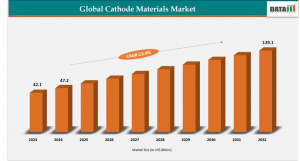

Cathode Materials Market to reach USD 129.1 Billion by 2032, driven by EVs, ESS, and Cleaner Energy Storage Solutions

Battery innovation, recycling, and green policies push cathode materials market toward USD 129 Biliion.

The global cathode materials market is witnessing a transformative growth phase driven by the rising adoption of electric vehicles (EVs), grid-scale energy storage systems (ESS), and high-performance consumer electronics. Cathode materials critical components in lithium-ion and other advanced batteries determine key parameters such as energy density, life cycle, and overall safety. As industries accelerate toward decarbonization and electrification, demand for advanced cathode chemistries like lithium nickel manganese cobalt oxide (NMC), lithium iron phosphate (LFP), and lithium nickel cobalt aluminum oxide (NCA) continues to surge.

𝗚𝗲𝘁 𝗮 𝗦𝗮𝗺𝗽𝗹𝗲 𝗣𝗗𝗙 𝗕𝗿𝗼𝗰𝗵𝘂𝗿𝗲 𝗼𝗳 𝘁𝗵𝗲 𝗥𝗲𝗽𝗼𝗿𝘁 (𝗨𝘀𝗲 𝗖𝗼𝗿𝗽𝗼𝗿𝗮𝘁𝗲 𝗘𝗺𝗮𝗶𝗹 𝗜𝗗 𝗳𝗼𝗿 𝗮 𝗤𝘂𝗶𝗰𝗸 𝗥𝗲𝘀𝗽𝗼𝗻𝘀𝗲): https://www.datamintelligence.com/download-sample/cathode-materials-market

Key Highlights from the Report:

➤ The global cathode materials market was valued at USD 47.2 billion in 2024 and is projected to reach USD 129.1 billion by 2032, at a CAGR of approximately 13.4%.

➤ Asia-Pacific dominated the market with over 32% share in 2024, led by China, Japan, and South Korea’s advanced battery manufacturing industries.

➤ The lithium-ion battery segment held the largest market share at around 49% in 2024, driven by electric vehicle and energy storage applications.

➤ High-nickel and cobalt-free cathode materials are rapidly gaining traction, offering improved energy density and reduced dependence on scarce materials.

➤ Growing government incentives and localization of supply chains in North America and Europe are creating new opportunities for domestic manufacturers.

➤ The automotive sector remains the leading end user, accounting for over half of global cathode material demand in 2024.

Recent Developments:

United States: Recent Industry Developments:

1. In July 2025, U.S.-based manufacturers announced large-scale production of nickel-rich NMC (nickel–manganese–cobalt) cathode materials to support the country’s expanding EV battery supply chain under the Inflation Reduction Act (IRA).

2. In June 2025, new lithium iron phosphate (LFP) facilities were commissioned in Texas and Michigan, emphasizing safer, cobalt-free chemistries for next-generation electric vehicles and grid storage applications.

3. In May 2025, U.S. research collaborations advanced solid-state battery cathodes using high-voltage manganese-based materials, aiming to deliver higher energy density and longer cycle life for advanced mobility solutions.

Japan: Recent Industry Developments:

1. In July 2025, Japanese battery giants unveiled high-nickel NCA (nickel–cobalt–aluminum) cathode technologies designed for ultra-fast charging and extended EV range, strengthening Japan’s position in global battery innovation.

2. In June 2025, Japan initiated pilot-scale production of cobalt-free manganese-rich cathode materials, reducing reliance on imported critical minerals and aligning with national resource security goals.

3. In May 2025, collaborations between Japanese universities and automotive OEMs led to breakthroughs in solid-state battery cathode interfaces, enhancing ionic conductivity and thermal stability for next-generation batteries.

Company Insights:

BASF SE

Huayou Cobalt Co., Ltd

POSCO FUTURE M

Sumitomo Metal Mining Co., Ltd.

Shanshan co

Umicore

Targray

Hitachi High-Tech Corporation

NICHIA CORPORATION

NEI Corporation

Market Segmentation:

The cathode materials market is segmented based on battery type, material type, and end-user application.

By Battery Type

The lithium-ion battery segment dominates the market, representing nearly half of the global revenue. These batteries are widely used in electric vehicles, portable electronics, and grid-scale energy storage due to their superior energy density and efficiency. Other battery types, such as lead-acid and nickel-based systems, continue to serve niche applications in industrial and backup power solutions, though their growth is slower compared to lithium-ion technologies.

By Material Type

Cathode materials vary in composition based on performance and safety requirements across applications. Key materials include Lithium Nickel Manganese Cobalt Oxide (NMC), popular in electric vehicles (EVs) for its high energy density and balanced performance; Lithium Iron Phosphate (LFP), valued for its stability, safety, and cost-effectiveness, making it ideal for energy storage systems and budget EVs; and Lithium Nickel Cobalt Aluminum Oxide (NCA), which offers high capacity and power output, commonly used in premium electric vehicles. Lithium Cobalt Oxide (LCO) remains prevalent in consumer electronics, though it is gradually being replaced by newer chemistries, while Lithium Manganese Oxide (LMO) is favored for its safety and thermal stability in power tools and hybrid vehicles. Among these, LFP and NMC are witnessing the fastest adoption due to their balanced cost-performance characteristics and growing use in both electric mobility and stationary energy storage applications.

