Ascendant Resources Exploration Program Successfully Expands and Improves Grades at the Main Massive Sulphide Zone and Significantly Expands the Stockwork Zone at the Lagoa Salgada Polymetallic VMS Project in Portugal

TORONTO, Jan. 14, 2019 (GLOBE NEWSWIRE) -- Ascendant Resources Inc. (TSX: ASND) (OTCQX: ASDRF; FRA: 2D9) ("Ascendant" or the "Company”) is very pleased to announce transformational results from its 20-hole drill program totaling 6,950 metres and an initial geophysics program at the Lagoa Salgada polymetallic VMS Project located on the Iberian Pyrite Belt (“IPB”) in Portugal; the IPB is home to some of the world’s largest volcanogenic massive sulphide mines.

|

|||||||||||||||

Highlights:

- Newly identified tin mineralization increases ZnEq grade by 15% in the Main zone

- Drill results expected to significantly increase new NI43-101 Mineral Resource Estimate due by end of January

- IP survey identifies 1.6km anomaly which includes the 2 known mineral deposits

- Geophysics work significantly expands the Project’s overall exploration potential by identifying new targets

Drill Hole Highlights:

-

LS_MS_19

Intersected 79.4m massive sulphide zone at 0.64% Cu, 1.94% Pb, 3.36% Zn, 0.57g/t Au, 60.11g/t Ag and 0.17% Sn (10.16% ZnEq)

-

LS_MS_16

Intersected 76.6m massive sulphide zone at 0.48% Cu, 2.06% Pb, 3.43% Zn, 0.39g/t Au, 40.30g/t Ag and 0.22% Sn (9.84% ZnEq)

-

LS_MS_17

Intersected 30.8 metres of high-grade massive sulphide at 0.32% Cu, 8.44% Pb, 1.91% Zn, 1.79g/t Au, 61.39g/t Ag and 0.26% Sn 15.6% ZnEq

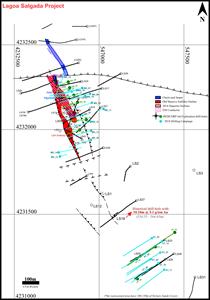

The drill program at Lagoa Salgada consisted of 12 holes (3,964 metres) in the Main Massive Sulphide Zone and 8 holes (3,113 metres) in the Stockwork Zone. The program has been very successful at confirming and expanding high-grade mineralization in the Main Massive Sulphide Zone and in expanding and improving the continuity of the sulphide mineralization in the Stockwork Zone. Results from the Main Massive Sulphide Zone indicate additional massive sulphide mineralization at grades in excess of 10% ZnEq. The identification of tin mineralization within the massive sulphides has contributed significantly to this grade improvement. In the Stockwork Zone results indicate that a thick, well mineralized ore zone has not yet been fully defined.

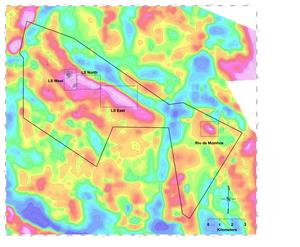

Concurrent geophysical work has confirmed a strong 1.6 km long chargeability anomaly which includes the Main Massive Sulphide and Stockwork Zones. A Residual Bouguer Gravity anomaly coincides with the Chargeability anomaly, but the gravity map also identifies numerous additional anomalies within Lagoa Salgada’s property boundary.

Chris Buncic, President & CEO of Ascendant stated “We are very pleased by the success of our latest exploration program at Lagoa Salgada. The drill results have more than exceeded our expectations in identifying similar high-grade massive sulphide and stockwork mineralization identified in previous drill campaigns at Lagoa Salgada. The addition of newly identified high-grade tin mineralization in the Main Zone provides further confidence in the potential to quickly increase high-grade tonnes to the known Mineral Resource. An update to the Mineral Resource Estimate is expected in January.”

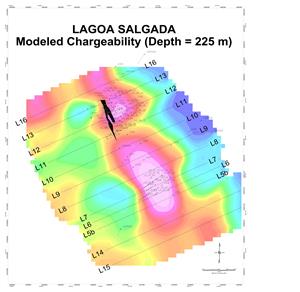

He continued, “In addition to the drill program the company has completed ground and downhole IP surveys. The results from these surveys have identified a 1.6 km IP anomaly coincident with the massive sulphide mineralization intersected by the drill program from the layered massive sulphides in the northwest (Massive Sulphide Zone) to the Stockwork Zone in the southeast. The IP anomaly is also coincident with a significant regional gravity anomaly which greatly expands exploration potential to the east.”

Drill Hole Details

Tables 1 and 2 below provide assay results for 11 holes in the Main Massive Sulphide Zone and 5 holes in the Stockwork Zone. One hole from the Main Massive Sulphide Zone and 3 holes for the Stockwork Zone are still pending. Drill holes in this program were collared in an area targeting the eastern expansion of the known main volcanogenic massive sulphide mineralization contained within the current Mineral Resource Estimate as defined in the National Instrument 43-101 report dated January 5, 2018 and targeting expansion of the Stockwork Zone.

The drill holes were drilled at an angle of 60o to provide additional information of the true thickness and orientation of the ore zone. Significant thickness of gossan and massive sulphide mineralization were intersected in holes LS_MS_07, LS_MS_16 through LS_MS_20. In several of the holes, including LS_MS_07, LS_MS_16, LS_MS_18 and LS_MS_19, a second massive sulphide horizon was intersected on the west side of a major fault identifying a possible new lens.

