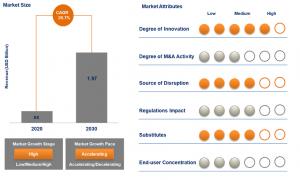

Global electric mobile crane market is projected to reach USD 1.97 billion by 2030, growing at a CAGR of 20.7%

"Global Electric Mobile Crane Market by Type, by Propulsion, by Power Source, by Capacity, by Application and by Regions - Forecast to 2030"

MILWAUKEE, WISCONSIN, USA, September 6, 2022 /EINPresswire.com/ -- The "Global Electric Mobile Crane Market by Type (Truck Mounted Crane, Trailer Mounted Crane and Crawler Crane), by Propulsion (Battery-Electric and Fuel-Electric Hybrid), by Power Source (Lithium-Ion Battery, Lead-Acid Battery and Others), by Capacity (5 ton, 10 to 20 ton, 21 to 30 ton and Above 30 ton), by Application (Construction, Mining and Excavation, Utility, Manufacturing, Transport/Shipping and Oil & Gas/Energy) and by Regions - Forecast to 2030" report has been added to Tersus Strategy’s offering.

Traditionally dependent on fossil fuels cranes are known as carbon-intensive equipment. New trends, such as battery-powered mobile cranes, are promising to disrupt that paradigm.

Companies operating in mining, construction, oil & gas, transportation industries are under pressure from stockholders, workers, local communities, consumers and governments to reduce greenhouse gas emissions, reduce carbon footprints, improve air quality and protect the health and safety of workers and people living nearby these industries. Adoption of battery-powered equipment to replace hydraulics is a factor expected to create potential opportunity for the prominent manufacturers operating in the market.

With this as a backdrop, battery-powered and fuel-electric hybrid mobile cranes are starting to replace cranes with diesel engines and equipment with electric motors is starting to replace those using hydraulics.

Recent, substantial advancements in battery performance and cost, global and local environmental concerns, and better and more available charging technologies have also contributed to the shift. This evolution is top of mind for all executives in the application industries, but it seems that less attention to vehicle electrification is coming from heavy cranes, despite the sector’s large and diverse fleet of cranes and set of applications.

Request detailed sample of this study: https://tersusstrategy.com/product/global-electric-mobile-crane-market-2022-2030/

Construction segment, by application, is projected to be the largest market during the forecast period: The construction segment accounted for the largest revenue share of xx% in 2021 and is anticipated to maintain its lead over the forecast period. Ever more stringent regulations relating to air purity from local authorities and governments are accelerating the trend of zero emissions construction sites.

Awareness of more ecologically sound drive systems is also rising in construction machinery – with electrical drive units becoming more and more common on construction sites.

Based on region, North America is expected to account for the largest share of the global electric mobile cranes market by 2030: The North American market is expected to be the largest region in terms of market share during the forecast period, especially the US. The growth of the US market is driven primarily by the environmental protection measures, with the upcoming stringent emission norms for fuel economy in the country, and local companies are making efforts to manufacture electric and hybrid cranes for the domestic market.

Moreover, companies are developing advanced solid-state battery technology with the aim to minimize drawbacks of the conventional battery types are further expected to drive the growth for the electric mobile cranes in the US.

For more information about this report visit: https://tersusstrategy.com/product/global-electric-mobile-crane-market-2022-2030/

Key Topics Covered:

1. Report Scope

1.1. Market Segmentation and scope

1.2. Regional Scope

1.3. Estimates and forecast timeline

2. Market Research Methodology

2.1. Research methodology and design

2.2. Sample selection

2.3. Reliability and validity

3. Executive Summary

4. Market Analysis

4.1. Market size and growth rates

4.2. Market growth drivers, market dynamics and trends

4.3. Market scenarios and opportunity forecasts

4.4. Market constraints and challenges

4.5. Industry value chain analysis

4.6. Industry analysis – Porter’s

4.6.1. Threat of new entrants

4.6.2. Bargaining power of suppliers

4.6.3. Bargaining power of buyers

4.6.4. Threat of substitutes

4.6.5. Competitive rivalry

4.7. PEST analysis

4.7.1. Political/legal landscape

4.7.2. Economic landscape

4.7.3. Social landscape

4.7.4. Technological landscape

5. Market Breakdown – by Type

5.1. Introduction

5.2. Truck Mounted Crane

5.3. Trailer Mounted Crane

5.4. Crawler Crane

6. Market Breakdown – by Propulsion

6.1. Introduction

6.2. Battery-Electric

6.3. Fuel-Electric Hybrid

7. Market Breakdown – by Power Source

7.1. Introduction

7.2. Lithium-Ion Battery

7.3. Lead-Acid Battery

7.4. Others

8. Market Breakdown – by Capacity

8.1. Introduction

8.2. 5 ton

8.3. 10 to 20 ton

8.4. 21 to 30 ton

8.5. Above 30 ton

9. Market Breakdown – by Application

9.1. Introduction

9.2. Construction

9.3. Mining and Excavation

9.4. Utility

9.5. Manufacturing

9.6. Transport/Shipping

9.7. Oil and Gas/Energy

10. Market Breakdown – by Geography

10.1. North America

10.1.1. North America Electric Mobile Crane Market, 2022-2030

10.1.2. North America Electric Mobile Crane Market, by Type

10.1.3. North America Electric Mobile Crane Market, by Propulsion

10.1.4. North America Electric Mobile Crane Market, by Power Source

10.1.5. North America Electric Mobile Crane Market, by Capacity

10.1.6. North America Electric Mobile Crane Market, by Application

10.1.7. North America Electric Mobile Crane Market, by Country

10.1.7.1. U.S.

10.1.7.2. Canada

10.1.7.3. Mexico

10.2. South America

10.2.1. South America Electric Mobile Crane Market, 2022-2030

10.2.2. South America Electric Mobile Crane Market, by Type

10.2.3. South America Electric Mobile Crane Market, by Propulsion

10.2.4. South America Electric Mobile Crane Market, by Power Source

10.2.5. South America Electric Mobile Crane Market, by Capacity

10.2.6. South America Electric Mobile Crane Market, by Application

10.2.7. South America Electric Mobile Crane Market, by Country

10.2.7.1. Brazil

10.2.7.2. Chile

10.2.7.3. Peru

10.2.7.4. Colombia

10.2.7.5. Argentina

10.3. Europe

10.3.1. Europe Electric Mobile Crane Market, 2022-2030

10.3.2. Europe Electric Mobile Crane Market, by Type

10.3.3. Europe Electric Mobile Crane Market, by Propulsion

10.3.4. Europe Electric Mobile Crane Market, by Power Source

10.3.5. Europe Electric Mobile Crane Market, by Capacity

10.3.6. Europe Electric Mobile Crane Market, by Application

10.3.7. Europe Electric Mobile Crane Market, by Country

10.3.7.1. UK

10.3.7.2. Germany

10.3.7.3. France

10.3.7.4. Russia

10.3.7.5. Italy

10.3.7.6. Sweden

10.3.7.7. Poland

10.4. Asia-Pacific

10.4.1. APAC Electric Mobile Crane Market, 2022-2030

10.4.2. APAC Electric Mobile Crane Market, by Type

10.4.3. APAC Electric Mobile Crane Market, by Propulsion

10.4.4. APAC Electric Mobile Crane Market, by Power Source

10.4.5. APAC Electric Mobile Crane Market, by Capacity

10.4.6. APAC Electric Mobile Crane Market, by Application

10.4.7. APAC Electric Mobile Crane Market, by Country

10.4.7.1. China

10.4.7.2. India

10.4.7.3. Japan

10.4.7.4. Singapore

10.4.7.5. South Korea

10.4.7.6. Australia

10.4.7.7. Indonesia

10.5. Middle East & Africa

10.5.1. MEA Electric Mobile Crane Market, 2022-2030

10.5.2. MEA Electric Mobile Crane Market, by Type

10.5.3. MEA Electric Mobile Crane Market, by Propulsion

10.5.4. MEA Electric Mobile Crane Market, by Power Source

10.5.5. MEA Electric Mobile Crane Market, by Capacity

10.5.6. MEA Electric Mobile Crane Market, by Application

10.5.7. MEA Electric Mobile Crane Market, by Country

10.5.7.1. South Africa

10.5.7.2. Congo

10.5.7.3. Zambia

10.5.7.4. UAE

10.5.7.5. Saudi Arabia

10.5.7.6. Israel

11. Competitive Landscape

11.1. Company Market Positioning

11.2. Company Geographical Presence Analysis

11.3. Market Revenue Share Analysis (%), by Leading Players

12. Company Profiles

• Company Overview

• Financial Performance

• Product Benchmarking

• Recent Developments

12.1. Fassi gru

12.2. Hiab

12.3. Konecranes, Inc.

12.4. Liebherr Group

12.5. Palfinger AG

12.6. Sany Group

12.7. Spierings Mobile Cranes

12.8. Tadano Ltd.

12.9. Valla (Manitex)

12.10.XCMG

12.11.Zoomlion Heavy Industry NA, Inc.

For more information about this report visit: https://tersusstrategy.com/product/global-electric-mobile-crane-market-2022-2030/

Kevin Matthew

Tersus Strategy

+1 414-882-8941

info@tersusstrategy.com