Orocobre Limited announces FY20 Results, Memorandum of Understanding with Prime Planet Energy & Solutions and Equity Raising

NOT FOR RELEASE TO US WIRE SERVICES OR DISTRIBUTION IN THE UNITED STATES

BRISBANE, Australia, Aug. 28, 2020 (GLOBE NEWSWIRE) -- Today, Orocobre Limited (ASX: ORE, TSX: ORL) (Orocobre or the Company), a dynamic global lithium chemicals producer, announces its financial results for the full year ended 30 June 2020 (FY20), as well as the execution of a non-binding Memorandum of Understanding (MOU) with the Prime Planet Energy & Solutions joint venture (PPES) and an equity raising comprising a fully underwritten placement (Placement) and non-underwritten Share Purchase Plan (SPP) (the Placement and SPP, together, the Equity Raising).

Highlights:

- Promising FY20 full year result despite significant pricing and COVID 19 impacts

- Olaroz Stage 2 to deliver a significant reduction in cash costs and step up in volumes

- Orocobre has entered into a non-binding MOU with PPES, a joint venture between Toyota Motor Corporation (Toyota) and Panasonic Corporation (Panasonic), for a sizeable long-term contract which would, if a binding agreement is executed on the anticipated terms, minimise Orocobre's exposure to spot prices and significantly improve the customer mix

- The Equity Raising delivers financial flexibility to support Stage 1 ramp up and Stage 2 development through a range of operating and pricing environments, as well as capital for future growth initiatives

FY20 Results

- Comprehensive COVID-19 bio-security protocols have so far been successful in preventing workforce infection and transmission. COVID-19 related operational restrictions throughout the second half of this year have impacted costs, production volumes and Olaroz Stage 2 Expansion activities, and continue to do so

- Statutory consolidated group net loss of US$67.1 million for FY20 is down from a profit of US$65.4 million in the previous corresponding period (PCP). The underlying net loss after tax for the group is US$22.0 million1 after adjustments for impairment, foreign exchange and other one-off items

- Attributable group EBITDAIX2 is negative US$3.9 million, down from positive US$54.1 million3, due mostly to lower product pricing, lower sales volumes and COVID-19 impacts

- Total production of 11,922 tonnes of lithium carbonate, down only 5% on PCP after COVID-19 shutdowns and operating capacity being restricted to match sales in the second half of the year

- Positive operational improvements from the Olaroz Lithium Facility:

- Full year costs at US$4,372/t2; within the year Q4 costs were down 22% on Q1 costs with a focus on reducing contractors and non-essential spend. June quarter costs were the lowest for three years and Olaroz remains among the lowest cost producers of lithium chemicals in the world

- Gross operating cash margins of 21% equating to US$1,148/tonne, despite lower prices

- Significant quality improvements, all production delivered within customer specifications

- Continued success with new customer contracts, more than 50% of FY21 sales are contracted

- Full year costs at US$4,372/t2; within the year Q4 costs were down 22% on Q1 costs with a focus on reducing contractors and non-essential spend. June quarter costs were the lowest for three years and Olaroz remains among the lowest cost producers of lithium chemicals in the world

- As of 30 June 2020, Orocobre Group (corporate + 100% SDJ PTE) had cash of US$171.8 million and net proportional group cash (excluding shareholders loans) of US$44.6 million

- Naraha Lithium Hydroxide Plant is 70% complete and the Stage 2 Expansion of the Olaroz Lithium Facility is 40% complete. Costs for the expansion were revised to US$330 million with further engineering refinements

- Orocobre completed the acquisition of all issued and outstanding shares of Advantage Lithium Corp. that Orocobre did not already own. Consolidated JORC Measured and Indicated Resources have nearly doubled to 11.2 million tonnes lithium carbonate equivalent. This will allow Orocobre to continue to develop the Olaroz/Cauchari basin in a cost-effective manner that will optimise extraction of the resource to the benefit of all stakeholders

Orocobre Managing Director and CEO, Mr Martin Pérez de Solay said, “Orocobre has continued to deliver positive operating margins despite COVID-19 restrictions and weaker market conditions.

