Corporate Citizenship in Transition: Lessons from 2025, Planning for 2026

Drawing on a survey of over 80 corporate citizenship and philanthropy leaders at US and multinational firms, this report examines how corporate citizenship is evolving in 2025 amid economic uncertainty, tax changes, legal scrutiny, and nonprofit challenges and outlines priorities for companies planning for 2026.

Trusted Insights for What’s Ahead®

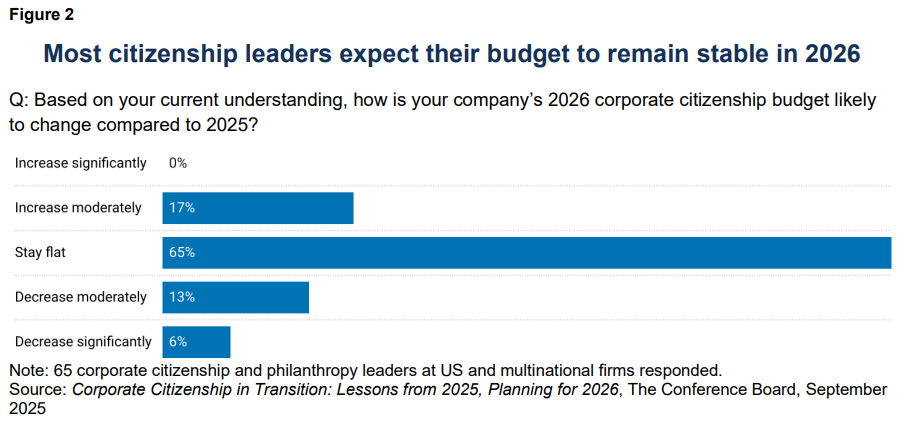

- Corporate citizenship budgets have held steady in 2025 and are likely to stay flat in 2026, although 19% of surveyed leaders anticipate reductions as companies continue to face economic and strategic uncertainty.

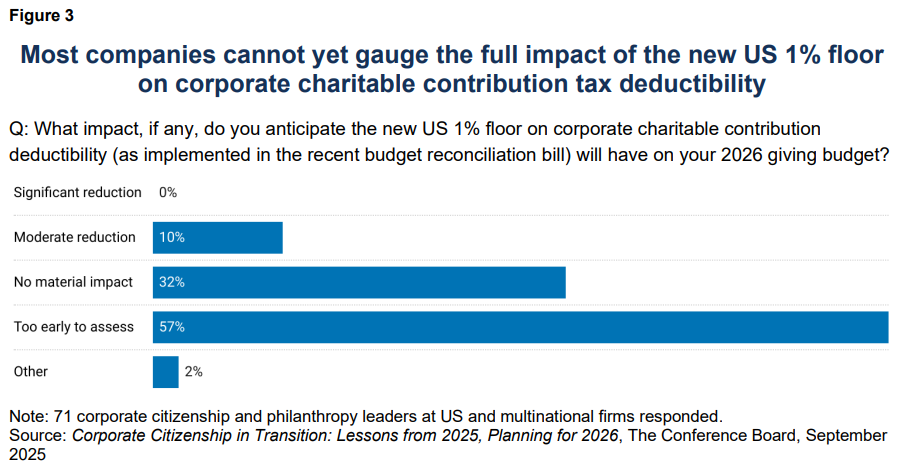

- A rule introduced in the recent US budget reconciliation measure restricts corporations to deducting aggregate charitable contributions only above 1% of taxable income; this may prompt some companies to reconsider how they plan, time, and structure giving.

- More than half of surveyed citizenship leaders report that federal scrutiny of diversity-related initiatives has shaped their giving decisions in 2025 as many scale back or reframe identity-based programs and increase emphasis on broad bipartisan themes like education.

