Will This Year Be A Turning Point For The Autonomous Driving Industry?

Whether 2022 could be the turning point of the automatic driving industry depends on several factors.

BEIJING, CHINA, May 12, 2022 /EINPresswire.com/ -- In 2022, automakers around the world start actively working on autonomous driving projects. On April 20 this year, DeepRoute, one of the leading automatic driving full-stack solution providers, announced that 30 L4-level autonomous driving units equipped with DeepRoute-Driver 2.0 products were officially put into RoboTaxi operation. According to reports, it is expected that by 2024, vehicles equipped with DeepRoute L4-level autonomous driving solutions will start mass production and enter the market on a large scale.In June last year, Baidu Apollo, a self-driving platform that belongs to the Chinese tech giant Baidu and ARCFOX, a leading renewable energy vehicle company which belongs to the Chinese auto giant BAIC, officially released the Apollo Moon, a new generation of mass-produced shared unmanned vehicles, which is expected to land 1,000 shared unmanned vehicles within three years.

In addition, Audi has launched three SPHERE series models, which have advanced L4 autonomous driving capabilities and will become mass-produced models around 2025. In order to achieve mass production goals, manufacturers have established joint ventures, autonomous driving technology research institutes, etc., recruiting talents and investing a lot of R&D funds to conduct autonomous driving algorithm training.

For example, Aptiv, a traditional Tier 1 car supplier, and Hyundai Motor of South Korea established an autonomous driving joint venture to integrate related resources of the auto-driving start-up NuTonomy, with the aim of developing L4 and L5 autonomous driving technologies. The new joint venture is headquartered in the United States Boston and will provide a mass-produced self-driving system for RoboTaxi suppliers, fleet operators, and automakers in 2022.

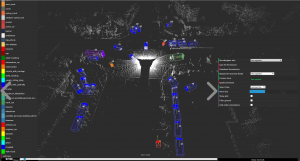

With the increasing attention to autonomous driving, related industries are also responding quickly. Innovusion, a representative Lidar manufacturer, has recently developed a large-scale automotive-level 1550nm Lidar. It is said that the price of Lidar will drop down to around $1,000 while the annual production reaches 100,000 units.

ByteBridge, a professional autonomous driving data annotation provider, recently announced that they provide consulting services for autonomous driving start-up teams. Automatic driving algorithm training and driving safety are directly related to the quality of training data. In addition, data labeling usually occupies a relatively high R&D cost. The earlier good data collection and labeling scheme plays a key role in cost savings and algorithm training efficiency. ByteBridge expressed that there is an obvious increase in related annotation requirements, and they will continue to actively respond to market demand.

According to data, the global autonomous driving market will reach US$162.9 billion in 2022, a year-on-year increase of about 14%. It is estimated that the global autonomous driving market will reach US$3,219.7 billion in 2030. In terms of self-driving data labeling, it is expected that by 2028, the US self-driving data labeling market will grow by 35%. As for autonomous driving equipment, it is expected that the global Lidar market will exceed US$10 billion in 2030.

In terms of production, the global autonomous vehicle market is expected to grow from 20.3 million in 2021 to 62.4 million in 2030, with a CAGR of 13.3%. By 2030, the sales of high-level autonomous vehicles (L3, L4) will account for 50% of the total passenger car.

Whether 2022 could be the turning point of the automatic driving industry depends on several factors: the first is the driving safety on the technical level, the second is to achieve mass production and reduce the cost sufficiently, and the third is the formal legalization of automatic driving. In addition to the driving safety, the cost, and the regulations, the development of automatic driving technology also needs the maturity of the whole ecosystem. The automatic driving needs the joint promotion and development of multiple industries such as OEMs, automatic driving technology companies, sensor manufacturers, and data service providers.

Anna QI

ByteBridge

support@bytebridge.io

Visit us on social media:

Facebook

Twitter

LinkedIn

Other