“In the second half of the year, management of COVID-19 has been paramount and we have been successful in preventing transmission of the virus within our operations. Our expansion plans continue to be delayed due to restrictions on personnel movement and we are working to mitigate the impact where possible.

“Our operating strategy retains a focus on safety, quality and productivity which combined with disciplined cost management is delivering improved operating results to ensure we remain a low-cost producer of lithium carbonate,” he said.

Consolidated Profit and Loss

| Summary of results for the half year ended 30 June 2020 |

Orocobre Consolidate Group 30 June 2020 30 June 2019# US $'000 US $'000 |

|||

| Revenue | 77.1 | 144.6 | ||

| EBITDAIX 1 | (3.9 | ) | 54.1 | |

| Less depreciation & amortisation | (13.9 | ) | (12.0 | ) |

| EBITIX 2 | (17.8 | ) | 42.1 | |

| Interest | (12.9 | ) | (6.8 | ) |

| EBTIX 3 | (30.7 | ) | 35.3 | |

| Gain on business combination | 30.7 | |||

| Other business combination costs | (5.0 | ) | ||

| Foreign currency gains/(losses) | (11.7 | ) | (12.9 | ) |

| Impairment | (33.1 | ) | (0.6 | ) |

| Share of losses of associates | (1.5 | ) | (1.5 | ) |

| Segment (loss)/profit for the half year before tax | (77.0 | ) | 46.0 | |

| Income tax benefit/(expense) | 9.9 | 19.5 | ||

| Net (loss)/profit | (67.1 | ) | 65.4 | |

# FY 2019 Proforma includes SDJ as 100% comparable with FY20

PPES MOU

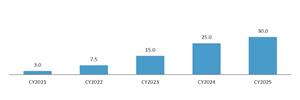

Orocobre has entered into a non-binding MOU with PPES, a joint venture between Toyota (51%) and Panasonic (49%) specialising in the production of automotive battery cells, for the long-term supply of product culminating in 30kt of LCE in CY25. It is anticipated that a majority of the volume supplied to PPES under any binding agreement will be in the form of battery grade lithium hydroxide from the existing Naraha plant, in addition to battery grade lithium carbonate from Olaroz.

If a binding agreement is executed on the anticipated terms, it would minimise Orocobre's exposure to spot prices, significantly improve the customer mix and would result in Olaroz Stages 1 and 2, along with Naraha volumes, being fully contracted, once added to contracts that already exist with other cathode manufacturers.

The MOU anticipates that certain price indicators will form the basis of arms-length pricing formulas.

Commenting on the signing of the MOU, Orocobre Managing Director and CEO, Mr Martín Perez de Solay said, “Orocobre is very pleased to have signed a Memorandum of Understanding with the PPES joint venture on the long-term supply of product from Olaroz and Naraha to PPES and we look forward to moving towards a binding agreement to conclude the commercially agreed arrangements."

Equity Raising

Placement

Orocobre is raising approximately A$126 million / US$91 million4 from the Placement and will issue approximately 50.0 million new fully paid ordinary shares (New Shares), representing 18.1% of Orocobre’s existing shares on issue.

Proceeds from the Equity Raising will be used to allow the Company to fully fund Olaroz Stage 2 and deliver the Olaroz Stage 1 ramp up through a range of operating, COVID-19 and pricing environments, as well as capital for future growth initiatives.

The Placement issue price of A$2.52 per share represents a 13.1% discount to Orocobre’s closing price of A$2.90 on the ASX on Thursday, 27 August 2020.