Figure 1: Plan View of the 2018 Planned Drill Holes

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/a0ba1d57-2222-4637-b44e-dff4caea0b90

Introduction of Tin in Mineralization

A significant achievement of the exploration program has been the identification of cassiterite (SnO2) associated with the Main Massive Sulphide Zone. The IBP is known for having areas rich in tin, however, there has been no historical assaying for tin on previous drill holes at Lagoa Salgada. As such, Ascendant has incorporated into the exploration program the analysis of all historic (2017) and current drill holes in the Main Massive Sulphide Zone being tested for tin (Sn). Significant tin values have been recognized in the holes and are being reported in Table 1 below for the current LS_MS holes. In many of the holes the results are material and add an average 1.5% to the ZnEq grade. The tin is significant in the gossan, massive sulphide and stringer zones of the Main Massive Sulphide Zone.

Geophysical Surveys

In addition to the drill program, recently completed ground and downhole IP surveys have identified a chargeability anomaly 1.6 kilometres long by 200-300 metres wide that is coincidental with the sulphide mineralization both in the Main Massive Sulphide Zone and the Stockwork Zone (Figure 2). This broad N-S zone of elevated chargeability can be traced from the Main Massive Sulphide Zone southwards to beyond the zone where the Stockwork Zone was drilled in 2018 with no evidence of a gap or eastward offset in mineralization suggested by a 2016 IP/Res survey. The IP 3D model suggests that the drilling at the Main Massive Sulphide Zone is coincident with the chargeability anomaly. However, the model for the Stockwork Zone suggests the stronger part of the anomaly lies to the east and remains untested. Furthermore, on the southern lines (lines 14 and 15) on the eastern extremity, a new anomaly is appearing with the possibility of a new zone developing that is also untested.

Figure 2: IP Survey Map Coincident with Known Mineral Resources

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/ae8aef75-661f-4117-b0ed-f7163ed285c9

The IP anomaly is also coincident with the more extensive regional Bouguer gravity anomaly that stretches southeast by approximately 8km to the Rio de Moinhos Target (Figure 3), highlighting a significant number of targets for the future. Pseudosections prepared for the 2018 IP lines indicate a second target southeast of the Main Massive Sulphide Zone, near the eastern end of lines 8-10 and extending as far south as line 14. This target shows a clear association with the anomaly shown on the map of residual Bouguer Gravity. We are establishing a naming convention referring to the greater areas within Lagoa Salgada region as indicated on Figure 3. Note that the Company’s work to date has been focused within the LS West area.

Figure 3: Gravimetric Survey Map with High Bouguer Gravity Coincident with Known Mineral Resources

A photo accompanying this announcement is available at http://www.globenewswire.com/NewsRoom/AttachmentNg/36312925-4d51-40d6-a77b-f263e198d4f8

Table 1: Drill Intersections

Main Zone (Massive Sulphide Zone)

| From | To | Length | True Width | Cu | Pb | Zn | Sn | Au | Ag | Zn Eq [2] | |

| (m) | (m) | (m) | (m) | (%) | (%) | (%) | (%) | (ppm) | (ppm) | With Sn(%) | |

| LS_MS_07* | 168.95 | 300.00 | 131.05 | 106.15 | 0.54 | 2.72 | 3.22 | 0.17 | 0.81 | 77.86 | 11.51 |

| including | 176.00 | 297.00 | 121.00 | 98.01 | 0.58 | 2.89 | 3.42 | 0.18 | 0.87 | 82.95 | 12.24 |

| gossan | 168.95 | 182.15 | 13.20 | 11.35 | 0.06 | 1.00 | 0.23 | 0.35 | 1.73 | 143.08 | 10.32 |

| including | 176.00 | 181.00 | 5.00 | 4.30 | 0.11 | 1.57 | 0.25 | 0.76 | 3.91 | 324.80 | 21.87 |

| 1st MS | 182.15 | 253.90 | 71.75 | 55.25 | 0.33 | 4.49 | 4.89 | 0.14 | 1.09 | 98.21 | 14.91 |

| including | 216.00 | 236.00 | 20.00 | 15.40 | 0.20 | 6.35 | 8.07 | 0.18 | 1.58 | 112.20 | 21.00 |

| STKW | 262.00 | 274.00 | 12.00 | 9.24 | 3.19 | 0.14 | 0.91 | 0.33 | 0.01 | 28.42 | 12.68 |

| Including | 264.00 | 273.00 | 9.00 | 6.93 | 4.06 | 0.16 | 1.03 | 0.30 | 0.01 | 27.56 | 14.94 |

| including | 269.00 | 273.00 | 4.00 | 3.08 | 8.22 | 0.26 | 1.44 | 0.27 | 0.01 | 47.75 | 26.68 |

| 2nd MS | 280.35 | 289.60 | 9.25 | 7.12 | 0.44 | 0.89 | 2.58 | 0.26 | 0.29 | 44.40 | 7.53 |

| LS_MS_08 | 189.00 | 373.25 | 184.25 | 149.24 | 0.11 | 0.04 | 0.34 | n.m. | 0.02 | 5.32 | 0.81 |

| STKW | 208.00 | 219.00 | 11.00 | 8.47 | 0.56 | 0.15 | 1.20 | n.m. | 0.09 | 24.27 | 3.56 |

| Including | 209.00 | 218.00 | 9.00 | 6.94 | 0.67 | 0.15 | 1.25 | n.m. | 0.10 | 27.89 | 4.01 |

| Including | 213.00 | 218.00 | 5.00 | 3.85 | 1.04 | 0.22 | 1.60 | n.m. | 0.15 | 45.60 | 5.92 |

| and | 305.00 | 306.00 | 1.00 | 0.77 | 0.82 | 0.02 | 1.26 | n.m. | 0.05 | 15.00 | 3.90 |

| LS_MS_09 | 194.00 | 370.00 | 176.00 | 142.56 | 0.12 | 0.02 | 0.24 | n.m. | 0.01 | 2.97 | 0.68 |