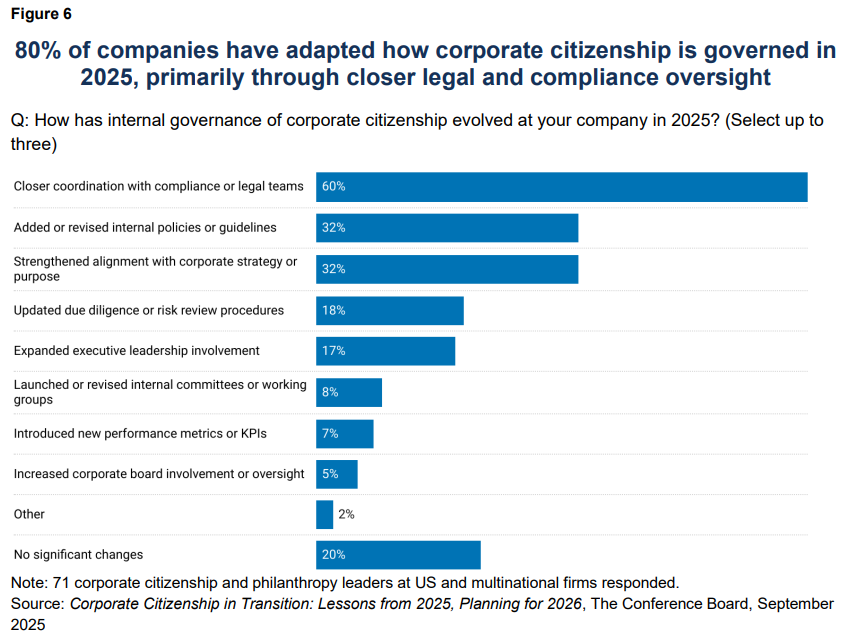

- Many companies have strengthened governance and risk oversight of corporate citizenship this year, with one-third introducing senior or legal approvals for certain types of grants and 60% increasing broader coordination with legal and compliance teams.

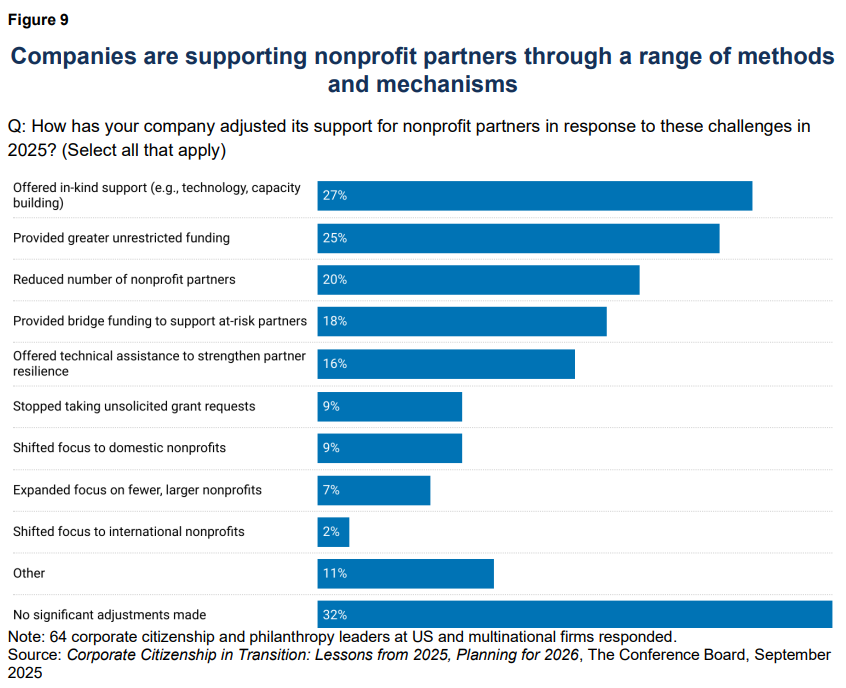

- Two-thirds of surveyed executives report that nonprofit grantees lost government funding in 2025, leading to layoffs and program cuts; corporates have responded in various ways, from providing unrestricted support to reducing partner portfolios.

| Corporate citizenship, or corporate social responsibility, is the established business practice of companies supporting communities and society through philanthropy, employee volunteering, and nonprofit partnerships. It is typically led by dedicated corporate citizenship teams or affiliated corporate foundations, though responsibilities are often dispersed throughout the company. |

