Mortgage Rates Decrease Slightly

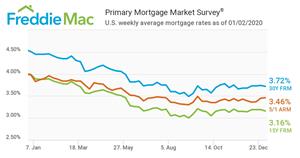

MCLEAN, Va., Jan. 02, 2020 (GLOBE NEWSWIRE) -- Freddie Mac (OTCQB: FMCC) today released the results of its Primary Mortgage Market Survey® (PMMS®), showing that the 30-year fixed-rate mortgage (FRM) averaged 3.72 percent.

“The combination of improved economic data and market sentiment has led to stability in mortgage rates, which have hovered around 3.7 percent for nearly the last two months,” said Sam Khater, Freddie Mac’s Chief Economist. “The stability is welcome news after the interest rate turbulence of the last year, which caused a slowdown in the housing market and other interest rate sensitive sectors. The low mortgage rate environment combined with the red-hot labor market is setting the stage for a continued rise in home sales and home prices.”

News Facts

- 30-year fixed-rate mortgage averaged 3.72 percent with an average 0.7 point for the week ending January 2, 2020, slightly down from last week when it averaged 3.74 percent. A year ago at this time, the 30-year FRM averaged 4.51 percent.

- 15-year fixed-rate mortgage averaged 3.16 percent with an average 0.7 point, down from last week when it averaged 3.19 percent. A year ago at this time, the 15-year FRM averaged 3.99 percent.

- 5-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.46 percent with an average 0.3 point, slightly up from last week when it averaged 3.45 percent. A year ago at this time, the 5-year ARM averaged 3.98 percent.

Average commitment rates should be reported along with average fees and points to reflect the total upfront cost of obtaining the mortgage. Visit the following link for the Definitions. Borrowers may still pay closing costs which are not included in the survey.

Freddie Mac makes home possible for millions of families and individuals by providing mortgage capital to lenders. Since our creation by Congress in 1970, we’ve made housing more accessible and affordable for homebuyers and renters in communities nationwide. We are building a better housing finance system for homebuyers, renters, lenders, investors and taxpayers. Learn more at FreddieMac.com, Twitter @FreddieMac and Freddie Mac’s blog FreddieMac.com/blog.

MEDIA CONTACT:

Angela Waugaman

703-714-0644

Angela_Waugaman@FreddieMac.com

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/bbb8b94b-6c50-4cde-ac93-bbbf3e4c6392

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.