Lake Simcoe Waterfront Report - Market Review for 2019

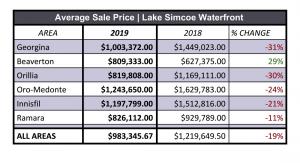

In 2019, the Lake Simcoe waterfront market, an area which we have been analysing for the past 11-years experienced a 19% Decrease to the average selling price.

TORONTO, ONTARIO, CANADA, January 14, 2020 /EINPresswire.com/ -- This area includes the communities of:

• Georgina (includes: Roches Point, Jackson's Point, Duclos Point, Keswick, Willow Beach)

• Innisfil

• Oro-Medonte

• Orillia

• Ramara

• Beaverton

Note: Data used includes only direct and indirect lakefront above $300,000. Canal and riverfront data are excluded.

Market Highlights:

• The average selling price in 2019 was $983,346 compared to $1,219,649 in 2018.

• The 2017 average selling price was $1,137,440, a Decrease of 13.5% over a 24-month period.

• Georgina reported a 31% Decrease to the average selling price in 2019.

• Orillia reporting a 30% Decrease.

• Beaverton was the only area reporting a rise in the average selling price with a 29% increase year-over-year.

Sales:

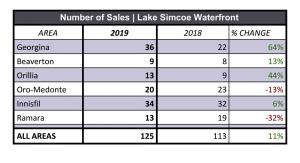

• In 2019, there was an 11% increase in sales from 113 to 115 in 2019.

• Georgina experienced a 64% increase, the largest increase on the lake rising from 22 sales to 36.

• Orillia reported 13 waterfront sales an increase of 44% since 2018.

Expired Listings:

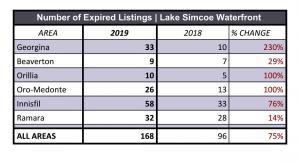

We analyzed all the data including the expired listing activity for the last three consecutive years in order to reach some reasonable explanation why the market was down in all but one area. It is not the first time we have seen “swings” in the waterfront market. The last time was in 2017, when prices rose by 30% from 2016.

• In 2019, The Toronto Real Estate Board reported 168 expired waterfront listings, a 75% increase from 96 in 2018.

• Oro-Medonte reported 26 expired listings of which, the majority being in the range of $1.5m to $17.9m.

• In Innisfil, 50% of the expired properties were in the $2m to $4m range.

• Georgina confirmed 33 properties expired, up from 10 in the previous year a 230% increase.

Mortgage Financing For Recreational Property:

It is important to mention that there were many properties that expired in some cases three times. The number of reported expired listings would have been considerably higher we excluded them to avoid distortng the data.

Financing the purchase of a waterfront property creates its own set of challenges. The new mortgage rules, particularly the upper-tier market has undoubtedly affected sales volume in 2019.

Darlene Hanley, Mortgage Agent of Hanley Mortgage Group commented that "cottages are a financing challenge with many variables that effect the quantum of the mortgage.” She outlined a number of key factors to take into consideration which are as follows:

• The maximum Loan to Value on a refinance is 80% subject to sliding scale & qualification (e.g., the stress test). The minimum down payment on the first $500,000 is 5% and 10% on the difference up to $999,999.

• For a purchase over $1 million, the minimum is 20% down.

• Depending on the lender and if there is an existing mortgage, a penalty to refinance may apply.

• Lenders will allow a gifted down payment; however, they also want to see 5-15% of the funds from the buyer.

• Cottage are not exempt from the mortgage stress test.

• Most lenders will only include the main building and exclude other buildings such as Boathouses and Bunkies when deriving an appraised value for mortgage financing.

• If the funds are directed to another property, housing costs would be added to the client’s liability which may affect debt ratios. e.g., taxes, maintenance fees.

Trends:

Younger Buyers:

There is more evidence confirming younger people are being shut-out of the housing market in major urban centers. They have redirected their attention to other rural areas including lakefront homes. This trend may explain why there was a larger percentage of lower priced Lake Simcoe properties sold in 2019.

Turn-Key Properties:

The Friday Harbour Development (“FHD”) appears to be successful in attracting buyers of waterfront condominiums. In 2019, eight “resale” units were sold at an average selling price of $1,278,875. FHD have released three other new phases including their 126-unit Ferretti towns, ranging in size from 2540 sq. ft. to 2731 sq. ft. with a starting price of $1.6m.

Seasonal or recreational buyers are attracted to the turn-key lifestyle with full amenities. This is a different buyer demographic to those seeking private properties dotting the 240 kms of Lake Simcoe shoreline.

The Eastern Shoreline:

Although travel time to Beaverton will add 30-minutes to your trip, this area offers exceptional, mostly all direct waterfront and priced well below other areas. Buyers are exercising their “buying power”. Properties tend to offer more direct water frontage, clear water with sandy bottom features. Beaverton prices rose by 29% in 2019. It appears the best kept secret on Lake Simcoe is out!

Conclusions:

Based on our extensive market analysis, we have concluded the Decrease in the average selling price was largely due to the upper-tier market pulling back. Luxury buyers of recreational waterfront did not invest as heavily in the upper-tier market on Lake Simcoe compared to previous years.

• Oro-Medonte has traditionally reported the highest selling price on the lake as many of the lakefront properties are situated on large acreage with substantial homes. Their upper-tier market was very quiet in 2019.

• Georgina’s waterfront sales were also very quiet in 2019.

(All data used in this report was obtained from The Toronto Real Estate Board.)

Roxanne Henderson

Chestnut Park Real Estate Ltd., Brokerage

+1 289-338-0767

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.