Evolving Resources and Funding

Budget adjustments and expectations

Giving USA notes that philanthropic giving from US companies entered 2025 with strong momentum, following a 6% inflation-adjusted increase in 2024 driven by robust corporate profits and stock market gains. That resilience has since been tested by geopolitical tensions, renewed tariffs, and supply chain disruptions, an environment that has led many firms to tighten spending and delay growth plans. Against this backdrop, corporate citizenship budgets have remained broadly stable in 2025 (Figure 1), though 21% of leaders report cuts that they attribute to internal cost pressures and restructuring. At the same time, 16% report increases, primarily attributable to leadership or strategy changes, event-driven needs such as disaster response, and stronger-than-expected business performance.

Looking ahead to 2026, most survey respondents expect their citizenship budgets to hold steady (Figure 2), reinforcing the sense that these programs are now mature and embedded within corporate structures. At the same time, nearly 1 in 5 anticipate reductions—including 6% bracing for significant cuts—underscoring that even institutionalized programs remain discretionary and exposed to shifting cost pressures and priorities.

US tax policy shifts

A key factor introducing uncertainty into 2026 citizenship budgets is changes to the US tax code, introduced in the recent budget reconciliation bill.[1] Previously, corporations could deduct aggregate contributions up to 10% of taxable income—calculated after ordinary business deductions, but before applying the charitable deduction, any net operating loss carryback, or other special deductions. While the 10% cap remains, only aggregate charitable contributions above 1% of taxable income now qualify for deduction—a shift that could reduce the value of giving for many firms, including those channeling funds through affiliated foundations.

Survey results underscore this uncertainty (Figure 3): 57% of respondents say it is too early to assess the impact, 32% expect no material effect, and 10% anticipate a moderate reduction in their giving budgets. None foresee significant cuts. While the policy change is unlikely to drive large-scale reductions, it adds new complexity to how companies operate.

Some companies are already weighing trade-offs under the new rule, such as whether to accelerate contributions into 2025 to maximize deductibility, shift resources toward other priorities such as R&D, or restructure giving across subsidiaries with steadier taxable income. Tax teams are also grappling with practical questions, including how the floor affects sudden event giving (such as disaster relief) and whether “bunching” strategies—concentrating contributions into certain years—remain viable.

Even if overall giving levels hold steady, the rule is likely to reshape how companies plan, time, and structure contributions, especially as tariffs, restructuring, and cost pressures put philanthropy and other discretionary spending under scrutiny.

To navigate this uncertainty, corporate citizenship leaders can consider:

- Engaging CFOs and tax teams early. Develop shared scenarios to clarify how the floor affects timing, deductibility, and 2026 planning. Work with finance to determine whether some expenditures, such as sponsorships or cause-related marketing, should be categorized as business expenses, while ensuring proper documentation and governance to manage audit risk.

- Scenario-planning event giving. Set clear policies for disaster response and other unplanned contributions under the new rules, balancing flexibility with tax efficiency.

- Evaluating timing strategies. Assess whether accelerating certain commitments into 2025 or spreading pledges over multiple years can preserve deductibility while maintaining consistency of impact.

- Strengthening the strategic case. Reinforce to boards and executives that philanthropy is guided by business priorities—brand, community, talent, and trust—rather than tax optimization alone.

- Assessing reputational risks. Before reclassifying or restructuring giving, weigh potential effects on stakeholder perceptions. Treating contributions as business expenses may preserve deductibility but risks undermining authenticity and credibility.

Navigating a Shifting Political and Legal Environment

Federal scrutiny and programmatic adjustments

Corporate citizenship in 2025 is being shaped not only by economic and resource factors but also by a shifting US political, legal, and regulatory climate. A key pressure point is heightened federal scrutiny of diversity, equity & inclusion (DEI). More than half of surveyed citizenship leaders report that this scrutiny has already influenced their giving decisions or is likely to do so (Figure 4). The trend accelerated after the Supreme Court’s 2023 ruling against affirmative action, which spurred broader pushback against workforce DEI programs and triggered lawsuits targeting corporate and nonprofit grants with race-based eligibility criteria. [2]

In 2025, the legal and regulatory environment has tightened further, with new executive orders, federal guidance, and oversight measures aimed at curbing diversity-related initiatives. As a result, companies face a more complex operating landscape, one where philanthropic and citizenship programs face tangible legal risks if they are perceived as discriminatory.

