Wasseem Dirani explores Inflation and the Omicron Variant

Wasseem Dirani explores Inflation and the Omicron Variant

HAMILTON, ONTARIO, CANADA, January 15, 2022 /EINPresswire.com/ -- Inflation and the Omicron variant seem to be our hot news items, and they are essential to acknowledge for the economy and our general well-being. Both are important; with inflation, the cost of living does go up, and too much inflation can severely affect our spending, day-to-day lives, and the overall economy. Omicron could interrupt and potentially end our life, but there are ways to reduce this. We will look at what is happening with inflation and Omicron, the outlook for each, and if there may be a tie between them as well.

Inflation touches all of us. Inflation is such a big discussion currently because it has now reached the highest level seen in 40 years. The most recent Consumer Price Index (CPI) measurement from the US Bureau of Labor Statistics showed that in December, the basket of goods used to monitor inflation saw a year-over-year increase of 7%. The last time this inflation level was seen was in June of 1982. The “core CPI,” removes energy and food from the basket, and was at 5.5%, and this number has not been seen since February of 1991.

Inflation (when it is in check) is not necessarily a bad thing. The economist John Maynard Keynes said that inflation prevents the “Paradox of Thrift.” When people must spend more of their money, they can not save it, and this helps boost consumer demand. The demand means that more money is circulating into the economy, helping it grow. Inflation can also keep deflation (a decrease in prices) in check. With deflation, people will want to wait for prices to go down wherever they can.

The key is if inflation is in check. With the printing of money spike that began during the covid pandemic:

This injection of funds, meant to keep the economy stable, has done a little more than it should, and the economy has gone a little out of balance. With increased inflation, workers have also demanded higher wages, and this becomes a vicious cycle when wages go up, the costs to produce products and services increase which raises prices and more demand from employees to again raise their wages further.

The current growth in wages is still less than the rate of inflation, and workers are now choosing to stay out of the labor market, which is a worry as the only way to get workers back will be further increases in wages.

So with higher inflation, the worry is primarily two fold. First, with rising prices, people will not be able to afford what they could in the past. Some will immediately conserve, and others will get around the rise in some prices for their discretionary spending by borrowing via credit cards, personal loans, refinancing, and the ever-growing buy now pay later system. There is potentially an inflation point where people would have to borrow to pay for necessities, and if they default on those, the economy would be in dire straits.

The second worry is that investors who are concerned with the conservation and lack of money that is being supplied to the economy to grow. The Fed has an inflation target of 2%, and if it sees inflation getting too high, one of the mechanisms that the Fed can use to slow the speed of the growing economy is to raise borrowing rates. A rate rise means that borrowing is more expensive, and fewer people will take the risk of borrowing, which slows the economy down. This rate hike has a slowing effect on the stock markets, real estate, and several other areas of the economy. It is estimated that homebuyer’s, who rely on financing, purchasing power is reduced by 13% for every 100 basis point increase in the 30 yr mortgage rate.

This week the Fed Chair, Jerome Powell, said that rate hikes and tighter policy are needed to control inflation. Goldman Sachs believes that there will be four rate hikes through 2022.

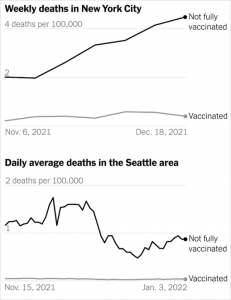

This leads to our second worry that is Omicron. The COVID virus variant is highly transmissible (between two and four times more contagious) when compared to Delta and other variants. Having taken over nearly every corner of the globe. Even Dr. Fauchi stated that the variant would “find just about everybody.” Omicron should not be discounted, as the hospitalizations due to covid have spiked after the holidays and reached the highest level since the start of the pandemic. This said, there is more and more data coming out the variant is less severe than Delta and others. This statement is true, but the definition of “less severe” is that adults are 29% less likely to be hospitalized. The more important evidence is that 90% of Covid 19 hospitalizations are from the unvaccinated, and with deaths, there is a drastic difference between vaccinated and unvaccinated.

The Omicron variant and the ongoing fight against COVID 19 will determine how the markets react and how the Fed will choose to conduct its monetary policy. The most likely scenario we be an end-of-January surge of Covid 19 deaths, but the infections and deaths will drop off dramatically after this surge. We will want to keep an eye on the CPI’s January and February results; if there is inflation at or below about 7.1 this will be a good sign that the rate is not getting worse. If inflation reverses (quickly drops below 7.0), then there may be less of a need for the Fed to have their four rate hikes and will only go with three for the year. Alternatively, suppose a new, very deadly variant appears, the deaths increase after January, and any sort of shutdown is required, then there will likely be no rate raises, but the inflation will continue to be higher; this is the least likely scenario but worst for the long-term economy and our health. Only time will tell.

Wasseem Dirani

Taxes to Save

+1 9059797109

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.