Will County Attorney Wins Reversal Before The Illinois Property Tax Appeal Board; County Board Decides Not to Appeal

Home owner appealed real estate tax assessment for his home with help of attorney; successful appeal resulted in 13% tax bill reduction for 2015 alone

Gaia Title, Inc./William B. Blanchard, Esq. (N/A:N/A)

The Homer Township Assessor originally determined the fair market value of value of the 3,455 square foot, 2-story home in Hidden Valley Estates as $436,207, while the homeowner, represented by Mr. Blanchard at the BOR hearing, requested an assessment based upon a value of $380,800. The BOA issued a “No Change” opinion which Mr. Blanchard appealed to PTAB. PTAB’s decision in favor of the homeowner to reduce the fair market value by $55,407 resulted in a 13% tax bill reduction for the homeowner on his 2015 real estate tax bill. The over-payment will be refunded by the Will County Treasurer.

Mr. Blanchard said, “the homeowner was extremely happy with the outcome especially when told that the decision would entitle him to similar refunds for tax years 2016 and 2017 as well.” Blanchard continued, “I’ve now received reductions for 24 Will County homeowners who appealed decisions by the Will County Board of Review.”

William B. Blanchard represents residential, commercial and industrial property owners who feel they are entitled to assessment reductions in Will, Kane and DuPage Counties in Illinois.

Further information about the Illinois Property Tax System is available at http://tax.illinois.gov/publications/localgovernment/ptax1004.pdf. Specifically about Will County, Illinois, additional real property tax information is at http://www.willcountysoa.com/search_address.aspx.

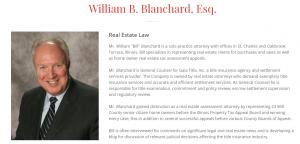

William B. Blanchard is General Counsel for Gaia Title, Inc. and a real estate law attorney representing clients in the Western suburbs of Chicago in all types of real estate transactions including real estate closings, short sales, and real estate tax appeals. See http://www.gaiatitle.com/

As General Counsel, Mr. Blanchard provides title insurance examinations, commitment and policy reviews, supervises closing activities and regulatory compliance issues. Mr. Blanchard received his Juris Doctor Degree from DePaul University College of Law in 1972, and was admitted to the practice of law in Illinois in 1973. His LinkedIn Profile is at https://www.linkedin.com/in/william-bill-blanchard-080a48b/

William B. Blanchard, Attorney at Law

Gaia Title, Inc.

(630) 560-4940

email us here

CNBC News Report with Billionaire Real Estate Investor Sam Zell On The Economy and Tax Reform.

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.