| STKW | 215.00 | 217.00 | 2.00 | 1.54 | 0.67 | 0.08 | 1.29 | n.m. | 0.01 | 22.50 | 3.71 |

| STKW | 267.00 | 268.00 | 1.00 | 0.77 | 0.08 | 0.18 | 1.85 | n.m. | 0.05 | 49.00 | 3.51 |

| STKW | 284.00 | 290.00 | 6.00 | 4.62 | 0.86 | 0.01 | 1.20 | n.m. | 0.03 | 5.83 | 3.67 |

| Including | 284.00 | 289.00 | 5.00 | 3.85 | 1.02 | 0.01 | 1.39 | n.m. | 0.02 | 6.80 | 4.30 |

| STKW | 320.00 | 322.00 | 2.00 | 1.54 | 1.13 | 0.01 | 0.61 | n.m. | 0.03 | 15.00 | 4.03 |

| STKW | 331.00 | 332.00 | 1.00 | 0.77 | 0.87 | 0.04 | 0.99 | n.m. | 0.00 | 11.00 | 3.59 |

| LS_MS_10 | 146.40 | 267.00 | 120.60 | 97.69 | 0.05 | 0.09 | 0.37 | 0.01 | 0.05 | 3.89 | 0.81 |

| gossan | 147.00 | 149.00 | 2.00 | 1.72 | 0.80 | 0.28 | 1.33 | 0.07 | 0.07 | 0.00 | 4.31 |

| Stringer | 233.00 | 261.00 | 28.00 | 21.56 | 0.03 | 0.13 | 0.72 | 0.00 | 0.07 | 6.04 | 1.20 |

| LS_MS_12 | No Significant Mineralization | ||||||||||

| LS_MS_13 | 167.00 | 200.00 | 33.00 | 26.73 | 0.05 | 0.70 | 1.25 | 0.03 | 0.02 | 10.52 | 2.55 |

| Including | 167.00 | 189.00 | 22.00 | 17.82 | 0.07 | 0.84 | 1.42 | 0.04 | 0.02 | 12.77 | 2.98 |

| gossan | 151.30 | 153.05 | 1.75 | 1.51 | 0.09 | 0.10 | 0.26 | 0.02 | 0.01 | 0.00 | 0.64 |

| Stringer | 167.00 | 168.00 | 1.00 | 0.77 | 0.76 | 0.05 | 0.15 | 0.01 | 0.01 | 100.00 | 4.74 |

| Including | 173.00 | 189.00 | 16.00 | 12.32 | 0.04 | 1.06 | 1.85 | 0.05 | 0.02 | 10.50 | 3.55 |

| Including | 180.00 | 187.00 | 7.00 | 5.39 | 0.06 | 1.60 | 2.70 | 0.06 | 0.03 | 12.86 | 5.12 |

| LS_MS_16 | 163.15 | 349.00 | 185.85 | 150.54 | 0.29 | 1.43 | 2.18 | 0.15 | 0.35 | 27.9 | 6.59 |

| including | 163.15 | 273.55 | 110.40 | 89.42 | 0.45 | 2.15 | 3.17 | 0.23 | 0.53 | 39.8 | 9.87 |

| gossan | 163.15 | 174.10 | 10.95 | 9.42 | 0.15 | 2.94 | 0.80 | 0.34 | 1.80 | 35.1 | 10.18 |

| including | 170.00 | 174.10 | 4.10 | 3.53 | 0.09 | 2.90 | 0.48 | 0.53 | 4.31 | 54.3 | 15.48 |

| MS | 174.10 | 273.55 | 99.45 | 76.58 | 0.48 | 2.06 | 3.43 | 0.22 | 0.39 | 40.3 | 9.84 |

| including | 194.00 | 222.00 | 28.00 | 21.56 | 0.28 | 3.65 | 5.16 | 0.20 | 0.44 | 43.5 | 12.47 |

| including | 257.00 | 262.00 | 5.00 | 3.85 | 2.64 | 0.35 | 2.12 | 1.00 | 0.06 | 63.60 | 18.61 |

| MS | 239.00 | 273.55 | 34.55 | 26.60 | 0.68 | 0.86 | 2.47 | 0.30 | 0.26 | 42.72 | 8.74 |

| Stringer | 277.00 | 284.00 | 7.00 | 5.39 | 0.19 | 0.63 | 1.76 | 0.07 | 0.19 | 35.9 | 4.54 |

| and | 312.00 | 315.00 | 3.00 | 2.31 | 0.15 | 1.93 | 2.72 | 0.13 | 0.18 | 28.3 | 6.85 |

| and | 347.00 | 349.00 | 2.00 | 1.54 | 0.19 | 2.37 | 3.30 | 0.15 | 0.15 | 33.5 | 8.16 |

| LS_MS_17 | 161.00 | 199.00 | 38.00 | 30.78 | 0.32 | 8.44 | 1.91 | 0.26 | 1.79 | 61.39 | 15.57 |

| including | 162.00 | 192.00 | 30.00 | 24.30 | 0.40 | 10.56 | 2.31 | 0.34 | 2.23 | 73.75 | 19.35 |

| gossan | 162.50 | 170.75 | 8.25 | 7.10 | 0.16 | 13.44 | 1.43 | 0.60 | 3.06 | 52.89 | 22.12 |

| including | 163.00 | 170.75 | 7.75 | 6.67 | 0.17 | 12.61 | 1.44 | 0.63 | 3.08 | 58.38 | 23.16 |

| MS | 170.75 | 194.30 | 23.55 | 18.13 | 0.45 | 7.77 | 2.33 | 0.19 | 1.78 | 79.56 | 16.47 |

| including | 171.00 | 191.00 | 20.00 | 15.40 | 0.53 | 9.00 | 2.86 | 0.22 | 2.07 | 87.05 | 19.54 |

