Setting Up LLC vs DBA

There are different business structures that you can choose from, and it can be tough to decide which is right for you. Should I Set Up DBA or LLC?

Understanding the basics helps when trying to decide whether to get an LLC or DBA.”

NEWPORT BEACH, CALIFORNIA, UNITED STATES, September 2, 2022 /EINPresswire.com/ -- There are different business structures that individuals can choose from, and it can be tough to decide which is right for a small business. Understanding the basics helps when trying to decide whether to get an LLC or DBA.— Brandon Parham

LLC (limited liability company) is a legal entity that protects assets if a business is sued. If an LLC is sued, assets like a car or home will be protected. DBA is a way to operate a business under a different name. A business might choose to do this if wanting to brand business differently. DBAs do not offer the same asset protection as an LLC, if the business is sued, personal assets could be at risk.

Pros of DBA and LLC

Advantages of LLC vs DBA

Pros of DBA

DBA asset protection – If a business is sued, it is at risk, not personal assets. This is an advantage of DBA.

DBA helps businesses look Ligitmate– A DBA can make a business look established and professional to potential clients.

DBA saves tax money – A LLC or sole proprietorship can save money on taxes by filing as a DBA. This is a significant advantage for small startup companies.

Pros of LLC

Limited Liability – The advantage of an LLC is its structure offers limited liability protection to its owners. The owners/members of an LLC do not have personal liability for the debts of the business. This is a big advantage over other company structures, like sole proprietorships and partnerships. In these structures, owners carry the liability for the debts of the business.

Flexibility – LLC offers more flexibility compared to other business structures. LLC members can organize an LLC as a partnership, limited liability partnership, or corporation. This flexibility allows Limited Liability Companies to adapt to the changing economic and personal needs.

Tax Haven – LLC offers tax benefits to each of its members. An LLC can opt to have the LLC taxed as a corporation or partnership. LLCs to save on taxes.

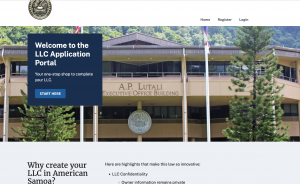

Location - Business owners can form an LLC in any State or Territory in the United States. American Samoa is the new hotspot for LLCs in the USA.

Cons of LLC and DBA

Disadvantages of LLC and DBA

Disadvantages of DBA

DBA structure a business is not a legal entity.

DBA doesn’t offer any personal liability protection.

DBA can be harder to register and maintain in many states.

Cons of LLC

LLCs can be more expensive to form than other business entities.

LLCs have self-employment tax.

LLCs may have a harder time raising capital.

What is the best option for small Businesses?

Business entities must choose when starting a business, the two of the most popular options are LLCs and DBAs.

There are differences between LLCs and DBAs. LLCs offer personal limited liability protection to their members, DBAs do not. If an LLC is sued, the court can only go after business assets. DBA assets are at risk if a business is sued.

LLCs are taxed as pass-through entities, meaning the business is not taxed. The owners are taxed on their share of the profits based on State tax laws. DBA are taxed as sole proprietorships, meaning the business is taxed on its company profits.

Which is the most suitable between LLCs and DBAs?

It depends! An LLC is a way to go if you want personal liability protection and privacy. DBA may be better if you’re looking for a simpler tax structure.

Turn DBA into LLC?

People who operate a business as a sole proprietor or with a DBA designation may wonder if it’s possible to convert their business to an LLC. Yes, it is possible to turn a DBA into an LLC. However, you must be able to follow the specific steps you must take to do so.

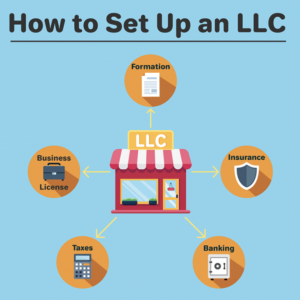

American Samoa has Ade the process of setting up an LLC simple and quick. Go to the official Government website at HTTPS://LLC.AS.GOV

doug gilmore

AmericaSamoa.com

email us here

Visit us on social media:

Twitter