Cognerium’s AML API Offers Quick And Affordable Solution For Banks And Credit Unions

Head of strategy and products at Cognerium, Kishore Sharma discusses challenges of maintaining AML standards and how their system offers an instant solution.

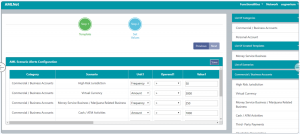

BOCA RATON, FL, UNITED STATES, November 3, 2020 /EINPresswire.com/ -- By implementing state-of-the-art AI technology, Cognerium now provides dynamic AML API services to the BFSI community. The system meets FinCEN standards and has been developed by seasoned AML officers and data scientists. Completely removing the need for employees with in-depth AML knowledge, Cognerium’s brand new AML API product can be applied to any bank or credit union’s on-premise or cloud platform, subsequently cutting costs and room for human error.Although Cognerium offers two separate solutions, AML API and AML Analytical Solution, the brand new AML API delivers instantaneous results, something that can’t be found anywhere else. Users can administer the API and run it against their data to identify suspicious transactions and networks. Cognerium’s AML API is best suited for organizations with rules-based AML systems and are planning to transition to data driven insights. It’s safe, secure and provides immediate results.

“Transitioning from rules-based to data driven insights saves significant time and cost to the company,” says Kishore Sharma, head of strategy and products at Cognerium. “Some of the organizations leverage AML API as a complementary solution to validate results against their home-grown systems. We are receiving high demand for AML API as it fosters a quick validation of SAR insights.”

Key features of Cognerium’s AML solutions are as follows:

• Segments the transactions based on the defined AML scenarios, and leverages advanced machine learning methods to accurately detect suspicious transactions and identify the suspicious networks.

• Can be plugged into an existing IT environment or it can be deployed on any cloud applications like AWS, Azure, IBM, Google, Snowflake, etc.

• Option to select base model or advanced model. Base model works on minimum and low data maturity capabilities, whereas advanced models work on the vast volumes of data and high-data matured capabilities.

• Meets FinCEN standards and generates automated SAR report.

Sharma adds, “Banks spend millions of dollars over many years building AML solutions and processes. And if they fail, they have to pay higher fines.”

The need for an economical AML solution is rapidly increasing. In 2019, 58 AML fines of $8.14 billion dollars were imposed globally. This is double the amount, and nearly double the value of penalties imposed in 2018, when 29 fines of $4.27 billion were imposed. Implementing Cognerium’s AML API is the most cost-effective solution for an organization’s AML needs.

For more information about Cognerium, please visit https://www.cognerium.com/.

About Cognerium

Cognerium is a Florida-based financial technology company specializing in AI-enabled Digital Transformations for banks and credit unions. With a vision to build intelligence that can assist humans in solving complex problems, Cognerium built the world’s first AI operating system for banking, financial services, and insurance (BFSI). The company’s services include Digital Lending, Anti-Money Laundering (AML/BSA), Current Expected Credit Loss (CECL) and Wealth Growth.

Kishore Sharma

Cognerium

contact@cognerium.com

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.