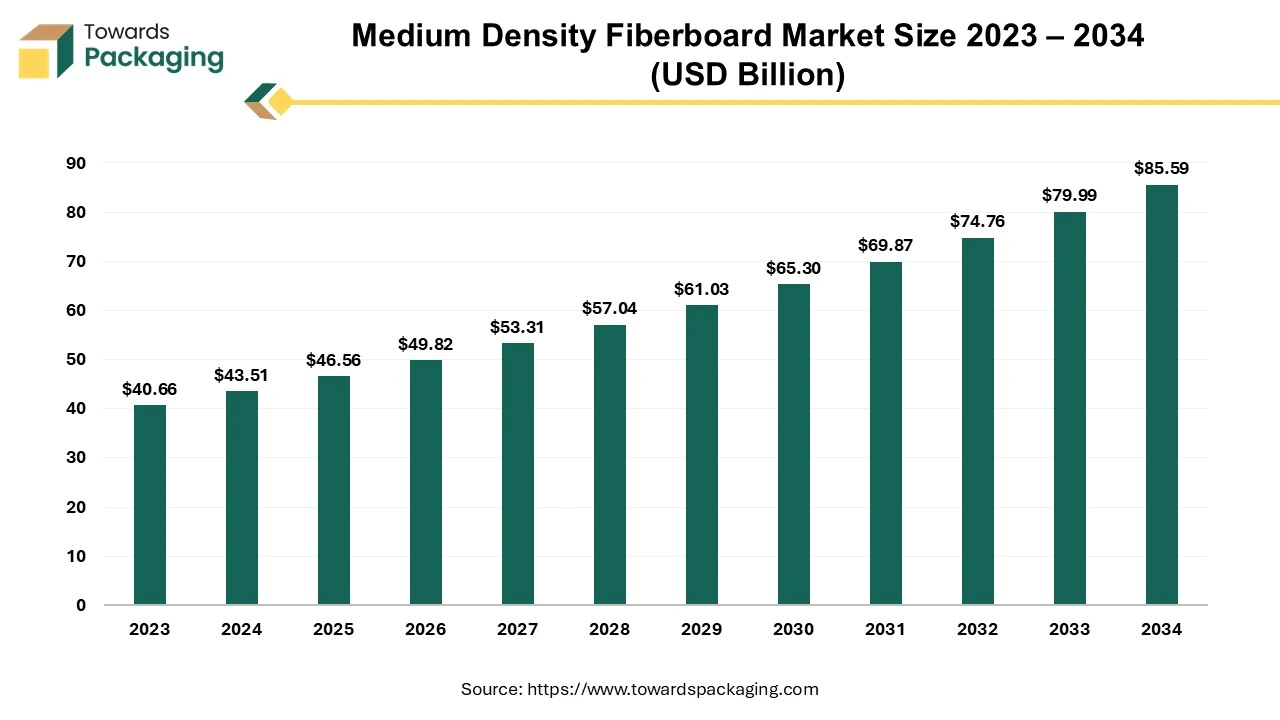

Medium Density Fiberboard Market to Apex USD 85.59 Bn by 2034, says Towards Packaging Consultants

The medium density fiberboard market size stood at USD 43.51 billion in 2024 and is predicted to exceed USD 85.59 billion by 2034, experiencing a CAGR of 7% from 2024 to 2034.

Ottawa, April 22, 2025 (GLOBE NEWSWIRE) -- The medium density fiberboard market size to record USD 46.56 billion in 2025 and is projected to grow beyond USD 85.59 billion by 2034, a study published by Towards Packaging a sister firm of Precedence Research. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and collaboration to develop new technology for medium density fiberboard, which has estimated to drive the growth of the medium density fiberboard market in the near future.

Get All the Details in Our Solutions – Request a Brochure: https://www.towardspackaging.com/download-brochure/5485

Market Overview

Medium density fiberboard is an engineered wood product manufactured by breaking down hardwood or softwood residuals into wood fibers, which are then combined with wax and resin binders formed into panels utilizing high temperature and pressure. The smooth surface of medium density fiberboard is ideal for painting or veneering. The uniform density of medium density fiberboard has no knots or grain, making it easy to cut and shape. The medium density fiberboard is affordable and cheaper than solid wood or plywood. The medium density fiberboard is commonly utilized for cabinetry, furniture, interior panelling, doors and moldings.

Major Key Trends in Medium Density Fiberboard Market:

Eco-Friendly and Sustainability Initiatives

The key players operating in the market are using recycled wood fibers and plant-based resigns to produce medium density fiberboard, aligning with global sustainability goals. There’s a rising demand for medium density fiberboard products with minimized formaldehyde emissions, such as E0 and E1 grades, to meet stringent environmental regulations and improve indoor air quality.

