Top 50 FinTech Startups To Watch Out For In 2017

With a trillion dollar plus market size, FinTech is one of the hottest segments for startups. Here are the top 50 FinTech startups to watch out for in 2017

Last few years have been great for FinTech Investments

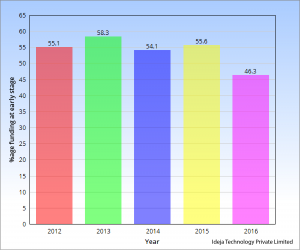

Financial Technology (Fintech) sector has seen an exceptionally keen interest from investors over the previous three years. What is more encouraging is the quantum of investment coming in at the seed and angel stage. From 2012 to 2015, we saw that 55 to 60% of investments were made at the seed and angel stage, which gave a vital boost to upcoming startups and entrepreneurs.

The year 2014 was a big turning point for Fintech startups; we see almost 4x jump in the investment in the year 2014 over the last couple of years. The trend has continued in 2015 and 2016, we have witnessed around 15% year on year growth in the investments. In 2016, Ant Financial, a China-based online payment services provider for individuals and businesses raised a staggering $4.5 billion in Series B round led by China Construction Bank and China Investment Corporation.

Top-50 FinTech startups with a huge promise for 2017

For the detailed study, we selected startups from Crunchbase from the following categories; Fintech, Payments, Mobile Payments, Crowdfunding, and Bitcoin, which are founded on or after 1st Jan 2008 and have raised more than $10 million in total funding. Based on these criteria, we narrowed down to 428 startups globally from Fintech sector. From this cohort, we selected top-50 startups based on their relevance, technological advancement and Crunchbase ranking.

The majority of startups (86%) that made its way into top-50 were founded in or before 2012; with the year 2012 alone contributing 12 startups. It is entirely understandable that owing to intense competition from established financial institutions and other peer startups; it takes four to six years before they can make their presence felt.

We further segmented these startups based on their business verticals into the following segments; Lending, Payments, Wealth Management, Bitcoin, Crowdfunding and Money Transfer.

Segments #of startups

Bitcoin 6

Crowdfunding 4

Lending 10

Money Transfer 3

Payments 10

Wealth Management 7

Others 10

The startups from the Lending and Payments segments dominate the top-50 list, both contributing 20% each to the list; followed by bitcoin and Wealth Management startups. With the advancement in technology and countries promoting digital payments, Payments segment is expected to continue dominating FinTech world in the coming times as well.

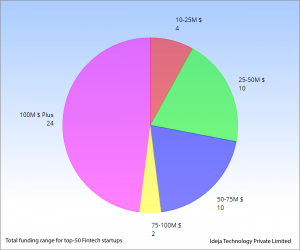

The majority of the startups (48%) in top-50 have raised more than $100 M in total funding. It is understandable as most of these startups are in direct competition with the big financial institutions, even though they are few years old, their customer service and security standards have to be at par with the big wigs.

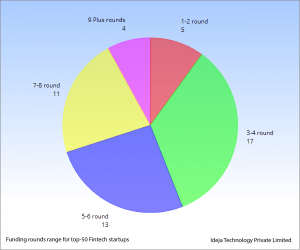

Talking about the number of funding rounds, the majority of startups have raised between three to eight rounds of investment making the average funding per round for these top-50 startups to be above $ 34 M.

The US again dominates the top-50 Fintech list with 36 startups in the league followed by the UK with eight startups and India with two startups. In average funding per startup, India is ahead of both US and UK by a huge margin; this is due to the huge success of Paytm and Mobikwik which together have raised more than $860 M.

Segments that will shape Financial Services in 2017

Lending segment

It's one of the most modern and attractive FinTech segment across the globe.

UK and US have seen big ticket investments in this sector, and there may be a momentary slow down, however, on the other hand, developing countries in Asia and Africa are a virgin territory for the Lending FinTechs because a significant chunk of the population in these countries is yet to be covered by the formal banking system.

According to YoStartups.com, the top ten Lending companies, which can do well in 2017, are Funding Circle, Sofi, Kabbage, Avant, LendUp, MoneyLion, Upstart, MarketInvoice, Fundbox and Kreditech Holding.

Except for Funding Circle and MarketInvoice, which are UK-based, and Kreditech Holding which is based in Germany, all other seven companies have their headquarters in the United States.

Average funding in these startups is above $520 million in an average over seven rounds of funding. What is more interesting to note is that five out ten startups were alone founded in the year 2012, what a great year for entrepreneurs.

Payment Segment

Like lending companies, financial technology companies in Payment segment are also famous, and the developed economies have quite a few players from this segment. The sector has attracted massive investments, and it is still a hot cake in the developing and underdeveloped economies.

Top companies in this segment are Stripe, Paytm, Mobikwik, Affirm, Ripple, Dashlane, Activehours, LevelUp, Circle and Revolut. Two among the top three Payments startups come from India. And with the recent move of demonetization, they are there to stay for some time.

