Private Wealth Systems Recognized as one of the Fastest Growing Tech Companies

Family Offices Seeking Investment Oversight and Lower Operational Costs turn to Leading FinTech Company for Total Financial Control

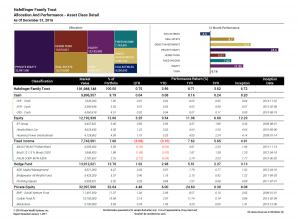

Private Wealth Systems attributes its record-breaking revenue growth to the company’s unique ability to capture, reconcile, process, calculate and present more data, faster, with greater accuracy at a lower total cost than any other platform. Private Wealth Systems’ cloud-based software provides the most powerful multi-asset, multi-manager, multi-currency consolidated portfolio management and investment reporting for family offices that manage complex wealth, supporting all asset classes including; equities, fixed income, private equity, real estate, hedge funds, derivatives, currencies, structured products, art and collectibles.

Modern family offices and ultra-high net worth individuals are increasingly demanding financial intelligence as several forces dramatically transform the private wealth landscape, including growing financial complexity, wealth transfer between generations, and market volatility that erodes wealth. “Our remarkable growth validates that today’s family offices recognize the need for instant oversight, understanding and control over their families’ fortune. It is not enough to receive a quarterly statement 45 days late. Sophisticated ultra-high net worth individuals are demanding full transparency over their managers, the fees they pay, and the investment choices that are being made on their behalf,” said Craig Pearson, CEO of Private Wealth Systems.

This accolade reinforces the tremendous and positive impact Private Wealth Systems continues to have solving the structural challenges that plague legacy software systems and the global financial services industry as a whole—in terms of data capture, data processing, and data presentation.

“We’re thrilled to be named as one of the Fastest Growing Tech Companies and we are excited to work with family offices to provide the platform that delivers the capabilities and operational scale they need to become active participants in the management of their wealth”, added Pearson. “It is my personal mission to enable those with complex wealth to avoid unwanted risks and losses and ensure their wealth will be sustainable for generations to come.”

About Private Wealth Systems, Inc.

Private Wealth Systems is a global financial technology company that is revolutionizing the way private wealth is analyzed, reported, and managed. The company’s award winning cloud based software provides multi-asset, multi-bank, multi-currency account aggregation, data reconciliation, performance calculation, and investment reporting to family offices, private banks, and institutional asset managers to provide instant access and understanding of the drivers of risk and return across the most complex investment portfolios.

For more information about Private Wealth Systems, visit https://privatewealthsystems.com or call US +1 980 500-3000.

Marketing

Private Wealth Systems

980 500 3000

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn

Solving the Structural Challenges of Multi-Asset, Multi-Custodial, Multi-Currency Portfolio Management and Investment Reporting

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.