In response, many corporate citizenship teams and foundations are recalibrating their strategies to navigate heightened scrutiny and reduce exposure to legal or political challenges. The most common adjustment is deemphasizing programs and partnerships that could be perceived as controversial, particularly those linked directly to identity-based eligibility criteria. Instead, companies are placing greater emphasis on broadly universal themes such as economic opportunity, education, and local community needs (Figure 5).

These shifts often take the form of changes in framing and delivery rather than wholesale rolling back of prior commitments. Looking ahead, survey respondents highlight education, disaster response, economic opportunity, and community resilience as the most commonly prioritized themes for 2026 planning; these areas allow companies to demonstrate inclusivity and relevance while minimizing legal exposure.

New approaches to governance and risk

Programmatic recalibrations have been accompanied by changes in how companies govern and oversee corporate citizenship, including one-third of surveyed companies now requiring senior-level or legal approval for grants tied to contested issues or partners. More broadly, 60% report closer coordination with legal and compliance functions, alongside updated internal guidelines and stronger due diligence frameworks (Figure 6).

To strengthen oversight of corporate citizenship further, companies can:

- Strengthen due diligence frameworks: Expand partner vetting, grant approval, and monitoring processes to capture political, legal, and reputational risks alongside financial and operational checks.

- Institutionalize legal and compliance review: Establish clear thresholds for when complex or potentially higher-risk grants and partnerships must be escalated, ensuring consistency and reducing exposure to litigation.

- Revisit oversight structures: Ensure board committees, executive sponsors, or cross-functional bodies have visibility into the corporate citizenship portfolio, including emerging risks or reputational exposure.

- Tighten integration with core strategy: Demonstrate how corporate citizenship programs advance long-term business objectives such as engaging and retaining talent, enhancing reputation, and supporting market access—reinforcing their strategic rather than discretionary value.