Paytm has raised $720 million in funding, which is the highest in this segment. It is followed by Affirm that has raised $520 million till now. The average funding in these startups is around $220 million with over five rounds of the financing in each of them.

Wealth Management segment

Wealth Management is another area entirely dominated by US FinTech firms as all seven companies are headquartered there. However, they offer their services globally.

Top companies in this segment are Betterment, Wealthfront, Personal Capital, Acorns, Robinhood, Stash, and StockTwits. The average funding in these startups is around $100 million with over five rounds of the financing in each of them.

Bitcoin Segment

The recent rise of the investment in this sector indicates a future for this segment. With wider acceptance and use, this area is gaining traction. YoStartups.com has identified six companies in Bitcoin and Blockchain related services that will lead the global trend. While three companies are from the US, rests three are from Belgium, Canada, and the UK.

The companies are Blockchain, Coinbase, Blockstream, BitPay, 21 Inc and Bitstamp. On an average, these companies have raised just over $64 million in total funding, but considering the early stage of the segment itself, this number is encouraging enough.

Crowdfunding Segment

Four FinTech startups are poised to lead the crowdfunding segment in 2017. Three of them – SeedInvest, Tilt and RealtyShares are US-based while Crowdcube has its base in the UK.

SeedInvest is an equity crowdfunding platform that connects investors with startups, Tilt helps money collection with your friends or community for free, RealtyShares is an online marketplace for real estate investing and Crowdcube enables individuals to invest or loan in small companies in return for equity or an annual return.

The average funding in these startups is around $42 million with over five rounds of the financing in each of them.

Money Transfer Segment

While US-based FinTechs dominate all sectors, UK gets an upper age in money transfer as all three startups identified by YoStartups.com belong to the UK.

TransferWise is a money transfer service allowing private individuals & businesses to send money abroad without hidden charges, WorldRemit helps migrants send money to their loved ones all over the world, and Azimo is an online international money transfer company that challenges the old fashioned, expensive ways of moving your money around the world.

All three companies have reported receiving last funding in 2016, which shows the segment, is alive and kicking among the VCs. The average funding in these startups is around $118 million with over six rounds of the financing in each of them.

Conclusion

"Traditional financial institutions are facing the heat from new FinTech competitors who are rewriting the rule book, In India and China, payment companies are all set to surpass banks in the number of customers in the near future. By working with these top 50 startups in the FinTech sector, traditional financial powerhouses can build a leaner, sleeker and futuristic offerings for their clients."says Jappreet Sethi, Co-Founder of Yostartups.com

________________

Top-50 Fintech Startups List

Funding Circle

( http://www.fundingcircle.com )

Funding Circle is the world's leading online marketplace for business loans, matching businesses that want to borrow with investors.

Stripe

( http://stripe.com )

Stripe provides a set of unified APIs and tools that instantly enable businesses to accept and manage online payments.

Blockchain

( http://blockchain.com/ )

Blockchain is a web-based bitcoin platform that makes using bitcoin safe, easy, and secure for all consumers and businesses worldwide.

SoFi

( http://www.sofi.com )

SoFi is modern finance company taking an unprecedented approach to lending and wealth management, with more than $12 billion lent to date.

Paytm

( https://paytm.com/ )

Paytm offers recharge on the go for mobile, DTH, data cards, utility bills, bus tickets, and mobile shopping.

Coinbase

( https://www.coinbase.com )

A digital currency wallet service that allows for you to buy and sell bitcoin.

Betterment

( http://www.betterment.com )

Betterment is a goal-based online investment company, delivering personalized financial advice paired with low fees and customer experience.

MobiKwik

( http://www.mobikwik.com )

MobiKwik is a popular mobile wallet app in India. Millions of Indians use it for shopping, P2P money transfer, & bill payments.

TransferWise

( https://transferwise.com )

TransferWise is a money transfer service allowing private individuals & businesses to send money abroad without hidden charges.

Affirm

( http://affirm.com )

Affirm, a financial technology services company, offers installment loans to consumers at the point of sale.

Kabbage

( http://www.kabbage.com )

Kabbage is a financial technology company. Its fully automated technology and data platform powers direct lending for itself and for its partners.

Wealthfront

( http://wealthfront.com )

Wealthfront is the largest and fastest growing automated investment service, with over $2 billion in assets under management.

Personal Capital

( http://www.personalcapital.com )

Personal Capital is the leading digital wealth management firm.

BlueVine

( http://www.bluevine.com )

BlueVine allows small businesses to get paid immediately on their outstanding invoices.

Acorns

( http://www.acorns.com )

Acorns is a finance company that allows individuals to round up purchases and automatically invest the change.

Tradeshift

( http://tradeshift.com )

Tradeshift is a global network and platform that helps companies innovate the way they buy, pay and work together.

Avant

( http://www.avant.com )

Changing the way you borrow with safer, faster, better financial products

Robinhood

( https://www.robinhood.com/ )

Robinhood is a stock brokerage that allows customers to buy and sell U.S. listed stocks and ETFs with zero commission.