| Stringer | 198.00 | 199.00 | 1.00 | 0.77 | 0.04 | 0.43 | 1.83 | 0.01 | 0.23 | 12.00 | 3.05 |

| and | 259.00 | 262.00 | 3.00 | 2.31 | 0.07 | 1.00 | 1.77 | 0.03 | 0.04 | 16.00 | 3.56 |

| LS_MS_18 | 164.40 | 304.00 | 139.60 | 113.08 | 0.20 | 1.04 | 1.17 | 0.09 | 0.29 | 46.65 | 4.91 |

| including | 167.00 | 231.00 | 64.00 | 51.84 | 0.35 | 2.07 | 1.86 | 0.19 | 0.57 | 92.81 | 9.30 |

| gossan | 164.40 | 175.90 | 11.50 | 9.89 | 0.12 | 1.71 | 0.54 | 0.39 | 1.05 | 69.25 | 8.41 |

| including | 167.00 | 175.90 | 8.90 | 7.65 | 0.13 | 1.90 | 0.46 | 0.51 | 1.40 | 92.22 | 10.56 |

| MS | 175.90 | 247.80 | 71.90 | 55.36 | 0.31 | 1.67 | 1.70 | 0.11 | 0.34 | 73.76 | 7.24 |

| including | 175.90 | 231.00 | 55.10 | 42.43 | 0.39 | 2.09 | 2.09 | 0.14 | 0.44 | 92.91 | 9.10 |

| including | 175.90 | 197.00 | 21.10 | 16.25 | 0.59 | 3.75 | 3.25 | 0.27 | 0.64 | 159.00 | 15.34 |

| Stringer | 249.00 | 250.00 | 1.00 | 0.77 | 0.21 | 0.11 | 1.88 | 0.02 | 0.03 | 17.00 | 3.15 |

| and | 259.00 | 261.00 | 2.00 | 1.54 | 0.17 | 0.67 | 1.63 | 0.02 | 0.18 | 15.00 | 3.49 |

| and | 281.00 | 283.00 | 2.00 | 1.54 | 0.04 | 0.86 | 2.38 | 0.04 | 0.03 | 8.00 | 3.78 |

| and | 291.00 | 293.00 | 2.00 | 1.54 | 0.24 | 0.12 | 2.36 | 0.04 | 0.15 | 19.50 | 4.11 |

| 2nd MS | 300.60 | 303.30 | 2.70 | 2.08 | 0.35 | 0.22 | 0.77 | 0.02 | 0.18 | 31.75 | 2.50 |

| including | 301.00 | 303.00 | 2.00 | 1.54 | 0.52 | 0.27 | 1.04 | 0.04 | 0.28 | 39.00 | 4.32 |

| LS_MS_19 | 168.40 | 344.00 | 175.60 | 142.24 | 0.46 | 1.37 | 2.39 | 0.13 | 0.44 | 45.67 | 7.33 |

| including | 169.00 | 280.00 | 111.00 | 89.91 | 0.60 | 2.00 | 3.18 | 0.18 | 0.63 | 63.86 | 10.10 |

| gossan | 168.40 | 177.50 | 9.10 | 7.83 | 0.19 | 2.45 | 1.00 | 0.32 | 1.19 | 95.50 | 8.13 |

| including | 174.00 | 177.50 | 3.50 | 3.01 | 0.23 | 3.10 | 0.49 | 0.35 | 2.63 | 223.25 | 11.13 |

| MS | 177.50 | 280.65 | 103.15 | 79.43 | 0.64 | 1.94 | 3.36 | 0.17 | 0.57 | 60.11 | 10.16 |

| including | 236.00 | 280.65 | 44.65 | 34.38 | 0.73 | 1.63 | 3.25 | 0.25 | 0.49 | 66.13 | 10.50 |

| Alunite | 258.60 | 264.80 | 6.20 | 4.77 | 2.77 | 0.22 | 0.84 | 0.57 | 0.04 | 121.86 | 13.64 |

| 2 lens MS | 311.70 | 314.40 | 2.70 | 2.08 | 0.73 | 0.35 | 2.00 | 0.05 | 0.31 | 25.75 | 4.03 |

| Stringer | 293.00 | 295.00 | 2.00 | 1.54 | 0.50 | 0.52 | 2.88 | 0.02 | 0.11 | 27.50 | 5.66 |

| and | 306.00 | 308.00 | 2.00 | 1.54 | 0.07 | 0.16 | 0.36 | 0.46 | 0.17 | 17.50 | 4.81 |

| and | 325.00 | 327.00 | 2.00 | 1.54 | 1.60 | 0.58 | 1.97 | 0.13 | 0.32 | 50.50 | 9.41 |

| and | 343.00 | 345.00 | 2.00 | 1.54 | 0.13 | 2.24 | 2.74 | 0.10 | 0.05 | 16.50 | 6.33 |

| LS_MS_20 | 141.00 | 198.00 | 57.00 | 46.17 | 0.06 | 0.71 | 0.57 | 0.03 | 0.16 | 24.68 | 2.32 |

| 141.00 | 163.00 | 22.00 | 18.04 | 0.09 | 1.26 | 0.33 | 0.06 | 0.17 | 40.87 | 3.19 | |

| gossan | 146.60 | 171.10 | 24.50 | 21.07 | 0.08 | 1.07 | 0.29 | 0.05 | 0.23 | 33.44 | 2.87 |

| including | 151.00 | 163.00 | 12.00 | 10.32 | 0.14 | 1.45 | 0.26 | 0.09 | 0.16 | 24.67 | 3.50 |

| including | 149.00 | 155.00 | 6.00 | 5.16 | 0.05 | 2.88 | 0.48 | 0.17 | 0.18 | 14.50 | 5.19 |

| including | 162.00 | 164.00 | 2.00 | 1.72 | 0.71 | 0.46 | 0.10 | 0.02 | 0.42 | 109.50 | 5.87 |

| Stringer | 178.00 | 181.00 | 3.00 | 2.31 | 0.07 | 0.96 | 2.25 | 0.03 | 0.16 | 21.75 | 3.81 |

| including | 197.00 | 199.00 | 2.00 | 1.54 | 0.07 | 0.61 | 2.49 | 0.03 | 0.12 | 14.00 | 3.99 |

* Hole LS_MS_07 was originally reported in the Company’s press release dated October 15, 2018 and is restated here to include the tin grades previously not reported.

