Illinois’ Closing Protection Letters (CPLs) Help Protect against Wire Fraud Losses

Illinois legislature is holding the major title companies and underwriters responsible for creating a situation which makes it easier to steal funds

Gaia Title, Inc./William B. Blanchard, Esq. (N/A:N/A)

theft of closing funds or sale proceeds is not just an Illinois problem as losses are prevalent throughout the country. Courts in many states without CPL legislation are struggling ...”

ST. CHARLES, ILLINOIS, UNITED STATES, September 3, 2018 /EINPresswire.com/ -- Real Estate Attorney William B. Blanchard commented that the loss of funds due to wire transfer scams is now the Number 1 insurance claim category for title companies, escrow closing services and their attorney/agents. Cunning hackers can intercept and replace wire transfer instructions sent via email between the various parties to a real estate transaction and have now diverted over a billion dollars in the U.S. alone. Cyber thieves and unscrupulous closing agents make off with closing funds or proceeds belonging to buyers, sellers and lenders involved in real estate transaction at a rapidly increasing rate. Once gone, the money is virtually impossible to recover as it moves quickly through a maze of domestic and foreign accounts. Criminals are having greater success now than ever before, with a large percentage of thefts taking place in Northern Illinois.— William "Bill" Blanchard, Real Estate Lawyer

Mr. Blanchard explains that a "Closing Protection Letter” (CPL) which must now be used is a form of insurance issued by title insurance companies, insuring the actions of a particular attorney, agent, and/or closer in conducting a closing. The business of issuing title insurance commitments, owner’s and lender’s policies and administering closings in Illinois, underwent a dramatic change during the 1980s and ‘90s. Residential real estate contracts, following established practice in Northern Illinois, provide that seller’s attorney is responsible for selecting the title company to provide title and escrow settlement services for the transaction. Title companies, attempting to increase title orders, took steps to build a base of loyal attorneys in a competitive market by entering into independent agent agreements. These agreements provided financial rewards to attorney/agents through generous premium splits in exchange for placement of title orders."

By the turn of the Century major title companies engaged in fierce competition to attract new agents until now virtually all real estate attorneys have affiliated business arrangements with at least one title underwriter. As a result, attorney policy premium splits quickly reached 80-20%. Attorney revenue continued to grow rapidly as title companies had to increase premiums in order to remain a competitive attorney recruitment program.

Title companies dealt with lost revenue from lower premium margins by increasing the cost of other services such as escrow settlement and closings fees. After profits from providing ancillary services and products grew, attorneys and investors opened full service title agencies allowing them to enter the lucrative escrow and settlement business. Most new agencies were and continue to be undercapitalized and are staffed by real estate attorneys and administrative staff having little hands-on title experience. Mistakes before, during and after closings increased as did the volume of claims. Dissatisfied lenders complained as they had to look to undercapitalized independent agencies to recover losses resulting from title errors and mishandling or theft of escrow funds. The result was a reluctance amongst mortgage lenders to recognize these new agencies as approved vendors for their closings.

Facing a need to bolster lender’s confidence in agency closings, major title companies and underwriters issued CPLs indemnifying lenders and buyers from losses occurring during the closing process. Underwriters paid or settled claims quickly in order encourage lenders to accept the newer agencies as approved vendors.

At first, CPLs were issued by underwriters to lenders and later to buyers upon request. Later Illinois enacted statutory coverage for CPLs and provided that title company underwriters must issue letters to buyers and lenders in all residential real estate transactions. Then on September 1, 2011 the Illinois legislature added CPLs for sellers under the Act and provided for payment of fees to title companies that issued CPLs (Illinois Public Act 96-1454) (“Act”).

Attorney William Blanchard notes that “theft of closing funds or sale proceeds is not just an Illinois problem as losses are prevalent throughout the country. Courts in many states without CPL legislation are struggling to justify decisions finding title companies and individual agency or agent’s errors and omission insurers responsible to the parties to real estate transactions that fail due to loss of funds or to sellers whose proceeds end up somewhere other than intended. Other state courts have moved in the opposite directions finding underwriters and insurers free from legal responsibility for losses.”

