Time to Dump Bitcoin and Shift Attention to Blockchain

As bitcoin collapses, blockchain technology will emerge from the ashes. This is where the real long-term opportunity is.

BTCS, Inc. (OTCQB:BTCS)

As bitcoin collapses, blockchain technology will emerge from the ashes. This is where the long-term opportunity is, as illustrated by deepening interest in blockchain by some the largest U.S. banks.”

MIAMI, FLORIDA, USA, February 12, 2018 /EINPresswire.com/ -- Emerging Growth Newswire - Cryptocurrency markets have been turbulent over the past two months following the dramatic plunge of bitcoin (BTC), the world’s foremost cryptocurrency. From an all-time high of $19,783 on December 17, 2017, the price slumped to just over $7000 during the first week of February 2018. In a span of just six weeks, billions of dollars were wiped off investors’ portfolios, inviting increased scrutiny and bad press for bitcoin.— EmergingGrowth.com Staff

During these six punishing weeks, other cryptocurrencies also plummeted in tandem with bitcoin, underlining the fact that their prices are primarily pegged on bitcoin’s price movement. This is despite each individual cryptocurrency boasting of its own unique functional attributes.

Ethereum (ETH), the number two cryptocurrency by market cap, dropped from a high of $1396 on January 13, 2018 to $685 on February 6. Ripple (XRP), another popular one, dropped from a peak of $2.9 on January 04, 2018 to $0.57 on February 06; while Monero (XMR) plunged from $436 on January 16, 2018 to $177 on February 05, 2018.

The equivalent of 43% of Russia’s GDP lost.

A blow-by-blow analysis of how each major cryptocurrency—including Litecoin (LTC), Bitcoin Cash (BCH), Ethereum Classic (ETC) and over 100 others, which are all tracked here— plunged simultaneously with bitcoin over the past few weeks is not necessary.

$554 billion is the magic number that puts everything into perspective. This number represents the erosion in total market cap of all cryptocurrencies in circulation between January 07, 2018 (when the market cap was $833 billion) and February 06, 2018 (when the market cap was $279 billion). The market cap of the cryptocurrencies market is computed by multiplying the average price of all tokens in circulation by the total number of all tokens in circulation.

The $554 billion erosion in total market cap of cryptocurrencies is significantly more than the combined net worth of Warren Buffet ($84. 6 billion according to Forbes), Jeff Bezos ($115.7 billion according to Forbes), Bill Gates ($90.5 billion according to Forbes) and Mark Zuckerberg ($73.1 billion according to Forbes). It is also slightly more than 43% of Russia’s $1.28 trillion GDP (according to World Bank 2016 data).

A market with such unheard-of price volatility can easily turn an investor into a gambler overnight. It doesn’t take an Ivy League educated financial analyst to conclude that smart money will never go into cryptocurrencies, at least not with the current price volatility.

Since Wall Street and large institutional investors from around the world are not putting in substantial money into cryptocurrencies any time soon, solid mechanisms for objective price discovery and valuation in the cryptocurrency markets are still far off on the horizon. This heightens the possibility that these markets will remain highly speculative in nature, prone to rampant price manipulation and frustratingly difficult to predict.

Unsurprisingly, cryptocurrency evangelists do not seem to understand this. Ever the optimists, most of them religiously believe bitcoin will rebound to dizzying highs, pulling up dozens of other smaller cryptocurrencies along the way.

A case in point is a recent analysis on Seeking Alpha by Victor Dergunov, who discloses at the end of the article that he is long on bitcoin. An excerpt from the article states that: “the digital asset should regain its upward trajectory and move significantly higher throughout 2018.” As with most bullish articles on bitcoin and other cryptocurrencies, the analysis is never complete without talking about the unique functional attributes that make the cryptocurrency in question a winning bet.

Dergunov states that Bitcoin is on the path to become the predominant digital store of value, adding that it has one of the safest, most impregnable networks in the world. How true these statements are is anyone’s guess in view of recent cyberattacks targeting digital wallets and bitcoin exchanges.

From a functional standpoint, Ethereum is typically praised for its potential in the field of smart contracts and has applicability in areas such as ecommerce and copyright protection, though these are presently unexploited.

Monero is lauded for its privacy and is popular in the dark web. The Monero team routinely adds new privacy features, including an overlay-network called ‘Kovri’ that obscures your IP address. It has a lot of potential in cyber security and the military-industrial complex, though these also remain largely unexploited.

Existing analysis of the functionality of different cryptocurrencies makes for interesting reading but is largely insufficient as far as making an informed long-term investment decision is concerned. This is because most commentators overlook a critical factor—the broader geopolitical environment.

