Bancorp 34, Inc. Reports 3rd Quarter Performance Announces Quarterly Dividend

Bancorp 34, Inc. (OTCQB:BCTF)

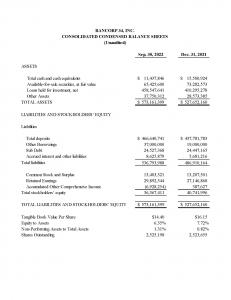

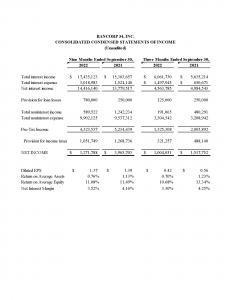

Bancorp 34, Inc. reported net income and diluted EPS for the quarter that ended September 30, 2022, of $1.0 million and $0.42, respectively, compared with $1.5 million and $0.56 for the same period in 2021. The Company reported consolidated total assets of $573.2 million, up from $527.7 million as of December 31, 2021.

Balance sheet growth continues to be concentrated in the loan portfolio as net total loans have grown $48.3 million during 2022. Provisions of $780,000 were provided to the Allowance for Loan and Lease Losses to support the aforementioned growth. Deposit growth has been strong and totals $28.9 million for the year. Total stockholders' equity experienced additional declines in the third quarter due to mark-to-market adjustments on the Company’s investment portfolio resulting from the continued increase in market interest rates. As a result, tangible book value per share declined to $14.40 as of September 30, 2022.

President and Chief Executive Officer Jim Crotty stated “We are pleased that the company continues to deliver positive balance sheet trends despite the uncertainty surrounding the current economic landscape. We continue to make prudent balance sheet decisions relating to asset growth and liquidity management while maintaining strong capital and loan loss reserve levels. That approach will ensure that the company is properly positioned and prepared for a wide array of economic environments.”

The Company’s Board of Directors approved a quarterly cash dividend of $0.07 per share of common stock, payable on November 25, 2022, to shareholders of record as of the close of business on November 11, 2022.

ABOUT BANCORP 34, INC. - Bank 34 has four full-service community bank branches, one each in Otero and Dona Ana Counties in the cities of Alamogordo and Las Cruces in southern New Mexico and two in Maricopa County, Arizona in the cities of Scottsdale and Peoria.

FORWARD-LOOKING STATEMENTS - Certain statements herein constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements may be identified by words such as “believes,” “will,” “expects,” “project,” “may,” “could,” “developments,” “strategic,” “launching,” “opportunities,” “anticipates,” “estimates,” “intends,” “plans,” “targets” and similar expressions. These statements are based upon the current beliefs and expectations of the Company’s management and are subject to significant risks and uncertainties. Actual results may differ materially from those set forth in the forward-looking statements as a result of numerous factors. Factors that could cause such differences to exist include, but are not limited to, general economic conditions, changes in interest rates, the effects of any health pandemic, regulatory considerations, competition, and other risks. Further, given the ongoing and dynamic nature of the COVID-19 outbreak, it is difficult to predict the impact on our business which will depend on highly uncertain future developments including when the coronavirus can be controlled and abated and when and how the economy may be reopened or remain open. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this release. Forward-looking statements speak only as of the date they are made, and we assume no obligation to update any of these statements in light of new information, future events or otherwise unless required under federal securities laws.

Kevin Vaughn

Bancorp 34, Inc.

+1 6233346064

BCTF@Bank34.com

Visit us on social media:

Facebook

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.