Elder Care Services Market Size, Analysis, Competitive Strategies and Forecasts 2022-2031

Elder care services reached US$ 1.23 Bn at the end of 2021 and market is anticipated to expand at a CAGR of 7.6% and reach US$ 2.56 Bn by 2031-end.

NEW YORK, NEW YORK, UNITED STATES, August 25, 2022 /EINPresswire.com/ -- Elder Care Services Market 2022

The Elder Care Services Market is slated to grow at a gracious rate of 7.6%, reaching US$ 2.56 Bn by the year 2031. With value-oriented approach being the need of the hour, the healthcare vertical is likely to go the technologically advanced way in the next 10 years. With Big Data, AI comprising these advancements, the healthcare vertical is bound to create greater strides going forward.

The global elder care services market is anticipated to expand at a CAGR of 7.6% and reach US$ 2.56 Bn by 2031-end.

Get Free Sample Copy of this Report@ https://www.persistencemarketresearch.com/samples/3427

Elderly care services include assisted living, nursing care, adult day care, home care, and long-term care. The geriatric population’s high susceptibility to illnesses and infections leads to significant financial burden on the individual and families. The elderly who are discharged from hospitals can receive care from trained caregivers at home or at long-term care facilities. This system is comparatively more economical and also produces better outcomes because older people are more prone to hospital-acquired infections and experience less anxiety at home.

Changing family structure is a prime driver for the elderly care service market. With the trend of nuclear families, the elderly are exposed to emotional, financial, and physical insecurities. Adding to this is the increase of the young working population, which is unable to devote time to care for the elderly.

Introducing care robots is also creating huge opportunity in the market, as the elder care services segment would require an increasing amount of resources and skilled workforce. Robotic caregiver technology is a solution set to replace human caregivers to some extent.

• Companies such as Jibo, for example, are developing social robots that will serve as a nice companion for the elderly. Although this companion robot is excellent for social contact, it lacks the mechanical components necessary to provide medical assistance.

• Waypoint Robotics focuses on the mobility component of autonomous robotics rather than the social aspect. The company is developing mobile robots that whizz along hospital corridors like mechanized room service carts.

Company Profiles:

• Eldercare Services.

• Korian Group

• ProVita International Medical Center, LLC

• Home Instead, Inc

• Living Assistance Services, Inc.

• Benesse Style Care Co., Ltd

• Econ Healthcare Group

• Epoch Elder Care

• St Luke’s ElderCare Ltd

• India Home Health Care

• Samvedna Senior Care

• ApnaCare India Private Limited

• Nichiigakkan Co. Ltd

• Golden Years Hospital

• Orange Valley Healthcare

• NTUC Health Co-Operative Ltd

• GoldenCare Group Private Limited

• Carewell-Service Co., Ltd.

• RIEI Co. Ltd.

• SASCO Integrated Eldercare Centre

• Cascade Healthcare

• Millennia Personal Care Services

• Rosewood Care Group Inc.

• Pacific Healthcare Nursing Home

• United Medicare Pte Ltd

Request for Methodology@ https://www.persistencemarketresearch.com/methodology/3427

Key Takeaways from Market Study

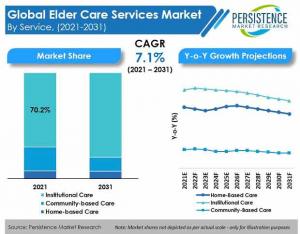

• By service, institutional care is set to hold a high share of 70%, expanding at 9% CAGR over the forecast period.

• By financing source, public expenditure is expected to hold well over 65.5% market share.

• By region, Europe accounts for the highest market share of around 35%, followed by North America.

“Increasing options for elder care services and strict health & safety regulations by governments and associations will provide fruitful growth opportunities for market players,” says an analyst of Persistence Market Research.

Market Competition

R&D activities, product launches, joint ventures, and mergers & acquisitions are key strategies being adopted by providers of elder care services.

• In August 6, 2021 Honor acquired Home Instead, one of the largest home care providers in the U.S, in a move that would create a company with more than US $2.1 Bn in home care services revenue and potentially impact the senior living industry.

• In Aug 2019, Econ Healthcare Group became the first Eldercare provider under the Chongqing Connectivity Initiative

• In Jan 2018, Orange Valley Nursing Homes opened its sixth home in Balestier, making it the largest operator of such facilities with more than 1,000 beds.

• In February 2017, NTUC Health launched its 13th Silver Circle Senior Care Centre in Ci Yuan Community Club in Hougang, Singapore.

What Does the Report Cover?

Persistence Market Research offers a unique perspective and actionable insights on the elder care service market in its latest study, presenting historical demand assessment of 2016 – 2020 and projections for 2021 – 2031.

Access Full Report@ https://www.persistencemarketresearch.com/checkout/3427

Persistence Market Research Pvt Ltd Atul Singh

PMR

+ +1 646-568-7751

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.