Employers Can Now Offer Bitcoin in Their Company 401K Plan

DAIM offers a diversified 401k option for businesses and employees that includes direct Bitcoin exposure.

NEWPORT BEACH, CA, USA, September 27, 2022 /EINPresswire.com/ -- As an employer are you doing everything you can to attract the best and the brightest? One of the main things employees look for in a potential employer is how attractive their benefits are. Income is important but it is not everything. A total compensation package that includes attractive benefits is also the key to landing good employees.What if there was a way to provide increased benefits without incurring any marginal cost as an employer? DAIM thinks that their unique 401k plan provides that answer. The plan includes allocations to Bitcoin at 1%, 5%, and 10% which are done within a low cost, diversified portfolio of index funds.

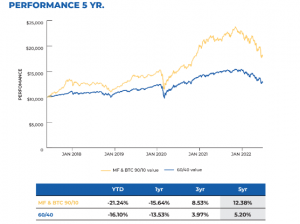

The important distinction here is obviously Bitcoin. Assuming contribution amounts are held constant, a portfolio with a modest 10% allocation to Bitcoin can see a participant increase the value of their retirement holdings considerably. While Bitcoin is an inherently volatile asset, the volatility of a portfolio does not create undue risk for the participant over long holding periods. Bitcoin has not had a 5 year period where it lost value, which is important to consider for plan participants with decades until retirement.

Founder Bryan Courchesne is confident that Bitcoin exposure is the key to setting up employees for retirement. "The investing landscape is looking pretty bleak right now and it can have a negative cognitive effect on plan participants who may feel that suspending contributions or not participating at all is a smart move. In reality forward returns after large drawdowns are very attractive for investors, especially those with long time horizons. No asset has a more attractive risk/return profile, after a large selloff, than Bitcoin. Now is the time to add, even in your 401k."

The plan differs from other managers who may try and gain BTC exposure through derivatives or stock of a company, like Microstrategy, that hold a lot of Bitcoin on their balance sheet. The Bitcoin in this plan is purchased on exchange through Gemini LLC, a leading US cryptocurrency exchange. This provides participants exposure that is free of tracking error. Tracking error occurs when the return of a proxy investment differs from the underlying being tracked. For an asset that trades 24/7 like Bitcoin, using instruments that are constrained by traditional market hours and other external factors can greatly erode investor wealth over time. DAIM feels that the ability to get this pure exposure is a benefit that shouldn't be overlooked by employers in a competitive hiring market. Courchesne concluded "Any time Bitcoin has sold off 75%+, forward returns for people with pure exposure have generated immense alpha for hodlers. Providing this exposure to companies sponsoring defined contribution plans allows employees to better prepare for retirement in a way that is cheap and streamlined."

DAIM has worked with companies to create new plans and transfer existing ones. Interested parties are encouraged to call them at 949-298-7582, email HQ@DAIM.io or visit at www.DAIM.io for more information.

HQ

DAIM

+1 949-298-7582

email us here

Visit us on social media:

Twitter

LinkedIn