Fake News Attack Against Ampio Pharmaceuticals (NASDAQ: AMPE) Starting to Unravel as Suitors Line Up

Ampio is in a unique position with world-wide patent coverage and a potential unmet need designation as the FDA has suggested.

Ampio Pharmaceuticals (NASDAQ:AMPE)

Get the Valuation Report, Investment Summary, and target price at:

http://emerginggrowth.com/fake-news-attack-against-ampio-pharmaceuticals-nasdaq-ampe-starting-to-unravel-as-suitors-line-up/

Phenomenal Trial Results

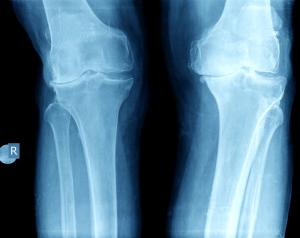

When looking at a biotech, investors need to know the science is solid so it’s helpful to go over the latest clinical trial results. Right now all existing drugs for OAK treat for pain and only pain. They don’t address an improvement in mobility or overall quality of life. So the first part in understanding these clinical trial results is understanding how high the bar was for this drug to meet its endpoints. OMERACT-OARSI is a composite analysis that measures pain, function, and quality of life. This measurement criteria recognized by the FDA, came from OMERACT which is the standing committee for Clinical Trials Response Criteria Initiative Outcome Measures in Rheumatology and OARSI the Osteoarthritis Research Society International. Bottom line – meeting this endpoint means the drug has more value than TKA (total knee replacement surgery)!

This chart ( http://emerginggrowth.com/wp-content/uploads/2018/03/AMPE-Picture2.png ) depicts that results of the trial were above the red line by over double. While the 30% threshold is not an FDA published threshold, it is a benchmark used by Osteoarthritis physicians as “significant” when referring to the unmet need of KL4 (bone on bone OAK). If it just hit the red line of 30% it’s good, but as you can see, they crushed it in all categories. The primary reason for this is the mechanism of action which is very complicated to discuss in just one article. In short it relieves the pain and helps the body repair the damage by being a beacon for stem cells to rebuild the cartilage. In the STRUT study, which we won’t go into detail on here, the drug replaced up to .2 mm of cartilage. Most people don’t realize that there is only 2 mm of cartilage on our knees so .2 mm of cartilage growth on one injection is a big deal. What if they did more than one injection? Well, they did in previous trials and there is currently a study going on for multiple injections which is an extended study. All of those patients in the last study we’re invited to the extended study and all of them had MRI’s prior to the original study. There is a high probability Ampion proves to be beneficial to those patients from a cartilage regeneration perspective as well as pain, function and quality of life.

Likelihood of Approval – Extremely High – Pathway to approval

Starting with the basics this drug is simply a filtered form of another FDA approved biologic called Human Serum Albumin known as HSA which has been around for decades. HSA is derived from pooled blood plasma that has been cleansed. The most basic argument for approval is that AMPE is using a filtered form of an already FDA approved biologic. The FDA didn’t require AMPE to do any animal testing. The FDA primarily cares about two things for approval; SAFETY & EFFICACY. The FDA required 2 successful pivotal trials before they would accept their Biologics License Application (BLA). They completed them and simply have to file their 80,000 page report with the FDA.

US Department of Health and Human Services

Since Ampion is a biologic manufactured from an already FDA approved feedstock known as HSA it contains no addictive properties. The opioid epidemic in the United States is very real. This epidemic is a national priority supported by President Trump. Ampion when approved could single handedly strike a devastating blow in the war against opioid abuse. From this chart, 2.1 million people who took opioids for the first time misused them. Substituting Ampion in place of opiates which do in fact work for pain would be a major step in curbing the exposure to the American population. Opioid use is as high as 30% in the OAK indication. Approximately 21 million people in the US are currently diagnosed with OAK, so reducing the exposure of opiates to 6.3 million people is a big first step. There is tremendous political clout looking for solutions, and if this drugs use is expanded to other forms of arthritis it has the potential to impact 54 million people who are currently diagnosed with arthritis today. This drug is a game changer in the war against opioid use.

Turn Key Drug with Manufacturing Facility

Not only is Ampion an approvable drug, but it also has world class manufacturing in place. It’s about as turn- key of an operation as you will find anywhere in the world. The Ampion process is so unique that it was asked to present to the Society for Pharmaceutical Engineers. The facility has been visited by the FDA and they have done small and large batch runs and are in compliance with Current Good Manufacturing Practice (CGMP) regulations. The company has indicated that if they run dual shifts they could produce about 7-8 million vials a year. This equates to $1.6 billion of drug annually assuming a $200 wholesale cost.

Value of the Labeling

The more claims that you can add to a label the more valuable it becomes. Reimbursement issue have been plaguing this market after JAMA and AAOS made derogatory comments last year regarding the use of the current OAK drugs. AMPE’s label would provide for insurance reimbursements on many levels while the competing drugs in this space are seeing erosion of their reimbursements as states discontinue coverage of these ineffective drugs and arguably dangerous drugs.

