Automotive Lighting Market: Growth, Opportunities, Ongoing Trends and Recent Developments

Automotive Lighting Market by Position & Application (Head, Side, Tail, Fog, Dashboard, Rear View Mirror), Technology, Adaptive Lighting and Region

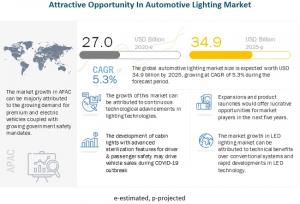

NORTHBROOK, ILLINOIS, UNITED STATES, April 13, 2022 /EINPresswire.com/ -- The Automotive Lighting Market size is projected to grow at a CAGR of 5.3% during the forecast period to reach USD 34.9 billion in 2025

A significant increase in the demand for new car sales and a considerable amount of usage of advanced lighting are surging the demand for automotive lighting in the market. With a soaring per capita income with a high purchasing parity, consumers can invest in advanced lighting features like adaptive lighting, thus, driving the market growth in the upcoming years.

Market Drivers:

1. Increase in demand for premium segment vehicles

2. Lighting Regulations for better visibility and safety

3. High demand for adaptive lighting

The key players automotive lighting market are Hella (Germany), Marelli (Italy), Osram (Germany), Valeo (France), Continental (Germany), Philips (Netherlands), Bosch (Germany), Varroc (India), Hyundai Mobis (South Korea), Koito (Japan), Denso (Japan), North American Lighting (US), Renesas (Japan), Lumax (India), Aptiv (Netherlands), Grupo Antolin (Spain), Lear Corporation (US), Keboda (China), NXP (Netherlands), Gentex (US), FlexNGate (US), Federal-Mogul (US), Stanley Electric (Japan), Ichikoh (Japan), and Zizala (Austria).

Opportunity: Evolution of new technologies

Matrix LED, OLED, and laser lighting are some of the new and promising technologies for automotive lighting manufacturers. In matrix LED headlights, the high-beam unit is made up of 25 individual segments. The small LEDs work in conjunction with lenses, and reflectors connected in series are activated and deactivated or dimmed individually according to the situation. This enables the system to react precisely to other cars. It recognizes other cars using a camera and illuminates the road brightly. For instance, Audi’s Matrix LED headlights to get the information they need from a camera, the navigation system, and other sensors.

Browse 393 market data Tables and 69 Figures spread through 302 Pages and in-depth TOC on the "Automotive Lighting Market"

Request FREE Sample Report @ https://www.marketsandmarkets.com/requestsampleNew.asp?id=1133

The passenger car segment is expected to be the largest segment of the automotive lighting market

Passenger cars are expected to be the largest segment of the automotive lighting market on account of the rapid adoption of advanced lighting systems. Moreover, increasing sales of premium vehicles with pre-installed adaptive headlights, adaptive taillights, and ambient lights are expected to augment the growth of the segment further. Additionally, visual appeal is considered a premium feature, and lighting is one of the vital parameters that add value to the visual appeal of the vehicle.

LED light technology is estimated to grow at the fastest CAGR during the forecast period

LED lighting technology is expected to dominate the automotive lighting market globally during the forecast period 2020-2025. The changing consumer preferences and the introduction of LEDs with adaptive features at competitive pricing are expected to drive the growth of this product category. Many leading manufacturers have already developed LED lights with adaptive features. The segment is driven mainly due to factors such as ease of use, the requirement of negligible initial setup, and lower power consumption by LED lights. Moreover, its use as a headlight with higher visibility also has a lesser impact on the eyes of the other drivers coming from the opposite direction.

The Asia Pacific to continue being the largest consumer of the automotive lighting market

China was the largest manufacturer and consumer of automotive lighting due to the presence of a robust automobile production base and huge domestic sales of cars. Other Asian countries such as Japan, Korea, and India showcased promising growth during 2017 and 2018, and this trend is likely to continue till 2025. The Asia Pacific is one of the main production bases for several European and North American automotive lighting manufacturers. Thus, the growing global sales of automobiles are expected to drive the growth of the automotive lighting industry.