Advancements in Coatings and Finishes

The development of superior medium density fiberboard boards will significantly contribute to improvements in finishes and coatings. These developments will enhance medium density fiberboard boards' strength, resilience to moisture, and longevity, making them suitable for a variety of packaging. For instance, medium density fiberboard boards with lower formaldehyde emissions and low volatile organic compounds (VOCs) can be improved by incorporating sustainable woody fibers and environmentally friendly production processes. For example, the steel sector has seen a revolution because to advancements in steel finishing techniques and powder painting, which offer increased durability, efficiency, and a wide range of hue and texture options.

How Does Advanced Technology Works in Fiberboard Industry?

The future of medium density fiberboard boards will entail greater technological integration as long as technology keeps developing. This should manifest itself in a number of ways, such as adding clever features to medium density fiberboard -based furniture or using better production techniques to create even more unique and durable boards. The creation of smart fixtures that can be operated by voice commands, sensors, or mobile devices may result from the integration of generation into medium density fiberboard boards. Advanced production techniques may potentially result in the creation of medium density fiberboard boards with increased strength and durability, which would make them appropriate for a range of uses, including outdoor use and high-site visiting areas. The latest coatings and finishes that enhance medium density fiberboard boards' functionality and appearance may also improve as a result of technological integration.

If there's anything you'd like to ask, feel free to get in touch with us @ sales@towardspackaging.com

Limitations & Challenges in Medium Density Fiberboard Market:

Market Fragmentation and Pricing Volatility

The market includes many small players with inconsistent quality, and raw material costs (like wood chips or resin) can fluctuate. The market fragmentation leads to price competition and difficulty in maintaining consistent product standards.

Competitive Pressure from Alternatives

Plywood, particleboard, OSB (Oriented Strand Board), and new biocomposites often provide better moisture resistance or structural strength. The competitive pressure from alternative options puts pricing and innovation pressure on medium density fiberboard manufacturers to differentiate their products.

Expansion in Non-Residential Construction Has Driven the Market Growth

Due to the growth of non-residential constructions the sectors like education, hospitality, retail and healthcare sector are using medium density fiberboard for decorative interiors, partitions, and acoustic applications. These sectors are forecast to grow post-pandemic, presenting large-scale interior refurbishment opportunities.

Regional Analysis:

Asia’s Rapid Industrialization to Promote Dominance till 2034

Asia Pacific region held the largest share of the medium density fiberboard market in 2024, owing to rising industrialization and urbanization in the region. Countries like China, Malaysia, and Vietnam are major furniture exporters, with medium density fiberboard being a primary raw material. Global brands outsource manufacturing to Asia Pacific due to low production costs. Asia Pacific countries have vast forest resources and plantation wood, which provide an abundant supply of raw material (wood fibers) for medium density fiberboard production.

Government subsidies and Make in India–type initiatives support domestic production of engineered wood products. Asia Pacific countries, especially China, Thailand, and Vietnam, export large volumes of medium density fiberboard to North America, Europe, and the Middle East. Massive construction activity in countries like China, India, Vietnam, and Indonesia drives demand for cost-effective building materials like medium density fiberboard.

India Fiberboard Industry Trends

India medium density fiberboard market is growing owing to expansion of organized retail & E-commerce sales furniture in the country. Brands like Pepperfry, IKEA, and Urban Ladder prefer medium density fiberboard for mass production due to uniformity and ease of customization. India has significantly increased its medium density fiberboard production capacity over the past decade. The key players operating in the Indian market like Century ply boards, Greenpanel, Action TESA and Rushil Décor are investing in new plants and automation. India has easy access to plantation wood (e.g., eucalyptus, poplar), agricultural residues, and wood waste, all of which are essential inputs for medium density fiberboard.

North America’s Advanced Infrastructure to Support Growth

North America region is seen to grow at the fastest rate in the medium density fiberboard market during the forecast period. The North American market favours eco-friendly and sustainable materials. Booming housing and renovation projects in the U.S. and Canada are creating demand for medium density fiberboard in flooring, panelling, cabinetry, and furniture. Presence of automated and high-tech medium density fiberboard production plants ensures consistent product quality. North America also benefits from well-trained carpenters, fabricators, and interior designers who prefer engineered wood for its ease of use. The U.S. and Canada serve as hubs for value-added MDF products that are exported to Latin America and the Caribbean.

