2023 Pension Buyouts: How Interest Rates Are Affecting Lump Sum Offers

Rising interest rates will cause lump sum pension buyouts to be significantly lower in 2023. It may be time for some to move their retirement date to this year.

BINGHAM FARMS, MI, USA, August 5, 2022 /EINPresswire.com/ --

Anyone planning to retire in the next few years, may want to consider moving up their retirement date.

This is because interest rates are rising and, as a result, lump sum pension buyouts are decreasing significantly. So those planning on taking a pension buyout in 2023 may want to move up their retirement date to this year instead. Doing so could save them a lot of money.

It's almost impossible not to hear about how interest rates have been rising aggressively this year. We understand that has an effect on loan rates, especially mortgages, but that's not the only thing interest rates affect.

Lump sum pension amounts go up and down based on interest rates.

That's right. Not only does company position, salary, and years employed impact the lump sum calculation, so do interest rates.

How do interest rates impact the lump sum offer?

Basically the company figures out the monthly pension amount. How much their employee is going to get every month for the rest of their life. Then they use actuaries and mortality tables to estimate how long they believe that employee will live. Then they add up all the monthly payments they think they will pay that person.

For example, if they think their employee will live for 20 years in retirement, and their monthly payment is $5,000, they will do the following math: (20x12)x$5,000= $1,200,000.

If they give them $5,000 a month for 20 years they will end up paying them $1.2 million over that span.

And if the retiree doesn't spend that money, but invest it instead, it will be more. For example, if the interest rates are at 4% it could be close to $1.8 million after 20 years.

But the lump sum offer isn't going to be $1.8 million, is it? It won't even be the $1.2 million.

It will be much less. But how much less is based off interest rates.

So if we stick with that 4% example the buyout would be somewhere between $800,000 - $850,000.

If interest rates were 6% the lump sum would be between $650,000 - $700,000.

If interest rates were 2% the lump sum would be between $950,000 - $1,000,000.

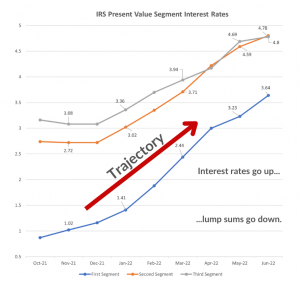

The rates that most companies use to calculate that number is based off the declared Minimum Present Value Segment Rates. They are released every month by the IRS.

As shown in the above examples, the lower the interest rates the higher the lump sum will be and vice versa. That's why there have been very large lump sum offers in the past few years - interest rates have been low.

But now they are on the climb. Which means lump sums are going to go down. At the rate they are climbing next year's lump sums could be some of the lowest we've seen in a long time.

But there is some good news.

The rising interest rates have no effect on this year's lump sum calculation. Typically the rates that are used in the calculation are based off of a month in the the previous year. Companies often use August, October, or November.

So people retiring this year will still take advantage of last year's low interest rate environment. However, those retiring next year may want to rethink their timing. As a matter of fact, they may want to move their schedule up to this year if they can.

Of course the lump sum offer is just one factor in determining a retirement date. It should not be the only consideration. Also, the lump sum isn't for everyone. Those opting for the monthly annuity payments don't need to worry about the interest rates, they have no effect on the monthly payments.

Of course there are risks both ways.

Those that take the lump sum payout will need to make sure that money lasts the rest of their life. If they spend too much too soon, or make bad investments, they could run out of money.

For those that take the monthly payment, the value of that money decreases as inflation increases, unless their company offers a cost of living increase, which is rare. Also, there is the chance that their company may become financially unstable in the future which could affect retiree pensions.

These are big decisions and, once they are made, cannot be undone.

It is important to consult with a financial professional and weigh all options. They can assist in understanding interest rates and how they will affect lump sum offers as well as what the monthly payments would be worth in today's dollars.

They can also help with understanding the risks of taking a lump sum vs. a monthly pension. And they can help develop an individualized retirement plan.

The most important thing is to be prepared to make the best decision at critical times.

Jeffrey Perry

Quest Financial USA

+1 248-599-1000

email us here

Visit us on social media:

Facebook

LinkedIn