The cleanest labels have no warnings for safety. When a drug is advertised on TV at the end of the commercial viewer are peppered with the side effects and warnings like the drug can cause risk of heart attack, stroke, nausea, itching, cancer development, etc. When this drug comes to market the message will be simple because it will state it’s for use in OAK and can reduce pain by over 50%, reduce inflammation, improve function and can be taken up to 5 times a year as needed. No warning labels at the end the commercial! In some cases half the commercials are the side effects. For the drug company that ultimately buys this company, the less money they have to spend on advertising the more profitable the drug. Investors should not underestimate the value of such a clean label.

Pricing of the Drug

Right now, each shot in the knee of the drugs that don’t work well or have potential side effects, according to JAMA and AAOS cost between $600 – $800 per shot. Reverse engineering the price and assuming the most conservative pricing put the wholesale cost per shot to the doctor at $300. If this assumption is too rich arbitrarily take off $80 per shot and assume the sale to the doctor occurs at $220. It costs the company $20 per shot to manufacture the drug leaving $200 profit per injection.

AMPE believes there are 1.1 million patients in their market per the corporate presentation. Using the most conservative estimates available, BJM estimated there are 640,000 knee replacements done annually. Assuming only a 40% penetration rate of this patient population that has no alternative but a $49,500 very painful knee replacement surgery the numbers work out to $256 million in profit alone in the first year. The primary assumption in this model is that people like pain and would rather have surgery than have 5 pin pricks of their knee over the course of a year. Other assumptions are that a disruptive new technology enters the market in the coming year and the company can only get one year of life out of the product. The final set of assumptions investors have to make in order to maintain the current market value are that people will not use this on other joints or other diseases. See what happens to today’s valuations of next year’s earnings if investors assume that people in general hate pain. Only one conclusion that should follow is that the stock should be 3 times its current valuation right now using these ridiculously conservative assumptions.

Author Illustration here: http://emerginggrowth.com/wp-content/uploads/2018/03/Screen-Shot-2018-03-04-at-12.43.50-PM.png

Bright Future for Ampio

Ampio is in a unique position with world-wide patent coverage and a potential unmet need designation as the FDA has suggested. That means it could be licensed in major markets or even minor ones by Country or by region. The biggest payout to investors would be license deals with upfront cash and royalties in multiple markets. It’s more difficult to piece together this type of organization, but the payout is greater. Licensing deals in China, North America, Europe, Japan, or all of Asia Pacific are all possibilities.

Big pharmaceuticals are known for devouring companies just like AMPE especially when they are in the stage of introducing a drug to the market. All the risk is out of the acquisition at this stage. At this point the only thing left for big pharma to do is their due diligence on the patents, review the data, and verify the FDA correspondence. With all the money sitting on the sidelines acquisitions are a hot commodity and this one could go for a premium because it turn-key. All big pharm has to do after the acquisition is file the BLA and get their marketing team positioned. The big names in the in the OAK or pain space are players such as Sanofi-Adventis (SNY), Merck (MRK), Johnson & Johnson (JNJ), and Pfizer (PFE) to name a few. They have either failed OAK or pain drugs and sales forces twiddling their thumbs. Perhaps a device player like Stryker decides to own the OAK severe market along with thumb, shoulder, hip, foot, neck etc. The possibilities are endless and big pharma has so much money sloshing around they need to put it to work and AMPE is clearly on their radar.

This article needs a follow up, because the topic of AMPION stem cells or regeneration hasn’t been addressed. These discussions could open a whole new set of players like Regeneron Pharmaceuticals (NASDAQ: REGN) or Biogen Inc. (NASDAQ: BIIB). The possibilities are endless when you’re dealing with a safe and effective biological compound that reduces inflammation, protects and promotes stem cells.

Get the Valuation Report, Investment Summary, and target price at:

http://emerginggrowth.com/fake-news-attack-against-ampio-pharmaceuticals-nasdaq-ampe-starting-to-unravel-as-suitors-line-up/

About EmergingGrowth.com

EmergingGrowth.com is a leading independent small cap media portal with an extensive history of providing unparalleled content for the Emerging Growth markets and companies. Through its evolution, EmergingGrowth.com found a niche in identifying companies that can be overlooked by the markets due to, among other reasons, trading price or market capitalization. We look for strong management, innovation, strategy, execution, and the overall potential for long- term growth. Aside from being a trusted resource for the Emerging Growth info-seekers, we are well known for discovering undervalued companies and bringing them to the attention of the investment community. Through our parent Company, we also have the ability to facilitate road shows to present your products and services to the most influential investment banks in the space.

All information contained herein as well as on the EmergingGrowth.com website is obtained from sources believed to be reliable but not guaranteed to be accurate or all-inclusive. All material is for informational purposes only, is only the opinion of EmergingGrowth.com and should not be construed as an offer or solicitation to buy or sell securities. The information may include certain forward-looking statements, which may be affected by unforeseen circumstances and / or certain risks. EmergingGrowth.com has not been compensated by, any company mentioned in this article. Please read our full disclosure, which can be found here, http://emerginggrowth.com/disclosure/. Please consult an investment professional before investing in anything viewed within this article or any other portion of EmergingGrowth.com. In addition, please make sure you read and understand the Terms of Use, Privacy Policy and the Disclosure posted on the EmergingGrowth.com website.

Emerging Growth Staff

EmergingGrowth.com

305-330-1985

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.