Join now to access the latest packaging in industry segmentation insights with our Annual Membership: https://www.towardspackaging.com/get-an-annual-membership

Segment Outlook

Product Insights

The standard MDF segment dominated the medium density fiberboard market with the largest share in 2024. Standard MDF is cheaper to produce than moisture-resistant or fire-retardant types. Its affordable price point makes it the go-to material for budget-friendly furniture, cabinetry, and interior panelling. As standard medium density fiberboard has smooth, uniform surface makes it ideal for lamination and finishing. This makes it highly attractive for manufacturers who want customizable and visually appealing products. Manufacturers can scale production with fewer modifications or added costs. For applications not exposed to high moisture or fire risk, standard MDF performs well in terms of strength, machinability, and consistency. In countries like India, China, Brazil, and parts of Southeast Asia, where price sensitivity is high, standard MDF dominates furniture and interior applications.

The fire resistant MDF segment is anticipated to witness lucrative growth during the forecast period. Building codes and fire safety standards in commercial and public infrastructure (schools, hospitals, offices, hotels) are increasingly requiring fire-retardant materials. Regulatory bodies in regions like North America, Europe, and the Middle East are mandating the use of FR-rated products in high-traffic and public spaces. The boom in commercial real estate, airports, malls, metro stations, office parks, demands materials that comply with fire-resistance norms.

In dense urban housing projects, especially in high-rise apartments, fire-resistant materials are preferred for partitions, ceilings, and furniture. Fire resistant MDF products that are also low in VOCs or formaldehyde-free are increasingly used in eco-friendly buildings. The key players operating in the MDF producers like Action TESA, Greenpanel, Kronospan, and West Fraser are expanding their fire-resistant MDF product lines.

Type Insights

The E1 medium density fiberboard segment accounted for the largest medium density fiberboard market share in 2024. E1 medium density fiberboard emits ≤0.124 mg/m³ of formaldehyde, making it safe for indoor use according to European standards. E1 MDF is increasingly being promoted over E2 due to health and environmental concerns. E1 provides a cost-effective alternative while still complying with most safety and environmental regulations. Manufacturers targeting European, North American, and Japanese markets must comply with E1 formaldehyde standards. Countries like India, Vietnam, and Brazil are tightening indoor air quality norms. Most MDF production facilities are optimized for large-scale E1 production, making it widely available and affordable for manufacturers and retailers. It strikes a balance between cost and environmental safety, unlike E2 (higher emissions) or E0/Super E0 (lower emissions but costlier).

The E0 medium density fiberboard segment is anticipated to show the fastest growth during the forecast period. E0 medium density fiberboard is favoured is green buildings and sustainable furniture because of its low health risk. E0 is compliant with BREEAM, LEED, FSC, and CARB Phase 2 guidelines. It is often required or preferred in export markets like Europe, Japan, and California (USA), where emission standards are strict.

Application Insights

The furniture segment dominated the medium density fiberboard market with the largest share in 2024. Medium density fiberboard is significantly cheaper than hardwood or plywood, making it ideal for mass-produced furniture. It enables manufacturers to offer stylish furniture at lower prices, attracting budget-conscious consumers. Its smooth, uniform surface makes medium density fiberboard perfect for laminates, veneers, and paint finishes utilized in modular furniture. It allows for precise machining and customization, critical in the growing modular and ready-to-assemble (RTA) furniture market. Online furniture brands (like IKEA, Wayfair, Pepperfry) rely heavily on medium density furniture for flat-pack furniture, which is affordable, lightweight, and easy to ship.

The interior decoration segment is anticipated to witness lucrative growth during the forecast period. As the medium density fibreboards can be easily routed, shaped, and CNC-machined enabling intricate interiors designs and mass customization. Its compatibility with a range of decorative finishes makes it visually appealing. Medium density furniture has fine texture and consistent density, making it ideal for lamination, veneering, CNC carving and painting. It allows for flawless decorative finishes with minimal preparation work.

More Insights in Towards Packaging:

- Paperboard Packaging Market Research, Consumer Behavior, Demand and Forecast: https://www.towardspackaging.com/insights/paperboard-packaging-market-sizing

- U.S. Custom Cardboard Boxes Market Research Insight: Industry Insights, Trends and Forecast: https://www.towardspackaging.com/insights/u-s-custom-cardboard-boxes-market

- U.S. Cardboard Storage Boxes Market Strategic Analysis & Growth Opportunities: https://www.towardspackaging.com/insights/us-cardboard-storage-boxes-market-sizing

- UK Large Cardboard Boxes Market Intelligence Report and Key Trends: https://www.towardspackaging.com/insights/uk-large-cardboard-boxes-market-sizing

- Ovenable Paperboard Trays Market Performance, Trends and Strategic Recommendations: https://www.towardspackaging.com/insights/ovenable-paperboard-trays-market-sizing

