Watches and Wearables Market Analysis — New Tech Partnerships Enable Adaptations for Luxury Conglomerates

Watches are evolving into lifestyle-supporting gadgetry

SAN FRANCISCO, CALIFORNIA, UNITED STATES, November 22, 2021 /EINPresswire.com/ -- Policy2050.com, a think tank for tech policy and business strategy, has released the report “Disruptions in Watches and Wearables,” which delivers qualitative and quantitative insights on a technologically-transformed watches market.

The market for traditional watches is being reshaped by the acceleration of ecommerce, the increased popularity of online auction platforms, and the emergence of high-tech alternatives.

With increased competition from new gadgets, established luxury watch brands must find creative ways to digitally resurface the brand heritage/country-of-origin elements and product details supporting their higher-priced, traditional models.

This digital content, and context, now matters as much as tangible and social qualities once did in boutiques. The situation calls for new hiring practices and organizational approaches.

Younger luxury buyers might be more inclined to scrutinize luxury product details, for several reasons: ecommerce reviews turned them into savvier consumers; social media engendered their longing for exclusivity; and digital disruptors redefined the meaning of luxury.

As luxury watch brands digitize more of their sales, they might also choose to pursue tech partnerships in order to capture market share of the smartwatches/wearables category. This category is supported by rising health/wellness interests and is, arguably, most competitive with mid-to-lower-priced traditional watch models.

Advanced sensors, algorithms, and synchronized devices (IoT) underpin these gadgets. Smart bands are an increasingly popular form factor defined by their smaller screens. The resulting health data is unprecedented; it’s being collected on a large-scale and adopters are empowered to directly engage with their health information.

This technological advancement and, essentially, structural change now facilitates recreational activities, in addition to providing some form of psychological reassurance by quantifying abstract concepts of wellbeing, identity, and life.

“Innovations in AI, sensors, and materials science will drive transformations in many markets. With smartwatches and wearables, people will get to witness this firsthand, literally, on their own wrists, and their lifestyle interests will be factored into the R&D,” said David Pring-Mill, founder and chief analyst of Policy2050.com.

MARKET DRIVERS:

• The concept of brand heritage can still be effectively leveraged in marketing materials to create intrigue or desirable associations.

• Traditional luxury watches are sometimes viewed as assets for securing wealth.

• Online marketplaces and digital content, including virtual launch events, are driving awareness of different watch brands and models.

• The pandemic led to a surge of health/wellness interests and smartwatches/wearables are looked upon as lifestyle-supporting tools.

• Health apps are leveraging a wide range of technological and entertainment IP to create awareness and drive adoption.

• Better sleep is a leading driver for wearables adoption, perhaps related to “coronasomnia.”

• Multiple generations have indicated that they enjoy wearables’ data visualizations.

OPPORTUNITIES:

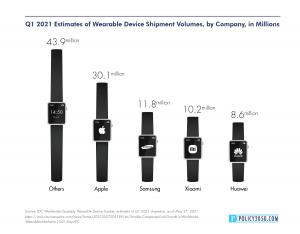

• Google’s acquisition of Fitbit for $2.1 billion signals a relatively popular belief that wearables will represent important nodes in future connectivity. Meanwhile, in a Q1 2021 earnings call, Apple CEO Tim Cook likened the size of Apple’s wearables business to a Fortune 120 company. Tech companies are now focused on strengthening their “digital ecosystems” (or “metaverse”) in order to support a variety of offerings, including devices and services.

• Color psychology is a surprisingly powerful factor. Watch brands can achieve sales growth by studying the relationship of colors to materials, styles, touchpoints, and cultures. Apple, the current global leader in wearables, is also a leader in the commercial use of colors, from the colorful iMacs that once contributed to a brand revival to the gold versions of iPhones that targeted the Chinese market.

• The introduction of luxury watch brands into the smartwatch category also represents an infusion of additional capital, which could further advance R&D and better address the functionality expectations and lifestyle goals that act as purchase drivers. Hublot’s CEO has characterized the luxury connected watch as an appealing niche, within which there’s potential for partnerships with different artists, sports leagues, and athletes.

• Smartwatches and other wearables are also being considered as tools in workforce management.

CHALLENGES:

• The perceived and legitimate risk of technological obsolescence, or discontinued updates, in the smartwatch category is an obstacle to luxury positioning. The vertical integration of luxury brands, followed by multiple pandemic-related disruptions, also upended the operations and margins of retailers, some of which responded with discounting strategies.

• The element of scarcity has long been used to justify luxury price tags. Recently, Hermès sounded the alarm for the industry, calling for other manufacturers to reduce their production to ease a luxury watch supply glut and, more fundamentally, to reconsider the incentives structures that contribute to this output. Watch brands might also be able to capture sales, without exacerbating this problem, by restoring and certifying their vintage pieces, or reviving old models in limited production runs. Meanwhile, new D2C watch brands are disrupting through crowdfunding and their own small batch manufacturing, which they leverage as a means of managing cash flow and testing product/market fit.

• Historical continuities in fashion trends, or cycles, have long been observed by those working in the industry, and in many ways, their work assumes and deliberately brings about these revivals (see Laver’s Law). However, social media, digital content, and ecommerce may have accelerated or otherwise meddled with the previous cycling.

• The high rate of growth in wearables during 2020 may not be sustainable, and additional efforts or pricing adjustments may be necessary to draw in new consumer segments.

• A lack of physician buy-in could undermine the credibility and usefulness of wearables. The black box nature of algorithms and other factors limit the suitability of consumer wearable devices for medical research, necessitating the use of different, research-grade devices that reveal raw data.

OTHER REPORT HIGHLIGHTS:

• Watches/wearables-related infographics are available for use by the news media (including content marketing blogs) with proper attribution to Policy2050.com.

• The Policy2050 “Disruptions in Watches and Wearables” report is approximately 26,000 words, covering aspects of the market such as digital strategies, corporate restructuring and culture, consumer survey results, and the relevance of color psychology.

• Please visit https://www.policy2050.com/reports/watches-wearables or contact david.pringmill@policy2050.com for more information.

David Pring-Mill

Policy2050.com

david.pringmill@policy2050.com

Visit us on social media:

Twitter

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.