Notes:

1 ZnEq% was calculated as follows: ZnEq% = ((Zn Grade*25.35)+(Pb Grade*23.15)+(Cu Grade * 67.24)+(Au Grade*40.19)+(Ag Grade*0.62)+Sn Grade*191.75)/25.35

2 Metal prices used: US$1.15/lb Zn, US$1.05/lb Pb, $3.05/lb Cu, US$8.70/lb Sn, US$19.40/oz Ag, and 1,250/oz Au. No recoveries were applied.

Stockwork Zone

| From | To | Length | True Width | Cu | Pb | Zn | Au | Ag | Zn Eq [1] | |

| (m) | (m) | (m) | (m) | (%) | (%) | (%) | (ppm) | (ppm) | (%) | |

| LS_ST_05 | 187.00 | 341.00 | 154.00 | 100.10 | 0.06 | 0.24 | 0.39 | 0.03 | 2.04 | 0.87 |

| STKW | 207.00 | 208.00 | 1.00 | 0.65 | 0.14 | 1.59 | 2.09 | 0.03 | 7.00 | 4.14 |

| STKW | 225.00 | 229.00 | 4.00 | 2.60 | 0.24 | 1.20 | 1.36 | 0.04 | 7.00 | 3.32 |

| STKW | 236.00 | 238.00 | 2.00 | 1.30 | 0.38 | 1.30 | 1.80 | 0.02 | 13.50 | 4.35 |

| STKW | 256.00 | 258.00 | 2.00 | 1.30 | 0.24 | 1.43 | 2.07 | 0.02 | 8.50 | 4.24 |

| STKW | 272.00 | 278.00 | 6.00 | 3.90 | 0.14 | 0.94 | 1.55 | 0.15 | 5.67 | 3.14 |

| LS_ST_07 | 170.00 | 421.00 | 251.00 | 163.15 | 0.26 | 0.55 | 1.02 | 0.04 | 11.53 | 2.57 |

| STKW | 170.00 | 175.00 | 5.00 | 3.25 | 0.70 | 0.65 | 0.83 | 0.08 | 26.40 | 4.04 |

| Including | 170.00 | 173.00 | 3.00 | 1.95 | 1.08 | 0.71 | 0.68 | 0.10 | 38.33 | 5.30 |

| STKW | 187.00 | 218.00 | 31.00 | 20.15 | 0.65 | 0.93 | 1.97 | 0.13 | 22.10 | 5.29 |

| Including | 206.00 | 218.00 | 12.00 | 7.80 | 1.57 | 1.81 | 3.55 | 0.15 | 44.50 | 10.69 |

| STKW | 228.00 | 236.00 | 8.00 | 5.20 | 0.34 | 1.45 | 1.97 | 0.05 | 12.75 | 4.59 |

| Including | 228.00 | 232.00 | 4.00 | 2.60 | 0.45 | 1.58 | 2.40 | 0.05 | 14.50 | 5.46 |

| STKW | 249.00 | 255.00 | 6.00 | 3.90 | 0.50 | 1.72 | 2.27 | 0.07 | 22.17 | 5.80 |

| Including | 253.00 | 255.00 | 2.00 | 1.30 | 1.39 | 4.34 | 5.90 | 0.18 | 59.50 | 15.28 |

| STKW | 274.00 | 284.00 | 10.00 | 6.50 | 0.59 | 1.18 | 1.24 | 0.09 | 18.80 | 4.47 |

| Including | 275.00 | 282.00 | 7.00 | 4.55 | 0.76 | 1.32 | 1.29 | 0.09 | 23.43 | 5.24 |

| STKW | 337.00 | 367.00 | 30.00 | 19.50 | 0.38 | 1.05 | 2.11 | 0.02 | 20.30 | 4.61 |

| Including | 337.00 | 361.00 | 24.00 | 15.60 | 0.43 | 1.21 | 2.44 | 0.02 | 23.83 | 5.30 |

| Including | 347.00 | 350.00 | 3.00 | 1.95 | 1.09 | 4.80 | 5.31 | 0.05 | 58.33 | 14.10 |

| STKW | 376.00 | 378.00 | 2.00 | 1.30 | 0.62 | 1.56 | 4.21 | 0.30 | 39.50 | 8.72 |

| STKW | 400.00 | 421.00 | 21.00 | 13.65 | 0.66 | 0.93 | 1.71 | 0.03 | 32.29 | 5.16 |

| Including | 400.00 | 409.00 | 9.00 | 5.85 | 1.19 | 0.86 | 2.11 | 0.05 | 34.44 | 6.97 |

| Including | 418.00 | 421.00 | 3.00 | 1.95 | 0.73 | 3.30 | 3.62 | 0.03 | 103.00 | 11.16 |

| LS_ST_08 | 159.00 | 338.00 | 179.00 | 116.35 | 0.11 | 0.44 | 0.77 | 0.01 | 3.30 | 1.57 |

| Main | 170.00 | 194.00 | 24.00 | 15.60 | 0.30 | 0.97 | 1.35 | 0.02 | 3.96 | 3.17 |

