Strengthened AML Compliance with Sanction Scanner

Sanction Scanner helps companies with their AML Compliance processes with its reliable global data.

LONDON, UNITED KINGDOM, August 18, 2022 /EINPresswire.com/ -- Sanction Scanner, a company that develops AML and CFT solutions for RegTech companies, provides AML Name Screening, Transaction Monitoring, and Customer Risk Assessment software to global companies. It was founded in June 2019, and the London headquarters of the company was opened in August 2020. The London headquarters created an opportunity for the company to get into the European market. Sanction Scanner has more than 300 customers from 40 different countries offering financial services such as banking, FinTech, and insurance. Sanction Scanner aims to develop solutions for financial companies of all sizes and grow in the global market while strengthening its customers' compliance programs.Compliance Support to Various Industries

Countries have different regulations, and it is hard to adapt companies to each one of them. Sanction Scanner builds end-to-end AML Compliance programs for companies. Companies need AML Compliance programs to minimize the risks of financial crimes, protect their reputation, and most importantly, pass the AML Compliance exams that are legal requirements. Sanction Scanner supports companies with its easy-to-use solutions, fast integration approach, and high-level customer satisfaction principle for companies' compliance and financial risks need. Companies are obligated to scan their customers on blacklists of countries they operate in, build a risk-based approach and monitor their customers' economic activities.

Sanction Scanner provides its solutions to NeoBanks, Banks, FinTech, Investment, Finance, Insurance, Crypto, and Financial institutions such as leasing and factoring companies to minimize the financial risks.

Financial Crimes Are Being Prevented Using Artificial Intelligence

Sanction Scanner protects companies from financial crimes by conducting blacklist checks using global sanctions lists, PEP lists, and Adverse Media data developed and updated every 15 minutes with AI. Organizations can build AML compliance programs using Sanction Scanner's data to monitor their customers. Institutions should scan their customers during the customer onboarding process and later since customers' risk levels can change over time. Sanction Scanner recommends its customers plan an automatic Ongoing Monitoring for their high-risk customers.

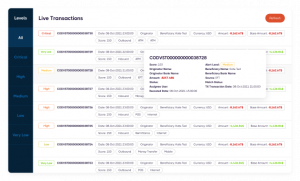

Customers of Sanction Scanner can get report papers for their queries. The report paper includes detailed current information for the person searched. In addition to all of these, organizations can monitor their customers' transactions and detect suspicious activities. Transaction Monitoring stops the action and saves the details of the activity for companies to write a report paper to regulators. It helps companies take required steps instantly without waiting until the end of the day.

Organizations use Customer Risk Assessment to visualize strategy and risk management data. They can set rules and scenarios according to their needs such as age, profession, age, income, country and currency without writing any code and strengthen their businesses' AML compliance by detecting high-risk customers based on the set rules.

Sanction Scanner's Solutions Are Used In More Than 40 Countries

Various financial institutions from 40 countries use Sanction Scanner's solutions to comply with regulations and audits. Sanction Scanner has customers all around the world, from East Asia to North America.

Sanction Scanner's biggest goal in 2022 is to offer RegTech-related end-to-end compliance solutions to companies and grow in the European market. Sanction Scanner provides a smooth compliance program that doesn't affect companies' business models. In addition, Sanction Scanner products are customer satisfaction-oriented and problem solver.

Sanction Scanner

Sanction Scanner

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Other

How Sanction Scanner Works

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.