This Company, in Collaboration with Oracle is Creating the first HIPAA Compliant Medical Blockchain Technology

Quantum Medical (OTC Pink: DRWN) could dominate the Medical Blockchain Space

Oracle Corporation (NYSE:ORCL)

MIAMI, FLORIDA, USA, April 3, 2018 /EINPresswire.com/ -- (EmergingGrowth.com NewsWire) – EmergingGrowth.com, aleading independent small cap media portal with an extensive history of providing unparalleled content for the Emerging Growth markets and companies, reports on Quantum Medical (OTC Pink: DRWN).The U.S. healthcare sector is estimated to have spent $100 billion on IT in 2017, underlining the increasingly central role that tech plays in the healthcare sector. Though the increased digitization of healthcare has its merits—such as improved data management—it also exposes clinics, medical suppliers, health insurers and other players in the sector to the growing threat of cybercrime.

Healthcare networks hold massive volumes of accurate, comprehensive and up-to-date financial, medical and personal information of millions of Americans. As a result, healthcare data is significantly richer in value than data from retail and financial services, making the sector more attractive to hackers. According to a report on Reuters, medical data is worth 10 times more on the black market than credit card data.

Back in 2014, Community Health Systems Inc. (NYSE: CYH ), one of the largest providers of general hospital healthcare services in the U.S., was infiltrated by alleged Chinese hackers in a breach that compromised 4.5 million medical records.

Although CYH hired cybersecurity experts from a FireEye (NASDAQ: FEYE) affiliated company to look into the matter, the bigger question that went unanswered was whether smaller healthcare players with leaner cybersecurity budgets silently suffer more damaging breaches. This question is difficult to answer with precision, but Ricky Bernard, the CEO of Quantum Medical Transport (OTC PINK: DRWN) believes the threat of data breaches in healthcare is steadily increasing for big and small players alike.

“Now more than ever, there is a need to pioneer more effective and lasting solutions that enhance data protection in healthcare,” added Mr. Bernard, who spoke exclusively to EmergingGrowth.com.

Quantum Medical Transport is a profitable medical technology and transportation public company based in Texas. The company grossed $1.31 million in annual operating revenue as of December 31, 2017, compared to $1.2 million the same period the previous year. “Over the past decade, our revenues have historically been in the $1.0-$1.3 million range” said Bernard. The company also recently closed its acquisition of United Ambulance LLC, strengthening its position in the medical transportation market.

However, Bernard says that the company’s recent successful acquisition and healthy topline aren’t its biggest accomplishments yet—rather, its bold foray into medical blockchain technology is.

Medical blockchain is a game-changer

The company recently embarked on developing a medical blockchain platform called QuantH, which aims to provide a subscription based secure encryption data sharing (Health Information Data Exchange) service to the $3 trillion healthcare sector. The company is currently raising $50 million in capital through the sale of tokens to accredited investors via a private placement.

QuantH will be the first HIPAA compliant medical blockchain platform. The Health Insurance Portability and Accountability Act (HIPAA) sets the standard for protecting sensitive patient data. HIPAA compliance will therefore give QuantH mainstream acceptance in the healthcare sector, something Bernard believes will significantly boost subscriptions to QuantH.

“We are pioneering blockchain-as-a-service in the healthcare sector and expect QuantH to enhance data protection and introduce new levels of efficiency in healthcare data management,” he noted. “In view of our HIPAA compliance, and the pressing need for more effective ways to secure healthcare data, we expect positive market reception,” he continued.

The company already has a robust B2B network of healthcare sector players in Texas that it regularly engages with technology in the course of offering its transport services. This increases the likelihood that it will successfully upsell its QuantH subscription service to existing players in its Texas network, giving it sufficient momentum to later fan out to other geographies across the country.

“I am optimistic about the number of subscriptions as demand for a more secure way of sharing and managing healthcare data is at an all-time high. Medical blockchain has been identified as a game changer, but there has been no HIPAA compliant blockchain to date. We are breaking new ground with our HIPAA compliant blockchain, something that competitively positions us to gain market leadership,” said Bernard.