- Duplex Paper and Board for FMCG Market Performance, Trends and Strategic Recommendations: https://www.towardspackaging.com/insights/duplex-paper-and-board-for-fmcg-market-sizing

- Solid Bleached Sulfate (SBS) Board Market Review, Key Business Drivers & Industry Forecast: https://www.towardspackaging.com/insights/solid-bleached-sulfate-board-market-sizing

- Boxboard Packaging Market Trends, Challenges & Strategic Recommendations: https://www.towardspackaging.com/insights/boxboard-packaging-market-sizing

- Containerboard Market Key Business Drivers & Industry Forecast: https://www.towardspackaging.com/insights/containerboard-market-sizing

- Paper and Paperboard Packaging Market Production and Consumption Data: https://www.towardspackaging.com/insights/paper-and-paperboard-packaging-market-sizing

Recent Breakthroughs in Global Medium Density Fiberboard Market:

- In March 2025, sat WISPAMERICA 2025 (booth 319) at the Oklahoma City Convention Center, March 24-27, 2025, Zyxel Networks, a pioneer in providing safe, Al- and cloud-powered business and home networking solutions, will showcase and demonstrate the most recent developments in its expanding line of fiber access solutions for ISPs. Contact Kell Lin, Vice President of Zyxel Network Solutions Business Unit, to schedule a preview of Zyxel's future FWA WiFi 7 solution, which will provide high-speed MLO of 5GHz and 6GHz. Attendees can schedule an appointment to get a preview of the Zyxel FWA WiFi7 and give feedback directly to the head of Zyxel NSBU product development, as the device will not be on open exhibit during WISPA.

- In February 2025, February 27, 2025, Tirupati (Andhra Pradesh) the largest wood panel producer in India and the top MDF (medium density fiberboard) company, (UNI) Greenpanel, announced the opening of a new production line at its cutting-edge manufacturing plant in Srikalahasti, Tirupati (D), Andhra Pradesh. According to a press release from the firm, Greenpanel's yearly MDF manufacturing capacity has grown from 660,000 CBM to 891,000 CBM with the addition of the new line, demonstrating its dedication to satisfying rising demand and preserving its leading position in the market. Shobhan Mittal, MD & CEO of Greenpanel, and other important stakeholders celebrated the occasion. Being the biggest MDF producer in the nation, Greenpanel has expanded the range of products it offers by launching a thin MDF line that ranges in thickness from 1.5 mm to 1.7 mm.

Elevate your packaging strategy with Towards Packaging. Enhance efficiency and achieve superior results—schedule a call today: https://www.towardspackaging.com/schedule-meeting

Global Medium Density Fiberboard Market Players

- Arauco

- CENTURY PLYBOARDS INDIA LTD.

- Kastamonu Entegre

- Swiss Krono Group

- EGGER Group

- Heera Enterprises

- West Fraser Timber

- Weyerhaeuser

- Century Prowud

- Crosta Panels

- Durga Plywood & Hardware

- Dynea AS

- Fantoni Spa

- Greenply

- Korosten MDF Manufacture

- Kaindl

- Navkar Plywood

- Padmavati Ply Pvt. Ltd

- Roseburg Forest Products

- DAIKEN corporation

Global Medium Density Fiberboard Market

By Product:

- Standard MDF

- Moisture Resistant MDF

- Fire Resistant MDF

By Type:

- E0 MDF

- E1 MDF

- E2 MDF

By Application:

- Furniture

- Construction

- Interior Decoration

By Region:

-

North America

- U.S.

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

-

Latin America

- Brazil

- Mexico

- Argentina

-

Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Invest in Premium Global Insights @ https://www.towardspackaging.com/price/5485

If you have any questions, please feel free to contact us at sales@towardspackaging.com

About Us

Towards Packaging is a leading global consulting firm specializing in providing comprehensive and strategic research solutions. With a highly skilled and experienced consultant team, we offer a wide range of services designed to empower businesses with valuable insights and actionable recommendations. We stay abreast of the latest industry trends and emerging markets to provide our clients with an unrivalled understanding of their respective sectors. We adhere to rigorous research methodologies, combining primary and secondary research to ensure accuracy and reliability. Our data-driven approach and advanced analytics enable us to unearth actionable insights and make informed recommendations. We are committed to delivering excellence in all our endeavours. Our dedication to quality and continuous improvement has earned us the trust and loyalty of clients worldwide.

Our Trusted Data Partners:

Precedence Research | Statifacts |Towards Automotive | Towards Healthcare | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire

For Latest Update Follow Us: https://www.linkedin.com/company/towards-packaging/

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.