Robo Advisory Market Competition Analysis 2025: How Players Are Shaping Growth

The Business Research Company's Robo Advisory Global Market Report 2025 – Market Size, Trends, And Global Forecast 2025-2034

LONDON, GREATER LONDON, UNITED KINGDOM, December 3, 2025 /EINPresswire.com/ -- The Robo Advisory market1 is dominated by a mix of global fintech platforms and emerging digital wealth management providers. Companies are focusing on advanced algorithmic solutions, personalized digital customer experiences, and robust compliance frameworks to strengthen market presence and ensure regulatory adherence. Understanding the competitive landscape is key for stakeholders seeking growth opportunities and strategic partnerships

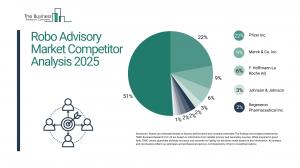

Which Market Player Is Leading the Robo Advisory Global Market2?

According to our research, Charles Schwab Corporation led global sales in 2024 with a 22% market share. The advisor services division of the company partially involved in the robo advisory market, provides custodial, trading, banking, and support services to registered investment advisors (RIAs), and their clients. It also provides retirement business services to RIAs and recordkeepers. It also offers a variety of educational materials to RIAs to expand and improve their knowledge and management skills.

How Concentrated Is the Robo Advisory Global Market?

The market is concentrated, with the top 10 players accounting for 50% of total market revenue in 2024. This concentration highlights the dominance of established financial institutions and digitally native investment platforms that leverage advanced algorithms, strong brand trust, and scalable digital ecosystems. Leading players such as The Charles Schwab Corporation, The Vanguard Group, and Fidelity Management & Research Company (FMR LLC) hold substantial market shares, driven by diversified investment products, hybrid advisory models, and robust client bases. Meanwhile, digital-first challengers like Betterment, Wealthfront, and Acorns continue to attract tech-savvy investors through automation, low-cost portfolios, and user-friendly mobile platforms. As competition intensifies, the market is expected to witness deeper integration of AI-driven personalization, ESG investment options, and cross-platform financial planning tools, enabling major players to consolidate their leadership while fostering innovation across emerging fintech entrants.

• Leading companies include:

o The Charles Schwab Corporation (22%)

o The Vanguard Group, Inc. (9%)

o Fidelity Management & Research Company (FMR LLC) (6%)

o Empower Personal Wealth (Personal Capital Corporation) (3%)

o Betterment Holdings Inc (2%)

o SoFi Investment (2%)

o Wealthfront Inc. (2%)

o BlackRock Inc. (1%)

o M1 Finance (1%)

o Acorns Grow Incorporated (1%)

Request a free sample of the Robo Advisory Global Market report

https://www.thebusinessresearchcompany.com/sample_request?id=5810&type=smp

Which Companies Are Leading Across Different Regions?

• North America: Charles Schwab & Co., Inc.; Revolut Ltd.; Ally Invest Managed Portfolios (offered by Ally Financial Inc.); Betterment LLC; Acorns Advisors, LLC; Wealthfront Advisers LLC; Empower Personal Wealth, LLC (formerly Personal Capital Corporation); Acorns Grow, Inc.; Wealthsimple Financial Corp.; Wealthsimple Invest (operated by Wealthsimple Inc.); BMO Smartfolio (offered by BMO Nesbitt Burns Inc.); Qtrade Guided Portfolios (offered by Credential Qtrade Securities Inc.); Justwealth Financial Inc.; Questwealth Portfolios (offered by Questrade Wealth Management Inc.); Nest Wealth Asset Management Inc.; and Smart Money Capital Management Inc are some of the leading companies in this region.

• Asia Pacific: Orowealth Investment Management Pte Ltd, Bambu Holdings Pte Ltd, Groww Wealth Technologies Pvt Ltd, Ant Group Co., Ltd., Wealthfront Inc. (China operations), Lufax Holding Ltd, JD Finance America Corporation, Futu Securities (Hong Kong) Limited, HDFC Securities Limited, Huatai International Financial Holdings Company Limited, Douugh Limited, InCred Financial Services Pvt Ltd, Waterfield Advisors, Manulife Global Fund Limited, Mitsubishi UFJ Financial Group, WealthNavi Inc., Ant Group Co., Ltd., Syfe Pte Ltd, Bibit Tumbuh Sempurna, Hana Financial Group Inc., InvestSMART Limited, Scripbox India Private Limited, DBS Bank India Limited, Bluevisor Inc are some of the leading companies in this region.