However, the Asia Pacific automotive industry has faced major challenges due to the COVID-19 pandemic. For instance, the production activities of major OEMs, like General Motors, Honda, Nissan, Peugeot, and Renault, have been disrupted, thereby impacting the automotive lighting market as well. For instance, two-thirds of automotive production has been directly affected by China’s industrial lockdown, impacting the suppliers of lighting system components as well. Additionally, the shortage of Chinese-made parts has impacted global production.

Download PDF Brochure @ https://www.marketsandmarkets.com/pdfdownloadNew.asp?id=1133

Recent Developments:

1. In January 2022, HELLA launched the new Black Magic LED series on the European market. Its dustproof and waterproof housing and robust construction is specially designed for off-road applications. Depending on the variant they provide outstanding off-road illumination with up to 15,000 lumens. A specially developed reflector ensures a homogeneous illumination. In addition, the integrated, intelligent thermal management system ensures adaptation to the ambient temperature and thus always provides an optimal light output and a longer lifetime for the LEDs. The Black Magic LED series are available as floodlight or spotlight versions and can be mounted vertically or in a suspended manner or they can be integrated into the bodywork or bumper.

2. In December 2021, Bosch launched new 4W (four-wheeler) lighting bulbs the Gigalight 120, 150, the Sportec Bright 4000K and the LED Retrofit ideal for almost any vehicle. The Bosch Bulbs Gigalight 120, 150, the Sportec Bright 4000K and the LED Retrofit provide motorists with the luminosity they need to vividly see road signs or obstacles ahead, under any weather circumstances.

3. In April 2019, Hella signed a strategic cooperation agreement with Wuling Automotive Industry, which belongs to the Chinese Guangxi Automobile Group. Both partners intended to work together on automotive lighting technologies for the Chinese market, with a focus on the development of headlamps for the volume segment.

4. In January 2019, Hella launched Shapeline lamps, work lights, auxiliary lamps, warning lights, and accessories. The company equipped a show truck with lighting solutions that were developed for trucks and trailers.

5. In November 2018, Hella and Faurecia entered into a strategic collaboration to partner on interior lighting solutions for the cockpit. Both companies jointly developed lighting solutions in the domain of surface lighting and dynamic lighting for a personalized cockpit environment. Faurecia contributed its expertise as a complete system integrator for vehicle interiors, while Hella supplied innovative products in the field of interior lighting.

COVID-19 Impact on the Automotive Lighting Market:

The COVID-19 outbreak has disrupted the automotive supply chain on a global scale. The outbreak has not only disrupted manufacturing facilities globally but also vehicle sales around the world. The suspension of manufacturing facilities and new vehicle sales has impacted the production of automotive lighting components, thereby impacting the global market as well. Demand for both conventional and electric vehicles is projected to witness a downward trend in 2020, further impacting the global market. Additionally, the budget allocation for R&D is likely to be significantly affected, which is anticipated to hamper the development of innovative automotive lighting solutions. The demand for lighting is proportional primarily to vehicle production. Now, with the outbreak of COVID-19, vehicle production, as well as sales, has witnessed a significant decline and is expected to exhibit a 20% decline in 2020 (MarketsandMarkets analysis). This decline is expected to impact the automotive lighting industry adversely. However, companies are taking various measures to tackle the adverse effects of the outbreak.

* In April 2020, Valeo variability its costs across all plants through part-time working arrangements. The company variability its costs for support activities, such as R&D and administration. It also decreased all investments and expenses that are not essential for business continuity.

* Continental is scrutinizing the necessity of all its current expenditures and investments and exploring savings measures that will have an immediate effect. The company also temporarily ceased activities starting mid-March at more than 40 per cent of its 249 production locations worldwide—for a few days to several weeks—to protect employees and in response to the drop-in demand. The company has now resumed production at many locations.

Mr. Aashish Mehra

MarketsandMarkets™ INC

+1 888-600-6441

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.