Global B2B Payments Platform Market Size and Shares To Grow At A CAGR Of 8.35% Revenue By 2028 - Zion Market Research

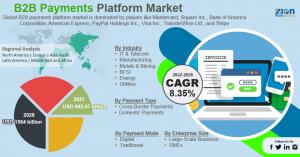

The global B2B payments platform market size was worth around USD 942.67 billion in 2021 and is predicted to grow to around USD 1564 billion by 2028

The security concerns related to digital payments may impede global market growth. The time and cost-saver benefits of online platforms are expected to provide growth opportunities during the forecast period. The transaction-related fees may challenge the global market expansion. The global B2B payments platform market is dominated by players like Mastercard, Square Inc., Bank of America Corporation, American Express, PayPal Holdings Inc., Visa Inc., TransferWise Ltd., and Stripe.

Request a Free PDF Sample@ https://www.zionmarketresearch.com/sample/global-b2b-payments-platform-market

Our Free PDF Sample Report Includes:

2022 Updated Report Introduction, Overview, and In-depth industry analysis

COVID-19 Pandemic Outbreak Impact Analysis Included

210 + Pages Research Report (Inclusion of Updated Research)

Provide Chapter-wise guidance on the Request

2022 Updated Regional Analysis with Graphical Representation of Size, Share & Trends

Includes an Updated List of tables & figures

Updated Report Includes Top Market Players with their Business Strategy, Sales Volume, and Revenue Analysis

Zion Market Research Methodology

The global B2B payments platform market is segmented based on industry, enterprise size, payment mode, payment type, and region.

1- By industry, the global market is segmented into IT & telecom, manufacturing, metals & mining, BFSI, energy & utilities. Almost all sectors entail at least some form of B2B payments but BFSI leads the global market owing to the heavy transactions conducted under this category.

2- By enterprise size, large-scale business and SMEs are the two main segments, and the global market is dominated by the large-scale business segment. This can be attributed to the higher adoption rate of B2B trading amongst large-scale organizations especially in international trade in order to expand their global presence. In June 2022, India’s overall export value was around USD 65 billion which is projected to grow further in the coming years.

Buy Our B2B Payments Platform Business Insight Report, Inquire Here (Get a Christmas Special Discount): https://www.zionmarketresearch.com/inquiry/global-b2b-payments-platform-market

The Key Audiences for Global B2B Payments Platform Market Report: (Who can Buy Our Report)

Global B2B Payments Platform Market Consulting Firms & Research Institutes

Industry Leaders & Companies aims to enter the B2B Payments Platform market

Universities and Student

Service Providers, Product Providers, Solution Providers, and other players in the B2B Payments Platform market

Government Bodies and Associated Private Firms

Individuals interested to learn about the B2B Payments Platform market

3- Based on payment mode, the global market segments are digital and traditional. The global market is expected to be dominated by digital payment modes since they offer faster transactions, less scope for error, well-organized data, and accurate transaction history. As per official reports, over 71% of businesses prefer digital payments with an increasing number of organizations accepting online transactions.

4- By payment type, the global market is divided into cross-border payments and domestic payments. Cross-border payments may generate higher revenues since a large sum of money is involved in such payments.

Global B2B Payments Platform Market Overview

Business-to-business or B2B payments are exchanges or transfers of monetary values from a buyer to the supplier where the transactions take place in a business setting. B2B payments can be recurring or a one-time event depending on the contractual obligations of the parties involved. The complexities involved in B2B payments are higher than the ones involved in business-to-customer payments since B2B payments involve larger transactions and the approval process of such transactions is more stringent. In some cases, the transactions may take up to more than a week to complete. B2B payments platform refers to systems or facilities that aid these transactions. Some of the most common platforms used widely are wire transfers, cheques, automated clearing houses (ACH), credit cards, cash, digital transactions, etc. Each payment method comes with its own set of pros and cons and it is up to the company to decide which platform best suits its requirement keeping in mind the total expense, needs of the business, frequency of transactions, and others.