• Western Europe: AssetBuilder LLC, Ally Financial Inc., Axos Financial, Inc., Scalable Capital Limited, flatexDEGIRO AG, JPMorgan Chase & Co., Raisin GmbH, National Westminster Bank Plc, quirin bank AG, Lloyds Banking Group plc, Santander Group, BNP Paribas S.A., Kingswood Group PLC, HSBC Holdings plc, Deutsche Bank AG, Sparkassen-Finanzgruppe, Personal Capital Corporation, M&G plc, Moneyfarm Limited, Acorns Grow Incorporated, T. Rowe Price Group, Inc., Ginmon Vermögensverwaltung GmbH, Invesco Ltd., WisdomTree Investments, Inc., Direxion Shares ETF Trust, Revolut Ltd, Amundi Asset Management SA, and Privé Technologies are some of the leading companies in this region.

• Eastern Europe: Fondee AG, Erste Bank Hungary Zártkörűen Működő Részvénytársaság, Crystal Finance LLC, De Vere Group Ltd, Sberbank of Russia, Aton LLC, BrokerCreditService Financial Group, Aion Bank NV, Revolut Ltd, Portu Invest Oy, ING Group N.V., inbestMe Robo Advisor S.L., and eToro Group Ltd are some of the leading companies in this region.

• South America: Alpha Ledger, Renda Fixa, Start Investimentos, Monetus, Magnetis, Fintual, and Quienaare some of the leading companies in this region.

What Are the Major Competitive Trends in the Market?

• Integrating AI And Premium Services is transforming automated portfolio management, AI-driven insights, and premium financial services

• Example: Robinhood Markets Inc (March 2025) a new robo-advisor platform offering automated, actively managed portfolios of stocks and ETFs (exchange-traded funds) with low, capped fees.

• These innovations prevent tailors allocations based on risk tolerance and time horizon, using quantitative and qualitative analysis for portfolio construction.

Which Strategies Are Companies Adopting to Stay Ahead?

• Enhancing user experience through mobile apps and real-time analytics dashboards

• Expanding algorithm capabilities to offer personalized investment solutions

• Increasing partnerships with financial institutions to broaden client reach

• Integrating advanced AI and machine learning for improved portfolio optimization

Access the detailed Robo Advisory Global Market report here:

https://www.thebusinessresearchcompany.com/report/robo-advisory-global-market-report

Learn More About The Business Research Company3

The Business Research Company (www.thebusinessresearchcompany.com) is a leading market intelligence firm renowned for its expertise in company, market, and consumer research. We have published over 17,500 reports across 27 industries and 60+ geographies. Our research is powered by 1,500,000 datasets, extensive secondary research, and exclusive insights from interviews with industry leaders.

We provide continuous and custom research services, offering a range of specialized packages tailored to your needs, including Market Entry Research Package, Competitor Tracking Package, Supplier & Distributor Package and much more.

Disclaimer: Please note that the findings, conclusions and recommendations that TBRC Business Research Pvt Ltd delivers are based on information gathered in good faith from both primary and secondary sources, whose accuracy we are not always in a position to guarantee. As such TBRC Business Research Pvt Ltd can accept no liability whatever for actions taken based on any information that may subsequently prove to be incorrect. Analysis and findings included in TBRC reports and presentations are our estimates, opinions and are not intended as statements of fact or investment guidance.

Contact Us:

The Business Research Company

Americas +1 310-496-7795

Europe +44 7882 955267

Asia & Others +44 7882 955267 & +91 8897263534

Email: info@tbrc.info

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Oliver Guirdham

The Business Research Company

+44 7882 955267

info@tbrc.info

Visit us on social media:

LinkedIn

Facebook

X

1 https://www.thebusinessresearchcompany.com/report/robo-advisory-global-market-report

2 https://www.thebusinessresearchcompany.com/report/robo-advisory-global-market-report

3 https://www.thebusinessresearchcompany.com/