Challenges Facing Nonprofit Partners

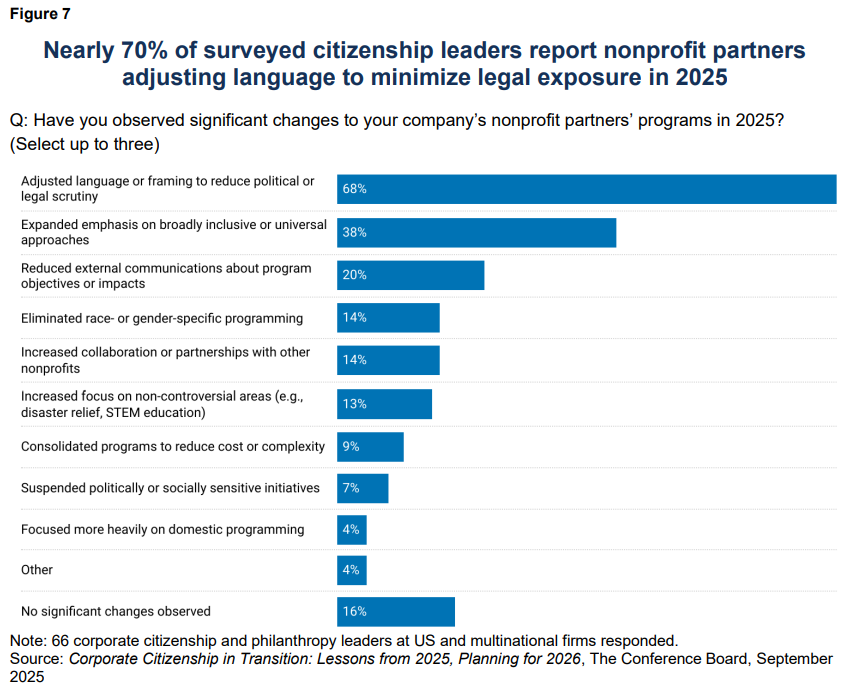

Evolving legal and political dynamics in the US are reshaping not only how companies structure and oversee their own citizenship programs, but also the nonprofit sector they support. Nearly 70% of surveyed companies observed that their nonprofit partners adjusted program language or framing in 2025 to limit legal exposure, with many shifting toward more broadly inclusive or universal approaches (Figure 7). Smaller but notable shares reduced external communications or eliminated race- and gender-specific programming altogether. The result is a nonprofit ecosystem recalibrating how it describes and delivers services.

This recalibration has been compounded by public funding volatility. Two-thirds of surveyed executives report that their nonprofit partners lost government support in 2025 due to legal or policy changes (Figure 8). Cuts affected major federal streams, including Community Development Block Grants, Title I education funds, social services, and Department of Health and Human Services programs. In response, many nonprofit grantees have reduced staff (45%), scaled back or suspended programs (38%), or consolidated operations. The strain has been most acute for organizations reliant on earmarked funding for identity-based programs, but ripple effects extend broadly, driving capacity shortfalls, higher turnover, and reduced flexibility.

Corporate responses to this fragility have varied (Figure 9). Recognizing that traditional restricted grants may be ill-suited for nonprofits under strain, some firms have offered more flexible forms of support, such as in-kind contributions (27%), unrestricted funding (25%), and bridge capital (18%) to help organizations manage cash flow and maintain core operations. Others focused on strengthening nonprofit resilience over the longer term, providing technical assistance (16%) for capacity building, financial management, and strategic planning.

By contrast, 1 in 5 companies streamlined their nonprofit partnerships to improve oversight, though this can heighten concentration risk. A third reported making no changes, pointing to a possible missed opportunity for some citizenship teams to strengthen resilience in the current environment.

Looking ahead, companies can strengthen the stability of nonprofit partners—and by extension their own strategic impact goals—by:

- Providing predictable multiyear commitments: Move beyond annual renewals to multiyear agreements that give nonprofits planning certainty, with checkpoints for accountability and alignment as well as monitoring potential reputational risks.

- Streamlining reporting and compliance demands: Minimize duplication by aligning with standard nonprofit reporting practices or audited financials, potentially freeing up capacity for service delivery.

- Coordinating with peer funders to reduce volatility: Establish joint funding mechanisms or pooled reserves for critical services, ensuring continuity when public funding gaps emerge and reducing the risk of sudden disruption.

- Investing in shared infrastructure and capacity: Support finance, data, and technology systems that multiple nonprofits can access, lowering overhead and building sector-wide resilience.

Conclusion

Corporate citizenship is in transition in 2025, influenced by shifting federal priorities, new tax rules, evolving regulatory scrutiny, and sustained pressures on nonprofit partners. Programs remain embedded in corporate structures, but many face growing tests of resilience, credibility, and alignment with business priorities. Looking ahead to 2026 and beyond, companies can sustain impact by maintaining financial discipline, strengthening governance, ensuring closer integration with core strategy, and strategically supporting nonprofit partners.

1The

[ref no=2]Since 2023, a wave of lawsuits has targeted philanthropic and charitable grant programs with race-based eligibility, building on the Supreme Court’s decision ending affirmative action in higher education. Many, led by the American Alliance for Equal Rights (AAER), invoked Section 1981 of the Civil Rights Act of 1866 to argue that grants for Black, Hispanic, or other minority groups unlawfully excluded nonminority applicants. Cases have spanned small-business grants (Fearless Fund, Hidden Star, Founders First, Progressive/Hello Alice), scholarships (McDonald’s HACER), and maternal health (Abundant Birth Project), but all advanced the same core claim: that remedial efforts based on race constitute unlawful discrimination. Outcomes have included dismissals on standing grounds, settlements, program closures, and shifts to race-neutral criteria. Together, these cases signal a climate of heightened scrutiny in which funders face pressure either to narrowly justify or to redesign programs to avoid explicit racial classifications.(go back)

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.