Anchor Advisors & Associates adds New Business Services Unit, Severall New Programs, and is Seeking New Talent

Take advantage of the new COVID-19 ERTC - Employee Retention Tax Credit while it’s still available. Check to see if you will qualify for a refund @ ERTC-dfy.com

These additions allow us to plan our Grand Reopening and provide hundreds of new part time & full time work opportunities over the next few years to help us fulfill our Mission to Make A Difference.”

GLEN ELLYN, IL, UNITED STATES, April 8, 2022 /EINPresswire.com/ -- Anchor Advisors & Associates (“AnchorAA”) announced a new Business Services unit & recruiting campaign due to changes in economic conditions, technology, and recent policy changes in anticipation of their upcoming Grand Reopening.— Joe Dorner Sr. Advisor & Advisory Board Member

The new unit AnchorBusinessSrvc.com was added to bring services to businesses that would bring value to them far in excess of their cost like audio, video, websites, (including mobile) web & mobile applications, (like mobile business cards) Social Media Posting, and introduce the new EFTC program through the recent ERTC Experts addition to their Association.

The new Business Services Unit could signal the possibility that Anchor Advisors & Associates (“AnchorAA”) may open once again to new Associates & Clients, since they have have been closed to new Associates & Clients since before 9-11 according to Joe Dorner, Sr. Advisor & Advisory Board Member.

“Our core group chose to leave the business and retire in the late spring of 2001 to avoid the mortgage meltdown we had seen coming for quite some time. At that time I 'fired' and 'retired' most of my personal Clients giving the balance to my Associates or partners who remained to wind down mortgage & real estate brokerage operations, and re-let excess office space. Overhead is not your friend. This was a few months before 9-11, which we did not see coming” Dorner said.

“Thankfully, since 9-11 most of us survived and went on to thrive, our only casualty was real estate brokerage office overhead, the people learned to pivot, some better than before. I spent a lot of time & money learning to adapt what we had in the physical world to the virtual world. A long, hard, time & money consuming process.” Dorner Quipped

“We've had a hard time mustering support from Sr. Associates & Advisors to to add more Associates & Clients ever since then. They are no longer 'hungry for more', they are satisfied with their current workload & income level that their current roster & deal flow provides to them.” Dorner said.

The Corona virus pandemic has impacted all of us and has been devastating to many businesses. The government has rolled out numerous programs to help individuals and businesses reduce the impact including expanded unemployment benefits, stimulus checks, PPP Loans, and the ERTC.

The ERTC was established by the Corona virus Aid, Relief, and Economic Security (CARES) Act, and provides a credit equal to 50 percent of qualified wages and health plan expenses paid after March 12, 2020 and before Jan. 1, 2021.

While the ERTC was created in the CARES act along with the PPP Loans - it is not a loan, there is no repayment.

The 2020 ETRC Program is a refundable tax credit of 50% of up to $10,000 in wages paid per employee from 3/12/20-12/31/20 by an eligible employer with a potential of up to $5,000 per employee.

In 2021 the ERTC increased to 70% of up to $10,000 in wages paid per employee per quarter for Q1, Q2, and Q3 with a potential of up to $21,000 per employee.

Most people have not heard much about it, and most accountants, banks, bookkeepers, and payroll services can't or won't deal with it for any number of reasons.

Anchor Advisors & Associates engaged ERTC Experts from one of the largest ERTC consulting firms in the United States with multiple accounting firms doing the work, all focused on refundable claims for Employee Retention Tax Credits, with a simple process requiring less than 15 Minutes of the client's time so clients can engage an EFTC done for you service to recover some of their payroll costs to offset some pandemic hardships.

“The addition of Anchor's Business Services Unit brings a B2B set of Programs to Anchor's primarily B2C Program lineup which will enhance the opportunity for new & existing Associates & new & existing Clients” according to Joe Dorner Sr. Advisor & Advisory Board Member.

“These additions allow us to plan our Grand Reopening and provide hundreds of new part time & full time work opportunities to help us fulfill our Mission to Make A Difference”, Dorner said.

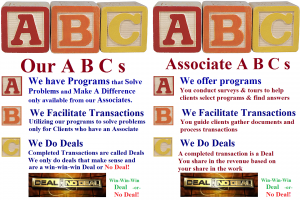

The original Anchor Model was simply 'We Provide Programs that can Make a Difference, We Facilitate Transactions, We Do Deals', the addition of the Anchor Business Services unit expands the number of Programs, and serves a broader audience, but does not substantially change the original model.

“The addition of Anchor's Business Services Unit brings a B2B set of Programs to Anchor's primarily B2C Program lineup which will enhance the opportunity for new & existing Associates & new & existing Clients” according to Joe Dorner Sr. Advisor & Advisory Board Member.

“These additions allow us to plan our Grand Reopening and provide hundreds of new part time & full time work opportunities to help us fulfill our Mission to Make A Difference”, Dorner said.

The original Anchor Model was simply 'We Provide Programs that can Make a Difference, We Facilitate Transactions, We Do Deals', the addition of the Anchor Business Services unit expands the number of Programs, and serves a broader audience, but does not substantially change the original model.

About - Anchor Advisors & Associates (AnchorAA)

Anchor Advisors & Associates is a private association of people, trusts, and other entities brought together in 1976 to work together in Financial Services, Marketing, & Real Estate.

The Association closed to new Associates & Clients a few months prior to 9-11 after well over 10,000 deals, worth several billion dollars. Associates & Clients continued to do their individual deals, most have retired, some are still doing deals into their 70s and 80s.

When the Association came together in 1976 the people, trusts, and other entities brought the collective experience of a couple of hundred years, What they have done is not important, what is important is what they can

Learn about Careers at Anchor @: https://anchoraa.evsuite.com/Careers

Learn about Anchor's Mission & Programs @: https://anchoraa.evsuite.com/mission

Joe Dorner

Anchor Advisors & Associates

+1 630-948-3700

Joe@AnchorAA.com

Visit us on social media:

Facebook

LinkedIn

Other

Anchor Advisors & Associates Program Intro