Even though millions of dollars are being hijacked by unscrupulous closing agents, attorneys and hackers, there are no appellate or supreme court cases on the issue of title insurance company responsibility for loss due to fake wire transfer instructions involving CPLs. Statutory defenses are provided in the Act, but for now it appears that underwriters are accepting claims under CPLs with a reservation of right to deny the claims. Therefore, if buyer, lender or seller closing funds are misappropriated and the closing does not occur, insurers are still settling claims very early in the process to prevent courts from interpreting issuer’s liability under the Act. The obvious desire not to litigate may be realization that it would be rare for a claim of diversion of funds to result from settlement actions by closing agents or attorney/agents who were completely free from negligence, error, fraud, or intentional taking.

Mr. Blanchard concludes that “the language of the Illinois Act makes it clear that the legislature is holding the major title companies and underwriters responsible for creating a situation which makes it easier for unscrupulous parties to steal funds and will now hold insurers strictly responsible for the damages.”

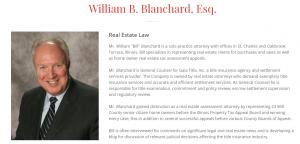

About William B. Blanchard, Real Estate Attorney

Bill Blanchard is a solo practice attorney with offices in St. Charles and Oakbrook Terrace, Illinois. He specializes in representing real estate clients for purchases and sales as well as home owner real estate tax assessment appeals. He is also General Counsel for Gaia Title, Inc. a title insurance agency and settlement services provider. The Company is owned by real estate attorneys who demand exemplary title insurance services and accurate and efficient settlement services. As General Counsel he is responsible for title examination, commitment and policy review, escrow settlement supervision and regulatory review.

LinkedIn: https://www.linkedin.com/in/william-bill-blanchard-080a48b/

Listing in Attorney Directory: https://www.lawyer.com/william-byron-blanchard.html

Facebook: https://www.facebook.com/blanchardlawgroup/

Attorney Directory: https://solomonlawguild.com/william-b-blanchard%2C-esq

Blog: https://williamblanchardblog.blogspot.com/

More information:

There are numerous news reports about this type of scam elsewhere in the U.S., for example:

http://www.chicagotribune.com/classified/realestate/ct-re-1105-kenneth-harney-20171030-story.html

http://time.com/money/5062964/this-sneaky-home-buying-scam-is-on-the-rise-heres-how-to-spot-it/

https://abc7chicago.com/realestate/wired-away-couple-loses-life-savings-during-home-purchase/2630496/

The Illinois Statutory CPL now reads as follows:

Illinois Agent Issued Seller Closing Protection Letter

7/19/2018

[…] Transaction File Number (hereafter, “the Real Estate Transaction”): Buyer/Borrower:

Property Address:

Loan Number:

Name of Issuing Agent or Approved Attorney ("title insurance agent"):

Re: Seller Closing Protection Letter

Dear Sir or Madam:

___________________ Title Insurance Company (the “Company”) agrees, subject to the Conditions and Exclusions set forth below, to reimburse you for actual loss not to exceed the amount of the settlement funds deposited with the title insurance agent and incurred by you, the Seller/Lessor in connection with the closing of the Real Estate Transaction conducted by the title insurance agent of the Company provided:

(A) A title insurance policy of the Company is issued in connection with the closing of the Real Estate Transaction;

(B) You are to be the (i) Seller of an interest in land, or (ii) Lessor of an interest in land; and

(C) The aggregate of all funds you transmit to, or are to receive from the title insurance agent for the Real Estate Transaction does not exceed $2,000,000.00 on a nonresidential transaction; and provided the loss arises out of:

1. Failure of the title insurance agent to comply with your written closing instructions to the extent that they relate to (a) the status of the title to that interest in land or including the obtaining of documents and the disbursement of funds necessary to establish the status of title, or (b) the obtaining of any other documents, specifically required by you, but only to the extent the failure to obtain the other documents affects the status of the title to that interest in land and not to the extent that your instructions require a determination of the validity, enforceability or the effectiveness of the other documents, or

2. Fraud, dishonesty, or negligence of the title insurance agent in handling funds or documents in connection with closings to the extent that the fraud, dishonesty, or negligence relates to the status of the title to the interest in land or, in the case of a Seller/Lessor, to the extent that the fraud, dishonesty, or negligence relates to funds paid to the Seller/Lessor or on behalf of the Seller/Lessor.