The New Shares issued under the Placement will rank equally with existing Orocobre fully paid ordinary shares on issue. The Placement is within Orocobre’s placement capacity under Listing Rule 7.1 as modified by the Temporary Extra Placement Capacity Class Waiver Decision (as amended) effective from 9 July 2020 (replacing the earlier waiver decision dated 23 April 2020), and accordingly no shareholder approval is required in connection with the Placement.

Settlement of New Shares issued under the Placement is expected to occur on Wednesday, 2 September 2020, with allotment of the New Shares issued under the Placement scheduled for Thursday, 3 September 2020.

Share Purchase Plan

Following completion of the Placement, Orocobre will conduct an offer of New Shares under a non-underwritten share purchase plan (SPP).

Eligible shareholders in Australia and New Zealand will have the opportunity to apply for up to A$30,000 of new fully paid ordinary shares free of any brokerage, commission and transaction costs.

The price paid by eligible shareholders for New Shares under the SPP will be the lesser of:

- the Placement price of A$2.52 per New Share;

- a 2% discount to the 5-day volume weighted average price of Orocobre shares up to the SPP closing date; and

- a 2% discount to the volume weighted average price of Orocobre shares on the SPP closing date.

Orocobre is aiming to raise up to A$30 million under the SPP. The amount of A$30 million is considered appropriate to provide the vast majority of Orocobre’s eligible shareholders in Australia and New Zealand with the opportunity to achieve at least a pro rata allocation, having regard to the total Equity Raising size, the composition of the share register and historical participation rates in share purchase plans generally. Orocobre may decide to accept applications (in whole or in part) that result in the SPP raising more or less than A$30 million in its absolute discretion. If a scale back is applied, this means that an eligible retail shareholder may be allocated fewer Orocobre New Shares than they apply for under the SPP. If Orocobre decides to conduct any scale back, it will apply the scale back having regard to the size of the existing shareholdings of applicants as at the SPP record date.

The New Shares issued under the SPP will rank equally with existing Orocobre fully paid ordinary shares on issue.

The SPP offer document containing further details of the SPP will be released on the ASX separately and will be mailed to all eligible shareholders in Australia and New Zealand.

Equity Raising Timetable

| Event | Date5 |

| Record date (for identifying Shareholders eligible to participate in the SPP) | 7:00pm, Thursday, 27 August 2020 |

| ASX and TSE Trading halt and announcement of the Placement and SPP | Friday, 28 August 2020 |

| Placement bookbuild and allocation | Friday, 28 August 2020 |

| Trading halt lifted – trading resumes on the ASX and TSX | Monday, 31 August 2020 |

| Settlement of New Shares issued under the Placement | Wednesday, 2 September 2020 |

| Allotment and normal trading of New Shares issued under the Placement | Thursday, 3 September 2020 |

| SPP opens and SPP Booklet is dispatched | Friday, 4 September 2020 |

| SPP closes | 5:00pm, Tuesday, 22 September 2020 |

| Announcement of results of SPP | Friday, 25 September 2020 |

| Allotment date for New Shares under the SPP | Thursday, 1 October 2020 |

| Despatch of holding statements and normal trading of New Shares issued under the SPP | Friday, 2 October 2020 |

Additional information about the Placement and SPP, including certain risks, are contained in the investor presentation released to ASX today.

This announcement has been approved by the Orocobre Limited Board of Directors

For more information please contact:

Andrew Barber

Chief Investor Relations Officer

Orocobre Limited

T: +61 7 3720 9088

M: +61 418 783 701

E: abarber@orocobre.com

W: www.orocobre.com

Twitter: https://twitter.com/OrocobreLimited

LinkedIn: https://www.linkedin.com/company/orocobre-limited

Facebook: https://www.facebook.com/OrocobreLimited/

Instagram: https://www.instagram.com/orocobre/

YouTube: https://www.youtube.com/OrocobreLimited

Click here to subscribe to the Orocobre e-Newsletter

Notes:

Unless otherwise stated, all financial data in this release is quoted in US dollars5.

