone, the figure increases to over $10 billion when taking into account economic failures such as stablecoin de-pegs. To solve for these gaps, DeFi-native insurance alternatives have emerged with the first large scale multi-provider payout occurring earlier this May after Terra’s UST algorithmic stablecoin lost its peg to the dollar. Investors having purchased cover from InsurAce, Unslashed and Risk Harbor were able to recoup over $14 million.

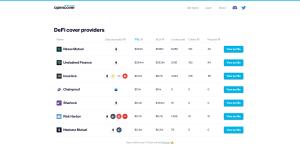

Unlike in traditional insurance, approaches to risk assessment, claims and reporting are highly heterogeneous across cover providers making it hard for investors to understand existing options and compare individual DeFi cover providers. Pioneered by Nexus Mutual, the space grew from a single player in 2017 to over 25 providers today with over $100 million in cover sold in the last 30 days.

"The DeFi insurance industry will grow massively in the coming years. For perspective, today, less than 0.5% of DeFi's total value is being insured," explained Morgan Beller, General Partner at NFX, a major investor in OpenCover. "To assist the market's maturation, a solution like OpenCover is needed: a product that provides comprehensive and real-time data on different insurance offerings."

As the first platform to collect market and provider-level data for DeFi insurance alternatives, OpenCover is helping investors understand their options and choose the right products. OpenCover data is compiled directly from on-chain events, smart contract state and transaction traces where access to contract ABIs is possible with third-party indexing protocols (e.g. The Graph) used as fallback. At the time of writing, OpenCover tracks over 85% of industry activity by Total Value Locked across Ethereum, Polygon, Arbitrum, Optimism, BNB Smart Chain and the Avalanche blockchains.

OpenCover data is available to investors through a free public dashboard at: https://opencover.com/

About OpenCover :

OpenCover is the first DeFi insurance alternatives analytics platform. OpenCover provides crypto investors with standardized, unbiased, real-time industry and provider-level data to help them protect their crypto portfolio across DeFi and centralised exchanges. The company is backed by leading web3 investors including NFX, Village Global, Alliance, Orange DAO, Jump Crypto, Third Kind VC and over a dozen leading Web3 angels. To learn more, visit: https://opencover.com/.

Jeremiah Smith

OpenCover

team@opencover.com

Visit us on social media:

Twitter

Other

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.