| Including | 209.00 | 228.00 | 19.00 | 12.35 | 0.16 | 0.69 | 1.79 | 0.01 | 6.05 | 3.02 |

| Including | 276.00 | 291.00 | 15.00 | 9.75 | 0.34 | 1.20 | 1.77 | 0.03 | 16.93 | 4.22 |

| Including | 333.00 | 338.00 | 5.00 | 3.25 | 0.27 | 1.13 | 2.29 | 0.01 | 6.80 | 4.23 |

| STKW | 170.00 | 177.00 | 7.00 | 4.55 | 0.85 | 2.55 | 3.25 | 0.04 | 2.71 | 7.95 |

| Including | 171.00 | 174.00 | 3.00 | 1.95 | 1.78 | 5.01 | 6.50 | 0.07 | 2.67 | 15.96 |

| STKW | 219.00 | 229.00 | 10.00 | 6.50 | 0.32 | 1.21 | 2.94 | 0.01 | 10.70 | 5.17 |

| Including | 222.00 | 228.00 | 6.00 | 3.90 | 0.48 | 1.53 | 3.72 | 0.02 | 14.50 | 6.77 |

| STKW | 276.00 | 283.00 | 7.00 | 4.55 | 0.46 | 1.32 | 2.43 | 0.01 | 15.71 | 5.26 |

| Including | 276.00 | 279.00 | 3.00 | 1.95 | 0.85 | 2.30 | 4.86 | 0.02 | 30.33 | 9.98 |

| STKW | 287.00 | 291.00 | 4.00 | 2.60 | 0.66 | 1.85 | 1.45 | 0.08 | 31.25 | 5.05 |

| Including | 287.00 | 289.00 | 2.00 | 1.30 | 0.66 | 3.15 | 1.86 | 0.11 | 53.50 | 7.96 |

| STKW | 333.00 | 334.00 | 1.00 | 0.65 | 0.46 | 1.92 | 4.58 | 0.01 | 12.00 | 7.87 |

| STKW | 336.00 | 337.00 | 1.00 | 0.65 | 0.49 | 1.89 | 3.32 | 0.02 | 10.00 | 6.62 |

| LS_ST_10 | 180.00 | 363.00 | 183.00 | 118.95 | 0.17 | 0.55 | 0.84 | 0.02 | 5.87 | 1.97 |

| Including | 181.00 | 331.00 | 150.00 | 97.50 | 0.20 | 0.64 | 0.98 | 0.02 | 6.87 | 2.29 |

| Including | 245.00 | 331.00 | 86.00 | 55.90 | 0.29 | 0.89 | 1.26 | 0.03 | 10.03 | 3.14 |

| STKW | 181.00 | 196.00 | 15.00 | 9.75 | 0.25 | 0.99 | 1.34 | 0.05 | 8.53 | 3.21 |

| Including | 181.00 | 189.00 | 8.00 | 5.20 | 0.43 | 1.47 | 1.80 | 0.07 | 12.88 | 4.70 |

| STKW | 245.00 | 249.00 | 4.00 | 2.60 | 0.59 | 1.02 | 3.61 | 0.08 | 11.75 | 6.50 |

| Including | 247.00 | 249.00 | 2.00 | 1.30 | 1.08 | 1.59 | 5.95 | 0.10 | 20.00 | 10.90 |

| STKW | 269.00 | 304.00 | 35.00 | 22.75 | 0.54 | 1.88 | 2.26 | 0.04 | 20.23 | 5.96 |

| Including | 269.00 | 283.00 | 14.00 | 9.10 | 0.89 | 3.28 | 2.93 | 0.04 | 36.36 | 9.24 |

| Including | 269.00 | 272.00 | 3.00 | 1.95 | 2.54 | 5.84 | 8.73 | 0.12 | 85.67 | 23.10 |

| Including | 294.00 | 304.00 | 10.00 | 6.50 | 0.50 | 1.41 | 2.91 | 0.08 | 14.60 | 5.99 |

| STKW | 320.00 | 322.00 | 2.00 | 1.30 | 0.87 | 0.82 | 1.50 | 0.02 | 9.50 | 4.80 |

| STKW | 330.00 | 331.00 | 1.00 | 0.65 | 0.85 | 1.33 | 1.76 | 0.02 | 30.00 | 5.98 |

| LS_ST_11 | 155.00 | 259.00 | 104.00 | 67.60 | 0.49 | 0.95 | 1.53 | 0.06 | 15.02 | 4.16 |

| Including | 160.00 | 175.00 | 15.00 | 9.75 | 1.86 | 0.88 | 0.66 | 0.19 | 39.47 | 7.67 |

| Including | 209.00 | 259.00 | 50.00 | 32.50 | 0.36 | 1.32 | 2.47 | 0.05 | 16.06 | 5.11 |

| STKW | 160.00 | 175.00 | 15.00 | 9.75 | 1.86 | 0.88 | 0.66 | 0.19 | 39.47 | 7.67 |

| Including | 165.00 | 169.00 | 4.00 | 2.60 | 6.54 | 2.20 | 0.80 | 0.32 | 139.00 | 24.07 |

| STKW | 201.00 | 203.00 | 2.00 | 1.30 | 0.36 | 1.85 | 2.20 | 0.03 | 13.00 | 5.21 |

| Including | 202.00 | 203.00 | 1.00 | 0.65 | 0.71 | 3.43 | 3.79 | 0.05 | 25.00 | 9.49 |

| STKW | 209.00 | 222.00 | 13.00 | 8.45 | 0.54 | 2.08 | 3.85 | 0.07 | 25.15 | 7.90 |

| Including | 209.00 | 217.00 | 8.00 | 5.20 | 0.72 | 2.34 | 4.68 | 0.08 | 29.50 | 9.56 |