Issuing cheques is one of the most traditional forms of B2B payments and still remains largely popular amongst all consumer groups. ACH are electronic transfers and are a common mode of money transfers in many large-scale firms. In 2019, more than USD 25 billion were exchanged with the help of the ACH platform. Wire transfers are used for high-value transactions and as per Glenbrook, they make up to 90% of the transactions involving a higher sum of money. Credit cards are yet to leave a mark in B2B payment platform systems because of the huge transaction fees charged by the credit card platforms.

Covid-19 managed to shift the dynamics in the global market owing to a change in the mode of B2B payments. Since the movement of individuals was restricted owing to the virus spread along with the closure of all non-essential units like banks, or other money-exchange places, the majority of the market players had to adopt online modes or wire transfers in order to continue with the payments.

Get a Customization on This Report: https://www.zionmarketresearch.com/custom/7030

Recent Development:

In February 2021, Eedenbull, a global Fintech innovation company, inaugurated its first office in the USA. From its new office, the company plans to create strategies that will aid banks in North America to use its Commercial Payments-as-a-Service (CPaaS) portfolio and payment technology in order to empower the banks with progressive thinking while providing better services to SMEs.

In May 2022, Visa announced that it will explore more opportunities to collaborate with fintech companies in India in order to enhance payment solutions for B2-B suppliers and the entire value-chain of corporates. This is regarded as one of the big bets in terms of B2B payments in the corporate and commercial world.

In May 2022, PayMate India, a leading B2B payments solutions provider, filed Draft Red Herring Prospectus for Initial Public Offering to raise around INR 1,500 Crore. As of the date, DRPH was filed, the promoter group held 66.7% of the company while the rest was distributed between Public shareholders. Book Building Process was used to make the offer.

In July 2022, French Fintech Hero, an upcoming B2B payments platform, managed to raise USD 12.49 million within 7 months of its launch. The payment solutions provided are more inclined toward mid-size firms and SMEs. The company aims to create a platform where users can take care of order-to-cash for suppliers and procure-to-pay for clients

Regional Analysis

North America is expected to dominate the global B2B payments platform market owing to higher transactions occurring across industries. The USA is one of the largest market shareholders globally. This is aided by a growing number of investments by the private and government sector in the field of finance to enhance experience related to financial deals. The regional growth may also be attributed to the growing demand for technological advancements in the field of payments. Asia-Pacific may also grow significantly because of the rising foreign investments in countries like China, India, and Singapore which is aided by domestic technological growth as well. The governments have been rolling out policies to attract foreign investors while also encouraging domestic players thus propelling regional market cap.

Read Other Related Reports:

Global Personal Cloud Market:- https://www.zionmarketresearch.com/report/personal-cloud-market

Global Smart Card In Healthcare Market:- https://www.zionmarketresearch.com/report/smart-card-in-healthcare-market

Global Legal Process Outsourcing Market:- https://www.zionmarketresearch.com/report/legal-process-outsourcing-market

Global Mobile Gaming Market:- https://www.zionmarketresearch.com/report/mobile-gaming-market

Global Master Data Management Market:- https://www.zionmarketresearch.com/report/master-data-management-market

Global Mobile Entertainment Market:- https://www.zionmarketresearch.com/report/mobile-entertainment-market

Global Big Data As A Service (BDaaS) Market:- https://www.zionmarketresearch.com/report/big-data-as-a-service-bdaas-market

Global Business-To-Business E-Commerce Market:- https://www.zionmarketresearch.com/report/business-to-business-e-commerce-market

Global Social Media Analytics Market:- https://www.zionmarketresearch.com/report/social-media-analytics-market

Global Battery Chargers Market: https://www.einnews.com/pr_news/606224717/battery-chargers-market-by-size-trends-shares-global-trajectory-analytics-demand-and-forecast-2028

Varsharani Lavate

Zion Market Research

+1 855-465-4651

varsha.l@marketresearchstore.com

Visit us on social media:

Facebook

Twitter

LinkedIn

Other

About Zion Market Research

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.