Open source solution to help transform the non-profitable business model of European car insurers

Our goal is to change the car insurance landscape sustainably - in a positive way.”

ZUG, SWITZERLAND, October 14, 2020 /EINPresswire.com/ -- Genadi Man, CEO of the start-up company kasko2go, announced at a telematics conference that he wants to reduce the dramatic losses in the car insurance industry with a high-tech open source product. In the long term, kasko2go aims to make the business model of Swiss and foreign insurers "significantly more profitable".— Genadi Man

At this year's telematics trade fair (Leipzig, Germany, 6 - 7 October 2020), Genadi Man announced that his company's advanced open source solution would be made available free of charge. In recent years, the product has been developed and tested on more than 100,000 drivers. In Switzerland, the software has already been on the market for almost two years.

The background

The main reason for this decision was to give all 900 European and Swiss motor vehicle insurance companies free access to telematics technology. This should enable the insurance companies to create their own Usage-Based-Insurance (UBI) products for their portfolio without high investment costs. With this step kasko2go is aiming at a real change and optimisation in the currently not very lucrative car insurance market.

Potential to be developed

The European motor insurance market has immense potential with revenues from motor insurance premiums of *135.3 billion euros in 2016. In the same year, however, *103.5 billion euros were also paid out in insurance claims. This means that *76.5 % of the income from motor insurance premiums had to be spent on claims. This explains the low margins of car insurers.

Genadi Man is happy about the upcoming open source launch. He explained: "Why do we offer an open source solution? With the kasko2go solution approach there is an enormous potential to change the entire industrial landscape in the field of motor vehicle insurance. Annual revenues in Europe amount to around 130 billion euros. If you take into account the high loss ratio of 76.5%, you realise that this business was and is not profitable." He wants to change this once and for all with kasko2go. “Our goal is to change the car insurance landscape sustainably - in a positive way," says the determined CEO.

Abolish an outdated business model

Traditional car insurers still base their risks on archaic parameters such as age, origin and gender. However, these business models lead to a high loss ratio because they are based on retrospective data, such as events that have already occurred. kasko2go, on the other hand, relies additionally on empirical, behavioural and location-related information. Thus the innovative solution is able to develop a comprehensive risk for the individual risk of each driver.

What the experts say

Remo Weibel worked for Swiss Life Select for a total of 25 years, ten of which as CEO and member of the Executive Board. He is also a proven expert in financial products and serves on the Advisory Board of kasko2go. He says "For insurers, access to more behavioural data on motorists will help them to process claims more quickly and efficiently, to better understand the price of the risks they underwrite and to offer innovative new products and services to their current and new policyholders".

Low-risk drivers currently share the high costs of high-risk drivers. kasko2go’s open source solution enables insurance companies to identify their risks in a targeted manner and to categorise them accordingly. This makes it possible to offer attractive premiums to low-risk drivers and create a portfolio with profitable policyholders.

Frederic Bruneteau is the Managing Director of the PTOLEMUS Consulting Group, which combines in-depth expertise of connected mobility issues with strategy development and market analysis capabilities. In more than 150 consulting assignments, PTOLEMUS supports clients in shaping future mobility. As a frequent speaker at insurance conferences, Bruneteau has published numerous groundbreaking reports on insurance telematics, insurance analytics and connected vehicle topics.

He says: "kasko2go is the first company in Europe to pursue the vision of an industry standard in insurance driver rating and to take the necessary steps to achieve this goal".

*Source: Insurance Europe, “European Motor Insurance Markets”, February 2019

About kasko2go AG

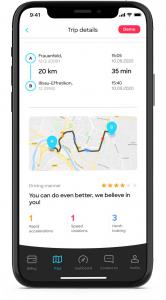

kasko2go is an innovative provider of insurance solutions that aims to promote a safe driving culture in society. Thanks to specially developed AI and telematic big data assessments with Pay-As-You-Drive and Pay-How-You-Drive models, kasko2go reduces insurance premiums by up to 50%. Since April 2019, kasko2go and its insurance partner, Dextra Versicherungen AG, have been offering a revolutionary car insurance app in Switzerland, which calculates the premium according to individual driving behaviour. The Zug-based company was founded in 2017. www.kasko2go.com

Genadi Man

kasko2go

+41 79 852 12 30

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.