| STKW | 225.00 | 229.00 | 4.00 | 2.60 | 0.82 | 1.69 | 4.80 | 0.11 | 32.75 | 9.47 |

| Including | 227.00 | 229.00 | 2.00 | 1.30 | 1.56 | 2.96 | 8.35 | 0.21 | 60.50 | 16.98 |

| STKW | 234.00 | 247.00 | 13.00 | 8.45 | 0.37 | 1.46 | 2.32 | 0.06 | 16.15 | 5.11 |

| Including | 240.00 | 242.00 | 2.00 | 1.30 | 0.75 | 2.95 | 4.68 | 0.10 | 32.50 | 10.32 |

| STKW | 255.00 | 259.00 | 4.00 | 2.60 | 0.53 | 2.25 | 3.82 | 0.10 | 21.75 | 7.96 |

| Including | 256.00 | 258.00 | 2.00 | 1.30 | 0.91 | 3.63 | 5.67 | 0.10 | 36.50 | 12.43 |

Notes:

1 ZnEq% was calculated as follows: ZnEq% = ((Zn Grade*25.35)+(Pb Grade*23.15)+(Cu Grade * 67.24)+(Au Grade*40.19)+(Ag Grade*0.62))/25.35

2 Metal prices used: US$1.15/lb Zn, US$1.05/lb Pb, $3.05/lb Cu, US$19.40/oz Ag, and 1,250/oz Au. No recoveries were applied.

Table 2: Drill Hole Information

| Drill Hole | Easting | Northing | Total Depth (m) | Elevation | Azimuth | Dip |

| LS_MS_07* | 546900 | 4232246 | 346.40 | 95.00 | 253 | -60 |

| LS_MS_08 | 546946 | 4232211 | 373.25 | 95.00 | 253 | -60 |

| LS_MS_09 | 546957 | 4232158 | 371.80 | 95.00 | 253 | -60 |

| LS_MS_10 | 546902 | 4232084 | 291.30 | 95.00 | 253 | -60 |

| LS_MS_12 | 546949 | 4232047 | 317.35 | 95.00 | 253 | -60 |

| LS_MS_13 | 546952 | 4231993 | 302.45 | 95.00 | 253 | -60 |

| LS_MS_14 | 546761 | 4231865 | 300.00 | 95.00 | 73 | -60 |

| LS_MS_16 | 546868 | 4232232 | 356.35 | 95.00 | 255 | -60 |

| LS_MS_17 | 546843 | 4232228 | 332.35 | 95.00 | 255 | -60 |

| LS_MS_18 | 546918 | 4232199 | 310.50 | 95.00 | 255 | -60 |

| LS_MS_19 | 546794 | 4232330 | 375.05 | 95.00 | 200 | -60 |

| LS_MS_20 | 546936 | 4231942 | 160.10 | 95.00 | 250 | -60 |

| LS_ST_05 | 547311 | 4231359 | 401.25 | 92.00 | 235 | -60 |

| LS_ST_07 | 547360 | 4231274 | 453.00 | 92.00 | 235 | -60 |

| LS_ST_08 | 547304 | 4231235 | 347.40 | 92.00 | 235 | -60 |

| LS_ST_10 | 547350 | 4231212 | 396.00 | 92.00 | 235 | -60 |

| LS_ST_11 | 547384 | 4231173 | 407.35 | 92.00 | 235 | -60 |

* Hole LS_MS_07 was originally reported in the Company’s press release dated October 15, 2018

Quality Assurance and Quality Control

Analytical work was carried out ALS Laboratories. Drill core samples were prepared in ALS Lab, in Seville, Spain. Pulp samples were then sent to their analytical Laboratory in Ireland, for analysis. The core samples are analyzed for gold (ppm) by fire assay (Au‐AA25), and for the other elements by Multi element analysis of base metal ores and mill products by optical emission spectrometry using the Varian Vista inductively coupled plasma spectrometer (ME-ICPORE). Samples from the Main Resource, LS_MS_DH ID, are also assayed for Tin (Sn) by ICP-AES after Sodium Peroxide Fusion (Sn-ICP81x).

ALS Laboratories has routine quality control procedures which ensure that every batch of samples includes three sample repeats, two commercial standards and blanks. ALS Laboratories is independent from Ascendant. Ascendant used standard QA/QC procedures, when inserting reference standards and blanks, for the drilling program.

Qualified Persons

The scientific and technical information in this press release has been reviewed and approved by Robert Campbell, P.Geo., Vice President, Exploration for Ascendant Resources Ltd, whom is a Qualified Persons as defined in National Instrument 43-101.

About Ascendant Resources Inc.

Ascendant is a Toronto-based mining company focused on its 100%-owned producing El Mochito zinc, lead and silver mine in west-central Honduras and its high-grade polymetallic Lagoa Salgada VMS Project located in the prolific Iberian Pyrite Belt in Portugal.

After acquiring the El Mochito mine in December 2016, Ascendant spent 2017 implementing a rigorous and successful optimization program restoring the historic potential of El Mochito, a mine in production since 1948, to deliver record levels of production with profitability restored. The Company now remains focused on cost reduction and further operational improvements to drive robust profitability in 2018 and beyond. With a significant land package of approximately 11,000 hectares in Honduras and an abundance of historical data, there are several near-mine and regional targets providing longer term exploration upside which could lead to further Mineral Resource growth.