Medical blockchain is viewed as a game-changer in the healthcare sector due to its ability to enhance data protection in a way cybersecurity companies have not been able to do. Blockchain decentralizes data storage, making the data available to all players in the health system in a timely manner. This streamlines data sharing, lowers data management costs and improves overall service delivery.

Likewise, data on blockchain cannot be changed once it has been recorded. This boosts transparency, which is an important ingredient in healthcare. Most importantly, data on blockchain is encrypted and the real identities of parties on the ledger are replaced with unique identifiers, eliminating the risk of linking information on the ledger back to individuals such as patients and institutions such as clinics.

See the image here: http://emerginggrowth.com/quantum-medical-otc-pink-drwn-potential-acquisition-candidate-through-disruptive-hipaa-compliant-blockchain-technology/

3 key reasons why blockchain is ideal for healthcare data protection

Owing to its merits, blockchain is gaining more acceptance in the healthcare sector. According to a recent study by IBM, 56% of surveyed healthcare executives have solid plans to implement a commercial blockchain solution by 2020. DRWN is therefore an early mover in a fast-growing space.

An article in the MIT Technology review notes that decentralized databases (blockchain) promise to revolutionize medical records, but not until the healthcare industry buys into the idea. HIPAA compliance is what will allow QuantH to get that much needed buy-in from the healthcare industry, underlining its massive commercial viability. This commercial viability is perhaps the core reason why QuantH has already aroused the interest of some of the largest tech companies on the planet, despite still being in the development stage.

Largest tech companies interested

DRWN announced in the final week of March that it had been invited by Oracle Corporation (NYSE: ORCL) to participate in the Oracle Blockchain Cloud Platform Beta program to support the development QuantH. This signals that the company’s blockchain technology is gaining traction—so much so that Oracle believes it has the potential to become commercially viable and is actively supporting its development.

It is instructive to note that Oracle’s cloud-based integration platform is the largest provider to banks and supply chain vendors for the transfer of information. It can easily handle the large amounts of data involved in the transmission of medical records.

The support from Oracle is the latest indicator yet that QuantH has tremendous commercial potential—a factor that will substantially increase potential returns for accredited investors who participate in the $50 million Initial Coin Offering (ICO). Commercial viability also heightens the chance that, after going live, QuantH will sign up a significant number of subscribers across the health sector.

“I am confident of two things: first, based on the amazing momentum we have garnered during the development phase, we will be able to raise the $50 million through the ICO. Second, upon commercial launch, we will be able to steadily expand our subscription base for our blockchain-as-a-service platform,” said Bernard.

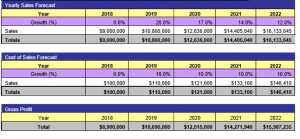

According to the 100 page prospectus for the ICO, which is available on the company’s website, annual subscription revenue for the blockchain-as-a-service platform could hit $9 million in 2018 and grow consistently at a double digit rate to $16.13 million in 2022. Through this period, annual cost of sales will not exceed $150,000 in any given year, delivering incredible returns for ICO investors and the company at large. These projections are based upon a successful $50 million capital raise in the ICO, which is plausible given the traction that QuantH is gaining, including support from big players such as Oracle.

See the projections here: http://emerginggrowth.com/quantum-medical-otc-pink-drwn-potential-acquisition-candidate-through-disruptive-hipaa-compliant-blockchain-technology/

Financial projections for QuantH; Source: ICO Prospectus

According to Bernard, the successful rollout of QuantH will secure the company income that will not only support organic growth across the whole business with a view to growing current profitability, but also support mergers and acquisitions in the electronic health records (EHR) space.

“We see a lot of synergies between our new strategic direction in medical tech and existing companies in EHR. Once income from our QuantH blockchain-as-a-service platform is sustainable, we will explore mergers and acquisitions in the EHR space,” he said.

The outlook for DRWN is bullish in light of the increasing likelihood that QuantH will have a successful commercial rollout that will help power the company’s broader objective of consolidating its position in medical tech through both organic growth and acquisitions of EHR players.