Difficulty integrating cryptocurrencies into real world

Though most cryptocurrencies are exciting from a theoretical point of view, they fail the test when it comes to integrating them into the real world where geopolitical undercurrents are always at play.

For instance, bitcoin is styled as a global currency. However, anyone remotely familiar with the history of money and the forex markets automatically knows that there is no way governments will allow bitcoin to complement, let alone replace, fiat currencies.

There is an awful lot of political (and sometimes even military) effort spanning decades and cutting across continents that goes into building a global currency like the U.S. dollar. There are simply too many vested interests. Concerned parties will not just sit by and watch bitcoin change the delicate balance of power in the global currency markets.

It is no surprise that U.S. regulators, large retailers and major banks around the world are apprehensive about bitcoin and are systematically edging it out of the formal economy and pushing it back to the peripheries of the cyber world. China has been less patient. Rather than systematically edging out bitcoin and issuing long windy statements while at it, Beijing simply banned all cryptocurrencies and shut down all domestic cryptocurrency exchanges. All cryptocurrency ads have also disappeared from Baidu and Weibo, China’s official search engine and social media site respectively. Similar crackdowns are also underway in India.

While it is easy to critique world governments by outlining the limitations of fiat currency (mostly drawn from conspiracy theory websites), the reality is that there is no strong academic case to support the use of bitcoin as a currency.

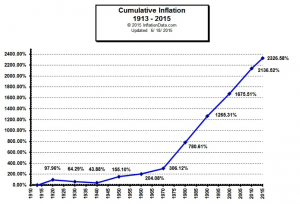

As far as conventional economic theory is concerned, a currency must have modest inflationary qualities. This means that its value should slowly decrease over time in order to make you consume your $100 today rather than tomorrow when it will have less purchasing power. This ensures that consumption in the economy remains stable, leading to sustained sales for companies, continued employment for its workers and timely payment to its suppliers and financiers.

U.S. dollar purchasing power has slowly weakened since 1913 in order to encourage consumption. All currencies must have inflationary qualities, which bitcoin lacks

Bitcoin has deflationary qualities, which means its value is expected to increase rather than decrease over time. Consequently, people are more inclined to hold on to it in anticipation of a higher value as opposed to spending it today. This is why it is increasingly described as a digital asset in addition to being called a digital currency. However, as an asset, it is neither predictable nor trusted in the same way gold or bonds are—you cannot peg your young children’s future college tuition solely on your bitcoin holdings, can you?

Regardless of whether you view bitcoin as a currency or a digital asset, it has limited applicability in a real economy guided by conventional economic theory.

Bitcoin will fall; if not for its limited functionality as far as economic theory is concerned, then because of the coordinated crackdown by world governments and corporates who have much more at stake than existing investors in bitcoin.

In the short-term, the cryptocurrency may rebound or even drop further—honestly, it is anyone’s guess as there is nobody smart enough to give an informed short-term price target on such a volatile instrument. However, in the long-run, bitcoin will undoubtedly nosedive and potentially never recover due to the factors outlined in this article. When this happens, most cryptocurrencies will follow it like sheep headed to the slaughter house.

What will happen after this? More importantly, where can investors who have ridden the bitcoin gravy train up until this point reallocate their capital?

The answer lies in looking beyond bitcoin and other cryptocurrencies and focusing on the underlying technology called blockchain.

Blockchain is an open, distributed ledger that records peer-to-peer transactions between two parties efficiently and in a veritable and permanent way. It allows anyone to securely enter a business transaction with someone else without needing to go through a trusted intermediary. Blockchain’s proven ability to cut out the middle man, while still retaining security, speed and functionality, makes it disruptive to industries such as financial services, law and the public sector.

One of the simplest yet most accurate descriptions of blockchain is by ex-Financial Times writer Sally Davies. She says that: “blockchain is to bitcoin what the internet is to email, a big electronic system on top of which you can build many applications. Currency is just one.” In other words, blockchain has many uses and bitcoin is just one of them.

Bitcoin is like Yahoo back in the dotcom era. For a short time, it was synonymous with the Internet due to its disruption of traditional mail. However, it slowly receded into the background when other more innovative web services came to the fore.

As blockchain gains increased mainstream acceptance, especially in fields such as banking and law, bitcoin, is likely to recede into the background just like Yahoo did. It will go down along with other cryptocurrencies and bitcoin investment vehicles such as Grayscale’s Bitcoin Investment Trust (OTCQX: GBTC) Tellingly, the share price of GBTC, which is a private, open-ended trust that is invested exclusively in Bitcoin and derives its value solely from the price of Bitcoin, plummeted simultaneously with Bitcoin in recent weeks, dropping from highs of $29.65 on December 15, 2017 to $12.00 on February 02, 2018.