Ascendant holds an interest in the high-grade polymetallic Lagoa Salgada VMS Project located in the prolific Iberian Pyrite Belt in Portugal. The Company is engaged in exploration of the Project with the goal of expanding the already-substantial defined Mineral Resources and testing additional known targets. The Company’s acquisition of its interest in the Lagoa Salgada Project offers a low-cost entry point to a potentially significant exploration and development opportunity. The Company holds an additional option to increase its interest in the Project upon completion of certain milestones.

Ascendant Resources is engaged in the ongoing evaluation of producing and development stage mineral resource opportunities, on an ongoing basis. The Company's common shares are principally listed on the Toronto Stock Exchange under the symbol "ASND". For more information on Ascendant Resources, please visit our website at www.ascendantresources.com.

Neither the Toronto Stock Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX) accepts responsibility for the adequacy or accuracy of this release.

For further information please contact:

Katherine Pryde

Director, Communications & Investor Relations

Tel: 888-723-7413

info@ascendantresources.com

Cautionary Notes to US Investors

The information concerning the Company’s mineral properties has been prepared in accordance with National Instrument 43-101 (“NI-43-101”) adopted by the Canadian Securities Administrators. In accordance with NI-43-101, the terms “mineral reserves”, “proven mineral reserve”, “probable mineral reserve”, “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are defined in the Canadian Institute of Mining, Metallurgy and Petroleum (the “CIM”) Definition Standards for Mineral Resources and Mineral Reserves adopted by the CIM Council on May 10, 2014. While the terms “mineral resource”, “measured mineral resource”, “indicated mineral resource” and “inferred mineral resource” are recognized and required by NI 43-101, the U.S. Securities Exchange Commission (“SEC”) does not recognize them. The reader is cautioned that, except for that portion of mineral resources classified as mineral reserves, mineral resources do not have demonstrated economic value. Inferred mineral resources have a high degree of uncertainty as to their existence and as to whether they can be economically or legally mined. It cannot be assumed that all or any part of any inferred mineral resource will ever be upgraded to a higher category. Therefore, the reader is cautioned not to assume that all or any part of an inferred mineral resource exists, that it can be economically or legally mined, or that it will ever be upgraded to a higher category. Likewise, you are cautioned not to assume that all or any part of a measured or indicated mineral resource will ever be upgraded into mineral reserves.

Readers should be aware that the Company’s financial statements (and information derived therefrom) have been prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board and are subject to Canadian auditing and auditor independence standards. IFRS differs in some respects from United States generally accepted accounting principles and thus the Company’s financial statements (and information derived therefrom) may not be comparable to those of United States companies.

Forward Looking Information

This news release contains "forward-looking statements" and "forward-looking information" (collectively, "forward-looking information") within the meaning of applicable Canadian securities legislation. All information contained in this news release, other than statements of current and historical fact, is forward-looking information. Often, but not always, forward-looking information can be identified by the use of words such as "plans", "expects", "budget", "guidance", "scheduled", "estimates", "forecasts", "strategy", "target", "intends", "objective", "goal", "understands", "anticipates" and "believes" (and variations of these or similar words) and statements that certain actions, events or results "may", "could", "would", "should", "might" "occur" or "be achieved" or "will be taken" (and variations of these or similar expressions). Forward-looking information is also identifiable in statements of currently occurring matters which may continue in the future, such as "providing the Company with", "is currently", "allows/allowing for", "will advance" or "continues to" or other statements that may be stated in the present tense with future implications. All of the forward-looking information in this news release is qualified by this cautionary note.

Forward-looking information in this news release includes, but is not limited to, statements regarding the exploration activities and the results of such activities at the Lagoa Salgada Project and the potential to expand mineralization and increase mineral resources. Forward-looking information is based on, among other things, opinions, assumptions, estimates and analyses that, while considered reasonable by Ascendant at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies and other factors that may cause actual results and events to be materially different from those expressed or implied by the forward-looking information. The material factors or assumptions that Ascendant identified and were applied by Ascendant in drawing conclusions or making forecasts or projections set out in the forward-looking information include, but are not limited to, the success of the exploration activities at Lagoa Salgada Project, the ability of the exploration results to expand mineralization and increase mineral resources, and other events that may affect Ascendant's ability to develop its project; and no significant and continuing adverse changes in general economic conditions or conditions in the financial markets.

The risks, uncertainties, contingencies and other factors that may cause actual results to differ materially from those expressed or implied by the forward-looking information may include, but are not limited to, risks generally associated with the mining industry, such as economic factors (including future commodity prices, currency fluctuations, energy prices and general cost escalation), uncertainties related to the development and operation of Ascendant's projects, dependence on key personnel and employee and union relations, risks related to political or social unrest or change, rights and title claims, operational risks and hazards, including unanticipated environmental, industrial and geological events and developments and the inability to insure against all risks, failure of plant, equipment, processes, transportation and other infrastructure to operate as anticipated, compliance with government and environmental regulations, including permitting requirements and anti-bribery legislation, volatile financial markets that may affect Ascendant's ability to obtain additional financing on acceptable terms, the failure to obtain required approvals or clearances from government authorities on a timely basis, uncertainties related to the geology, continuity, grade and estimates of mineral reserves and resources, and the potential for variations in grade and recovery rates, uncertain costs of reclamation activities, tax refunds, hedging transactions, uncertainty related to the results of the Company’s exploration activities at the Lagoa Salgada Project, as well as the risks discussed in Ascendant's most recent Annual Information Form on file with the Canadian provincial securities regulatory authorities and available at www.sedar.com.

Should one or more risk, uncertainty, contingency, or other factor materialize, or should any factor or assumption prove incorrect, actual results could vary materially from those expressed or implied in the forward-looking information. Accordingly, the reader should not place undue reliance on forward-looking information. Ascendant does not assume any obligation to update or revise any forward-looking information after the date of this news release or to explain any material difference between subsequent actual events and any forward-looking information, except as required by applicable law.