Tables could turn

However, there is a likelihood that the tables could turn. Although the company is exploring acquisitions in the EHR space, it could actually end up being the one acquired by a larger player. The hunter could become the hunted.

DRWN is a potential acquisition target for two reasons. Firstly, because of the commercial viability of its HIPAA compliant blockchain technology, especially now that Oracle is supporting its development. Secondly, because of its track record as a revenue generating and profitable company with an established track record in the healthcare sector that spans over a decade.

To expound on the second point, it is instructive to note that most of the companies currently getting into blockchain are completely new entrants. These are development stage companies with no sales and little-known top executives. While some are legitimate, others have been flagged down by regulators, who have warned investors that they lack solid fundamentals and could be using blockchain as nothing more than a buzzword. These are not the qualities that typically make a company an acquisition target.

In contrast, DRWN is well established, profitable and properly governed—going by its historical performance and publicly available audited results. The fact that it is participating in the Oracle Blockchain Cloud Platform Beta program further demonstrates that it has both the in-house talent and polished corporate reputation needed to be an acquisition target. It makes greater sense for large caps interested in medical blockchain to buy DRWN than the dozens of untested players mushrooming in the blockchain space. – Further, it’s easier to acquire the technology than to reinvent it.

Conclusion

When a new technology such as blockchain gains mainstream acceptance, the historical market entry strategy by large caps has predominantly been the acquisition of promising emerging growth companies that have existing familiarity with the technology.

This positions DRWN very competitively as it puts it on the radar of deal hungry large caps, especially now that has an existing working relationship with Oracle. Based on this working relationship, Oracle could very well end up being a potential suitor in future.

Alternatively, the support from Oracle could also serve to whet the appetite of other big players such as IBM (NYSE: IBM) and General Electric (NYSE: GE), which both have vested interests in blockchain and healthcare, respectively. IBM has produced a tremendous body of research on blockchain and currently has several blockchain patents under its belt, while GE has previously said that it is looking “very actively” into blockchain in light of its potential to protect the integrity of medical data.

DRWN’s current market cap of less than $5 million grossly underrepresents the company’s underlying value. It is a potential acquisition target pioneering a HIPAA compliant medical blockchain platform that is commercially viable. It also has healthy financials and is generating $1 million plus in sales without its game-changing block-chain-as-a-service platform. Overall, sales could grow fivefold in the first of year of the service. Once all these factors are priced into the stock, the uptrend could be historic.

About EmergingGrowth.com

EmergingGrowth.com is a leading independent small cap media portal with an extensive history of providing unparalleled content for the Emerging Growth markets and companies. Through its evolution, EmergingGrowth.com found a niche in identifying companies that can be overlooked by the markets due to, among other reasons, trading price or market capitalization. We look for strong management, innovation, strategy, execution, and the overall potential for long- term growth. Aside from being a trusted resource for the Emerging Growth info-seekers, we are well known for discovering undervalued companies and bringing them to the attention of the investment community. Through our parent Company, we also have the ability to facilitate road shows to present your products and services to the most influential investment banks in the space.

All information contained herein as well as on the EmergingGrowth.com website is obtained from sources believed to be reliable but not guaranteed to be accurate or all-inclusive. All material is for informational purposes only, is only the opinion of EmergingGrowth.com and should not be construed as an offer or solicitation to buy or sell securities. The information may include certain forward-looking statements, which may be affected by unforeseen circumstances and / or certain risks. This report is not without bias. EmergingGrowth.com has motivation by means of either self-marketing or EmergingGrowth.com has been compensated by or for a company or companies discussed in this article. Full details about which can be found in our full disclosure, which can be found here, http://emerginggrowth.com/5647386697-3 Please consult an investment professional before investing in anything viewed within. When EmergingGrowth.com is long shares it will sell those shares. In addition, please make sure you read and understand the Terms of Use, Privacy Policy and the Disclosure posted on the EmergingGrowth.com website.

Emerging Growth Staff

EmergingGrowth.com

305-330-1985

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.