Focus on banks and fintech ecosystem

Going forward, investors’ focus is likely to shift away from bitcoin to large established companies (mostly banks) that have begun tapping into the potential of blockchain.

Banks are making serious inroads into blockchain, cognizant of the potential the technology has to disrupt areas within banking such as Know Your Customer (KYC) regulations, international money transfer and securities clearing and settlement. According to Harvard Business Review, blockchain will do to the financial system what the Internet did to media. Banks don’t want to be caught flatfooted and are being proactive in order to establish an early mover advantage in this disruptive space.

Bank of America (NYSE: BAC) currently has 48 blockchain related patents and applications, according to a company spokesman quoted on Bloomberg. This is more than IBM and other payment firms, underlining the banking sector’s deepening interest in the technology. JPMorgan Chase (NYSE: JPM) also launched a payment network using blockchain in October last year, despite its CEO Jamie Dimon calling Bitcoin a fraud but later backpedaling on those comments.

Despite banks’ growing interest in blockchain, fiscal policy, monetary policy and broader macroeconomic trends will undoubtedly continue shaping the overall performance of banking stocks. However, in the coming years, blockchain could also become a critical determinant of bank’s financial performance, alongside the aforementioned drivers such as monetary policy. This means that blockchain should be a key area of interest for investors looking for high performing banking stocks.

Investors should also watch out for small cap stocks that are not only focused on blockchain, but also have existing linkages with the fintech ecosystem. This is because, rather than venture into blockchain on their own, mainstream financial institutions are likely to acquire smaller blockchain pure plays. This makes small caps that are proficient in this space likely acquisition targets, presenting significant upside potential for investors who pick the right emerging growth blockchain pure plays.

There a couple of interesting emerging growth stocks exclusively focused on blockchain that investors can add to their watchlist. One such stock is BTCS (OTCQB: BTCS), the first blockchain focused public company in the U.S. The company is modelling itself as an acquisition target, according to a letter from the CEO to shareholders in January 2018. This could unlock great shareholder value in case a substantial deal materializes.

Investors need to be careful about is that some of the blockchain pure plays out there have limited experience in blockchain as they were operating in totally unrelated sectors before blockchain became a buzzword. For instance, highly traded Riot Blockchain (NASDAQ: RIOT) was formerly a biotech company called Bioptix before changing its name to Riot Blockchain in 10/2017 in order to focus exclusively on blockchain. Another risk that needs to be factored in is that valuation is difficult in this nascent sector owing to the fact that most blockchain companies have limited sales and earnings since they are still in product development stages.

Conclusion

Bitcoin’s recent bear run wasn’t a normal market correction, as crypto evangelists would have it, but a clear pointer to the unacceptably high price volatility that is keeping smart money away from the cryptocurrency markets. This, coupled with the ongoing global crackdown on cryptocurrencies, points to a bleak future for bitcoin and other cryptocurrencies whose price movements are pegged on bitcoin.

As bitcoin collapses, blockchain technology will emerge from the ashes. This is where the real long-term opportunity is, as illustrated by the deepening interest in blockchain by some the largest U.S. banks.

About EmergingGrowth.com

EmergingGrowth.com is a leading independent small cap media portal with an extensive history of providing unparalleled content for the Emerging Growth markets and companies. Through its evolution, EmergingGrowth.com found a niche in identifying companies that can be overlooked by the markets due to, among other reasons, trading price or market capitalization. We look for strong management, innovation, strategy, execution, and the overall potential for long- term growth. Aside from being a trusted resource for the Emerging Growth info-seekers, we are well known for discovering undervalued companies and bringing them to the attention of the investment community. Through our parent Company, we also have the ability to facilitate road shows to present your products and services to the most influential investment banks in the space.

All information contained herein as well as on the EmergingGrowth.com website is obtained from sources believed to be reliable but not guaranteed to be accurate or all-inclusive. All material is for informational purposes only, is only the opinion of EmergingGrowth.com and should not be construed as an offer or solicitation to buy or sell securities. The information may include certain forward-looking statements, which may be affected by unforeseen circumstances and / or certain risks. EmergingGrowth.com has not been compensated by, and holds no position (long or short) in any company mentioned in this article. Please read our full disclosure, which can be found here, http://emerginggrowth.com/disclosure/. Please consult an investment professional before investing in anything viewed within this article or any other portion of EmergingGrowth.com.

Emerging Growth Staff

EmergingGrowth.com

305-330-1985

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.