Orocobre’s results are reported under International Financial Reporting Standards (IFRS). This report also includes certain non-IFRS financial information, including the following:

- NCI is the non-controlling interest which represents the portion of equity ownership in SDJ PTE

- EBITDAIX is ‘Earnings before interest, tax, depreciation and amortisation, impairment and foreign currency gains/(losses), share of associate losses and share of profit from joint ventures’

- EBITIX is ‘Earnings before interest, tax, impairment and foreign currency gains/(losses), share of associate losses and share of profit from joint ventures’

- EBTIX is ‘Earnings before tax, impairment and foreign currency gains/(losses), share of associate losses and share of profit from joint ventures’

- ‘underlying NPAT’ and ‘underlying EBITDAIX’ being statutory profit being adjusted for certain one off and non-recurring items

5Financial data has been translated to US Dollars using average exchange rates for the relevant period in the income statement.

About Orocobre Limited

Orocobre Limited (Orocobre) is a dynamic global lithium carbonate producer and an established producer of boron. Orocobre is dual listed on the Australia and Toronto Stock Exchanges (ASX: ORE), (TSX: ORL). Orocobre’s interests include its Olaroz Lithium Facility in Northern Argentina, a material JORC Resource in the adjacent Cauchari Basin and Borax Argentina, an established boron minerals and refined chemicals producer. The Company has commenced an expansion at Olaroz and construction of the Naraha Lithium Hydroxide Plant in Japan. For further information, please visit www.orocobre.com.

Summary Information

The following disclaimer applies to this announcement and any information contained in it (the Information). The Information in this announcement is of general background and does not purport to be complete. It should be read in conjunction with Orocobre's other periodic and continuous disclosure announcements lodged with ASX Limited, which are available at www.asx.com.au. You are advised to read this disclaimer carefully before reading or making any other use of this announcement or any Information contained in this announcement. In accepting this announcement, you agree to be bound by the following terms and conditions including any modifications to them.

Forward-looking Statements

This announcement may include forward-looking statements. These forward-looking statements are based on Orocobre's expectations and beliefs concerning future events. Forward-looking statements are necessarily subject to risks, uncertainties and other factors, many of which are outside the control of Orocobre, which could cause actual results to differ materially from such statements. Orocobre makes no undertaking to subsequently update or revise the forward-looking statements made in this announcement, to reflect the circumstances or events after the date of this announcement.

Restriction on distribution of this announcement

This announcement has been prepared for publication in Australia and may not be release to US wire services or distributed in the United States. This announcement does not constitute an offer to sell, or a solicitation of an offer to buy, securities in the United States or any other jurisdiction. Any securities described in this announcement have not been, and will not be, registered under the U.S. Securities Act of 1933 (US Securities Act) and may not be offered or sold in the United States except in transactions exempt from, or not subject to, registration under the US Securities Act and applicable US state securities laws. No public offering of the securities described herein will be made in the United States. This announcement is not an offer of securities for sale in the United States and securities may not be offered or sold in the United States absent registration or an exemption from registration. Any public offering of securities to be made in the United States will be made by means of a prospectus that may be obtained from the company and will contain detailed information about the company and management, as well as financial statements.

TSX matters

Orocobre is an “Eligible Interlisted Issuer” for purposes of the TSX. Orocobre has relied upon Section 602.1 of the TSX Company Manual in respect of the Placement on the basis that it has been completed in accordance with the standards of the ASX.

1 Underlying net loss is calculated after adjustment for impairment, forex losses, COVID-19, restructuring and other costs

2 see notes at end of release

3 FY19 Proforma include Olaroz as 100% comparable with FY20

4 Based on USD / AUD exchange rate of 0.722 as at 27 August 2020.

5 All dates and times are indicative only and subject to change, and refer to Brisbane time

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/346691e3-3386-4236-9389-27da59081f1d

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.