Digital Banking Platform Market was valued at US$ 3.17 Billion in 2018 and is expected to reach US$ 8.67 Billion by 2027

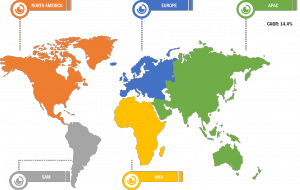

Global Digital Banking Platform Market, Asia Pacific is expected to grow with the highest CAGR of 14.4% during the forecast period of 2019 to 2027.

PUNE, MAHARASHTRA, INDIA, December 23, 2019 /EINPresswire.com/ -- The global Digital Banking Platform Market is anticipated to exhibit an impressive growth rate during the forecast period of 2019 to 2027. Factors such as growing digital transformation in the banking industry and rising demand for smart mobile devices and digital banking services among consumers are expected to drive the digital banking platform market in the next few years. However, factors such as lack of cloud infrastructure, data localization requirements in various countries, and cybersecurity concerns related to cloud-based banking solutions are anticipated to hinder the market growth in the coming years. In spite of these hindering factors, rising adoption of cloud-based solutions in the banking industry will offer ample opportunities for the players operating in the digital banking platform market.Digital banking platform acts as a foundation for any digital bank by allowing the bank to use its existing and new processes to create innovative digital products as well as services. These innovative digital solutions play a crucial role in attracting and retaining customers in the highly competitive digital banking platform market. Digital banking platforms help banks in digitizing banking operations, creating digital financial products, and facilitating digital customer communications. Increasing regulations pressure, price war, new competitors, and changing customer behavior are some of the major factors driving the demand for efficient digital banking platforms worldwide. Digital banking platforms allow banks to transform from a brick & mortar institution into a multichannel digital bank.

Download Sample PDF Of Report@ https://www.theinsightpartners.com/sample/TIPRE00006157/

Company Profiles

Appway AG

CREALOGIX Holding AG

EdgeVerve Systems Limited

Fiserv, Inc.

Oracle Corporation

SAP SE

Sopra Steria

Tata Consultancy Services Limited

Temenos Headquarters SA

Worldline SA

The increasing digital transformation revolution in banking industry presents a massive opportunity for digital banking platform providers as they enable banks to launch digital services faster and enhance the customer experience. In addition to this, the proliferation of smart devices, easy availability of internet, the advancement of IoT, and in Artificial Intelligence have been increasing exponentially, which is further leading to the increasing need of mobile/digital-first strategy among banks. The paradigm shift of banks from traditional channels to digital and automated channels results in multiple benefits ranging from improved efficiency to reduced cost and increased revenue opportunities. In addition to this, the rising technological advancements in cloud computing and storage technology, the power of cloud-based digital banking platforms has increased multi-fold during the past few years. This has further created opportunities for digital banking platforms. In the global digital banking platform market, Asia Pacific is expected to grow with the highest CAGR of 14.4% during the forecast period of 2019 to 2027.

The global banking industry landscape is becoming highly competitive majorly due to the increasing demand of innovative digital services by customers, changing business models, and emerging new ecosystems due to the entry of new competitors such as fintechs, technology companies, & challenger banks among others. In order to remain competitive in the digital banking platform market, banks are continuously working on improving services to enhance customer experience, reduce costs, and meet legislation requirements.

With changing customer preferences, today’s banks are shifting fast towards digital channels. Various banking services are now commonly available through convenient digital channels. However, in order to deliver exceptional customer experiences and survive in the highly competitive banking industry, banks need to move towards a much broader digital shift. In order to meet the expectations of both digital and non-digital consumers, banks are now adopting omnichannel banking, which helps in maintaining traditional service channels and optimizing them to meet customer needs. To achieve this, traditional banks have started partnering and sharing data with new ecosystems, which include FinTechs, open banking, payment services directive, and SWIFT standards.

Buy Now Full Report@ https://www.theinsightpartners.com/buy/TIPRE00006157/

Reason to Buy

• Save and reduce time carrying out entry-level research by identifying the growth, size, leading players and segments in the global Digital Banking Platform Market

• Highlights key business priorities in order to assist companies to realign their business strategies.

• The key findings and recommendations highlight crucial progressive industry trends in Digital Banking Platform Market, thereby allowing players to develop effective long term strategies.

• Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

• Scrutinize in-depth global market trends and outlook coupled with the factors driving the market, as well as those hindering it.

• Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation and industry verticals.

About Us:

The Insight Partners is a one stop industry research provider of actionable intelligence. We help our clients in getting solutions to their research requirements through our syndicated and consulting research services.

Contact us:

The Insight partners,

Phone: +1-646-491-9876

Email: sales@theinsightpartners.com

Sameer Joshi

The Insight Partners

+91 9666111581

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.