Cloud spending surged in Q2 2020, as lockdowns drove high levels of consumption

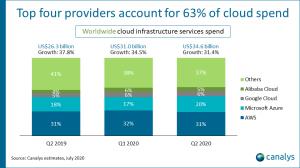

The Q2 2020 worldwide cloud infrastructure services market continued to surge, as spending grew 31% to US$34.6 billion.

Business continuity emerged as a top priority for many organizations from the start of the year. The need for robust plans to enable operations to continue no matter the situation has never been more crucial considering the impact of the COVID-19 pandemic. “Cloud-based services were pivotal in enabling emergency continuity plans designed to maintain virtual operations during lockdown,” said Canalys Chief Analyst, Matthew Ball. “These will also prove to be critical in the next phase of the response to COVID-19, as economies gradually re-open. In addition to supporting continued remote working and distance learning, cloud-based services will underpin the deployment of new digital workflows such as online booking and ordering systems as well as other contactless service engagements. It will also be part of solutions to make workplaces COVID-secure by monitoring occupancy levels and footfalls as well as contact-tracing to help reopen large offices and education facilities with confidence. Demand for cloud-based services will remain strong, as organizations accelerate their digital transformation initiatives over the next 12-months to capitalize on new emerging opportunities.”

Organizations will take advantage of the different strengths and capabilities of each cloud service provider, as they migrate more of their existing workloads to the public cloud and develop new cloud native applications. But this will not be a quick process. Instead it will be a multi-stage, multi-year process. “Differentiation among the leading providers will be critical as competition for customer’s spending on digital transformation projects intensifies,” said Canalys Research Analyst, Blake Murray. “Security, code development and migration tools, support for multi-cloud and hybrid-IT deployments, as well as enabling more predictable costs will be key areas of focus as organizations look to move as quickly as possible, minimize disruption and keep within more constrained budgets. The top four cloud service providers have maintained the pace of innovation over the last six months and will look to add further capabilities to help win new business. But competition from other cloud service providers will intensify.”

Rachel Lashford

Canalys

+44 7775 503940

email us here

Visit us on social media:

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.