By End-User

The automotive industry is the largest end-user segment, accounting for nearly 55% of total demand. The growing global shift toward electric mobility continues to boost consumption of high-performance cathode materials. The industrial and energy storage sectors are also expanding rapidly, supported by renewable energy integration and grid modernization efforts. Meanwhile, consumer electronics including smartphones, laptops, and wearables remain an important but smaller contributor due to the relatively small battery size per device.

Looking For A Detailed Full Report? Get it here: https://www.datamintelligence.com/buy-now-page?report=cathode-materials-market

Regional Insights:

Asia-Pacific

Asia-Pacific leads the global market, accounting for more than 32% of the total revenue in 2024. China remains the dominant force, hosting the world’s largest battery manufacturing and raw material refining capacity. Japan and South Korea further contribute with strong R&D investments and established supply chains for advanced cathode chemistries. Favorable government policies, growing EV penetration, and large-scale renewable energy storage projects are sustaining regional dominance.

North America

North America is emerging as one of the fastest-growing regions in the cathode materials market. The U.S. government’s Inflation Reduction Act (IRA) has spurred new investments in domestic battery manufacturing and material processing. Strategic initiatives to localize the battery supply chain and reduce dependence on imports are driving strong market momentum across the region.

Europe

Europe’s cathode materials market is expanding under the influence of sustainability regulations and the push for energy independence. The European Critical Raw Materials Act and new recycling mandates encourage local sourcing, manufacturing, and reuse of critical metals like nickel and cobalt. Major automakers and battery producers are establishing gigafactories across Germany, France, and Sweden to strengthen Europe’s energy transition capabilities.

Other Regions

Latin America, the Middle East, and Africa hold smaller shares but represent promising future markets. Countries like Chile and Argentina are key lithium producers and could attract investment for regional cathode production as global supply chains diversify.

Market Dynamics

Market Drivers

The cathode materials market is primarily driven by the surging demand for electric vehicles (EVs) worldwide. EV adoption continues to accelerate, leading to exponential growth in battery production. The increasing deployment of energy storage systems (ESS) to support renewable energy integration is another major driver. Continuous technological innovations such as the development of high-nickel, cobalt-free, and solid-state-compatible cathodes are enhancing battery performance while lowering costs. Additionally, government incentives and localization strategies are fostering strong investment in regional manufacturing capacities.

Market Restraints

Volatile prices of raw materials such as lithium, nickel, and cobalt remain a key restraint for cathode manufacturers. High capital costs and the complex manufacturing processes associated with advanced cathode chemistries can also limit scalability. Moreover, safety concerns, such as thermal instability in certain high-energy chemistries, require advanced engineering solutions. Environmental and ethical challenges related to mining operations—particularly cobalt continue to raise sustainability concerns and affect supply stability.

Market Opportunities

The market presents significant opportunities in next-generation EVs and grid energy storage applications. The growing shift toward solid-state and cobalt-free batteries opens avenues for new material innovations. Recycling and circular economy initiatives are expected to reduce dependency on virgin raw materials while ensuring sustainability and cost competitiveness. Emerging regional manufacturing hubs in North America and Europe will further enhance supply chain resilience.

Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/cathode-materials-market

Reasons to Buy the Report:

✔ Comprehensive insights on market size, growth trends, and future forecasts up to 2032.

✔ Detailed segmentation by battery type, material, and end-use industry to identify growth opportunities.

✔ Analysis of key market drivers, restraints, and opportunities shaping industry growth.

✔ Competitive landscape profiling major players, product portfolios, and strategic initiatives.

✔ Valuable intelligence to support strategic decision-making and investment planning.

Frequently Asked Questions (FAQs):

◆ How big is the global cathode materials market in 2024, and what is its projected value by 2032?

◆ Who are the key players operating in the global cathode materials market?

◆ What is the forecasted CAGR of the cathode materials market during 2025–2032?

◆ Which region dominates the global cathode materials market?

◆ What are the major cathode chemistries driving market growth?

Conclusion:

The cathode materials market stands at the forefront of the energy transition, playing a pivotal role in the evolution of electric mobility and renewable power storage. With the market valued at USD 47.2 billion in 2024 and projected to surpass USD 129.1 billion by 2032, it offers immense growth opportunities. While Asia-Pacific currently dominates production and consumption, the rise of regional manufacturing in North America and Europe is reshaping global dynamics. Continuous advancements in material chemistry, recycling, and supply chain localization are set to define the next phase of market evolution. As demand for sustainable, high-performance batteries grows, cathode materials will remain the cornerstone of the clean energy future.

Request for 2 Days FREE Trial Access: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

Competitive Landscape

Sustainability Impact Analysis

KOL / Stakeholder Insights

Unmet Needs & Positioning, Pricing & Market Access Snapshots

Market Volatility & Emerging Risks Analysis

Quarterly Industry Report Updated

Live Market & Pricing Trends

Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Related Reports:

Lithium Ion Battery Market

Battery Electrolyte Market

Sai Kiran

DataM Intelligence 4Market Research

+1 877-441-4866

email us here

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.