Ripple

( http://ripple.com )

Ripple provides instant, certain, low-cost international payments.

Dashlane

( http://www.dashlane.com )

Dashlane makes identity and payments simple and secure everywhere.

Stash

( http://www.stashinvest.com )

Stash is investing for real people. We are breaking the mold of traditional finance, making investing accessible to everyone.

WorldRemit

( http://www.worldremit.com )

WorldRemit is a money transfer service that helps migrants send money to their loved ones all over the world.

Digital Asset

( http://www.digitalasset.com )

Reducing Settlement Latency and Counterparty Risk.

Activehours

( https://www.activehours.com )

Activehours develops a smartphone-based application that enables hourly workers to get paid early when they need it.

LendUp

( http://www.lendup.com )

LendUp is an online-only direct lender of small-dollar-amount, short-term, unsecured loans designed for emergency cash or making ends meet.

Blockstream

( http://blockstream.com/ )

Blockstream is a bitcoin-focused, FinTech company that works to accelerate innovation in cryptocurrencies, open assets, and smart contracts.

SeedInvest

( https://www.seedinvest.com )

SeedInvest is an equity crowdfunding platform that connects investors with startups.

LevelUp

( http://thelevelup.com )

LevelUp is an American mobile payment platform that lets users accept mobile payments and engage with customers through loyalty programs.

Tilt

( http://www.tilt.com )

Tilt is the easiest way to collect money with your friends or community for free.

Addepar

( http://www.addepar.com )

Addepar is a cloud-based platform connecting a user's financial data in a single repository.

MoneyLion

( http://www.moneylion.com/ )

MoneyLion is using big data to revolutionize consumer lending and help people achieve financial wellness.

Nubank

( https://www.nubank.com.br/ )

Nubank provides financial services in Brazil. Nubank is the leading digital finance company in Brazil. It is based in São Paulo, Brazil.

RealtyShares

( http://www.realtyshares.com )

RealtyShares is an online marketplace for real estate investing.

Taulia

( http://www.taulia.com )

Taulia provides cloud-based invoice, payment and discount management solutions for large buying organizations.

Plaid

( https://plaid.com )

Plaid is an API to power developers of financial services applications and help them connect with user bank accounts.

Circle

( https://www.circle.com/ )

Circle builds products that enable greater ease-of-use in online and in-person payments.

Expensify

( http://use.expensify.com )

Expensify is a financial services startup that provides an online expense management service for customers worldwide.

Upstart

( http://www.upstart.com )

Upstart is an online lending marketplace that provides personal loans using predictive models to determine creditworthiness of borrowers.

Revolut

( http://www.revolut.com )

Revolut is a platform to use and manage money around the world.

BitPay

( http://bitpay.com )

BitPay is a payment processor for the peer-to-peer digital currency, Bitcoin.

Quantopian

( http://www.quantopian.com )

Quantopian inspires talented people to write investment algos. Select authors may license their algos to us and get paid for performance.

MarketInvoice

( http://www.marketinvoice.com )

MarketInvoice is Europe's first and biggest peer-to-peer lender for businesses with outstanding invoices.

21 Inc

( https://21.co )

21 Inc is a bitcoin startup that enables its users to build, buy, and sell machine-payable apps with developers all around the world.

Fundbox

( http://fundbox.com )

Leverages deep data analytics to accelerate cash flow and clear invoices for small businesses

Azimo

( http://azimo.com/en/ )

Azimo is an online international money transfer company that challenges the old fashioned, expensive ways of moving your money around the world.

ZestFinance

( http://zestfinance.com )

ZestFinance develops big data underwriting technologies to give lenders a better understanding of risk.

Kreditech Holding

( http://www.kreditech.com )

Kreditech provides credit access to people with little or no credit history.

StockTwits

( http://stocktwits.com )

StockTwits is a real-time financial communications platform for the financial and investing community.

Bitstamp

( http://www.bitstamp.net )

Bitstamp is an European Union based bitcoin marketplace. It allows people from all around the world to safely buy and sell bitcoins.

Crowdcube

( https://www.crowdcube.com )

Crowdcube, a crowdfunding service, enables individuals to invest or loan in small companies in return for equity or an annual return.

________________

About YoStartups:

YoStartups guides startups to success through a team of talented and experienced professionals, utilising a unique web platform that provides virtual startup acceleration, content management, investor readiness and, market entry services. YoStartups is an active startup ecosystem builder and collaborates with leading Universities, co-working spaces, incubators, VC’s and business angels to reduce the failure rate of startups.

Our team members travel across the world, drop us a note to check when we are visiting your city.

For more information, please contact:

Jappreet Sethi

Co-Founder & Head of Marketing

YoStartups.com

Ideja Technology Private Limited

Email: j(at)yostartups(dot)com

web: http://www.yostartups.com

FB: http://www.facebook.com/yoStartups

twitter: http://www.twitter.com/YoStartups

Instagram: http://www.instagram.com/YoStartups

Jappreet Sethi

YoStartups

+91 99100 12370

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.