Conditions and Exclusions:

1. The Company will not be liable for loss arising out of:

A. Failure of the title insurance agent to comply with your written closing instructions which require title insurance protection inconsistent with that set forth in the title insurance binder or commitment issued by the Company. Instructions which require the removal of specific exceptions to title or compliance with the requirements contained in the binder or commitment shall not be deemed to be inconsistent.

B. Loss or impairment of your funds in the course of collection or while on deposit with a bank due to bank failure, insolvency or suspension, except as shall result from failure of the title insurance agent to comply with your written closing instructions to deposit the funds in a bank which you designated by name.

C. Defects, liens, encumbrances, mechanics' and materialmen's liens, or other matters in connection with the Real Estate Transaction if it is a sale, lease or loan transaction except to the extent that protection against those defects, liens, encumbrances or other matters is afforded by a policy of title insurance not inconsistent with your closing instructions.

D. Fraud, dishonesty or negligence of your employee, agent, attorney, broker, buyer/borrower/lessee, borrower’s lender or warehouse lender.

E. Your settlement or release of any claim without the written consent of the Company.

F. Any matters created, suffered, assumed or agreed to by you or known to you.

G. The title insurance agent of the Company acting as a Qualified Intermediary/Accommodator pursuant to IRC 1031, Like Kind Exchanges. However, the Company is liable for the acts or omissions of the title insurance agent pursuant to the coverage’s afforded by this Closing Protection Letter if the title insurance agent fails to follow written instructions directing the disbursement of exchange funds to a third party Qualified Intermediary/Accommodator. The terms and conditions of this Closing Protection Letter extend only to the disbursement of exchange funds to a designated Qualified Intermediary/Accommodator disclosed in written instructions and not to the subsequent acquisition of the replacement property as defined in IRC 1031, Like Kind Exchanges.

2. When the Company shall have reimbursed you pursuant to this Closing Protection Letter it shall be subrogated to all rights and remedies which you would have had against any person or property had you not been so reimbursed. Liability of the Company for such reimbursement shall be reduced to the extent that you have knowingly and voluntarily impaired the value of this right of subrogation.

3. The title insurance agent is the Company’s agent only for the limited purpose of issuing title insurance policies. The title insurance agent is not the Company’s agent for the purpose of providing other closing or settlement services. The Company’s liability for your losses arising from closing or settlement services is strictly limited to the protection expressly provided in this Closing Protection Letter. Any liability of the Company for loss does not include liability for loss resulting from the negligence, fraud or bad faith of any party to the Real Estate Transaction other than the tile insurance agent pursuant to this Closing Protection Letter; the lack of creditworthiness of any borrower connected with the Real Estate Transaction, or the failure of any collateral to adequately secure a loan connected with the Real Estate Transaction. However, this letter does not affect the Company’s liability with respect to its title insurance binders, commitments or policies issued by the title insurance agent in connection with the Real Estate Transaction

4. You must promptly send written notice of a claim under this letter to the Company at its principal office, First American Title Insurance Company, Attn: Claims National Intake Center, 1 First American Way, Santa Ana, CA 92707. The company is not liable for a loss if the written notice is not received within one year from the date of the closing. from the date of the closing.

Any previous Closing Protection Letter or similar agreement is hereby cancelled with respect to the Real Estate Transaction.

William B. Blanchard, Attorney at Law

Gaia Title, Inc.

(630) 560-4940

email us here

Federal Trade Commission (FTC), Money Wiring Scams, Federal Trade Commission