FemTech Industry Investment Digest 2021/Q3

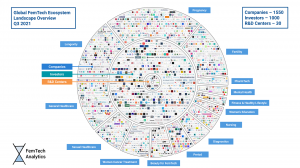

FemTech Analytics Has Profiled and Analyzed the 2021 Global FemTech Industry Investments, Covering 1550 Companies, 1000 Investors, 30 R&D Centers, 14 Sectors

Link to the Investment Digest: www.femtech.health/femtech-investment-digest

Link to the Interactive Dashboard: www.femtech.health/femtech-dashboard

FemTech includes a broad spectrum of digital and health technologies dedicated to the improvement of women’s health and wellbeing. By developing technological solutions for pregnancy and nursing care, women's sexual wellness, reproductive system healthcare, menopause solutions, female oncology, and general healthcare, FemTech seeks to fulfill the currently unmet needs of women. Reducing income inequality and unemployment for women will be an important factor in market development. The global FemTech Market Size accounted for $40.2B in 2020 and is projected to grow an average CAGR of 13.3% from 2020 till 2025 to reach $79.4B.

The analytical case study offers detailed insights on several aspects of the FemTech Industry that are crucial for effective investment decision making, including:

- A comprehensive analysis of the structure, number, and volume of investments of the 1500 FemTech Companies

- An analysis of structural and geographical allocations

- A performance review and analysis of Key Players of the FemTech Industry

- A comparison of the most successful and influential Publicly Traded FemTech engaged companies, emphasizing the scope of operational activities

- A glance at the FemTech companies that are funded and co-funded by the Top-500 Investors

Major business takeaways from the Investment Digest include the following:

- From the beginning of 2020, FemTech market capitalization increased by 21.9% – from $784B to $955B. This growth is expected to continue

- Big corporations such as Johnson & Johnson, Eli Lilly, and Sanofi held more than 80% of the market capitalization

- The global FemTech Market Size amounted to $46.3B in 2021 and is projected to grow an average CAGR of 13.3% from 2020 till 2025 to reach $79.4B. The main drivers of this include an increase in the life expectancy of women and the female employment to population ratio (up to 70% by 2030)

-The main focus of publicly traded corporations is on the following subsectors of FemTech: Pregnancy and Nursing, Reproductive Health, and General Healthcare. Leading companies invest heavily in the development of diagnostic devices and data analytics in those areas. Together these subsectors cover around 70% of the FemTech market

- Most publicly traded companies involved in FemTech are located in North America, with 58 companies having headquarters in the US. More than 30% of European companies are located in the UK

Some of the key points from the analysis include the following:

- The FemTech stock index includes more than 60 companies that are involved in the Women’s Health and IT sectors. More than 80% of firms have a positive average daily return. The cumulative FemTech index has greater average daily return than closest comparable indexes: Dow Jones U.S. -Pharmaceuticals Index (DJUSPR), S&P 500, and S&P 500 Pharmaceuticals

- The distribution of companies by type of investor shows that most are in the range of up to $500B in total amounts of funding and 400 investments. The largest volumes of investment came from government offices, private equity firms, and investment banks. Accelerators, incubators, and micro venture funds are leaders in terms of the frequency of investments

North America is still firmly in the lead in terms of the number of FemTech investors (57.6%). The European Union ranks second (25.9%). But in terms of distribution by total amounts of funding, the highest-ranking region are Asia-Pacific (81%) and North America (12%)

- Among countries, China occupies the largest share of total funding received from investors (80%). In comparison, the number of investors from China is only 4%, which is associated with large investments in local non-institutional investors

- The companies with recent IPOs demonstrate negative capitalization dynamics as well as overall net losses; however, this is not surprising as these were issued at the end of 2020 or in 2021. Meanwhile, the IPOs of 2019 are now starting to bring profit

About FemTech Analytics

FemTech Analytics (FTA) is a strategic analytics agency focused on the FemTech market, which is relatively young yet already treated as the next big market disruptor. The FemTech market encompasses key sub-sectors such as Longevity for women, Mental Health & Healthy Lifestyle, Reproductive Health, and General Healthcare. The range of FTA’s activities includes providing research and in-depth analysis on major areas of high potential in the FemTech Industry; maintaining profiling of companies and governmental agencies based on their innovation potential and business activity; and providing consulting and analytical services to advance the FemTech sector.

For press and media inquiries, cooperation, collaboration, and strategic partnership proposals, please contact: info@femtech.health

Maria Shmelova

FemTech Analytics

m.sh@dkv.global

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.