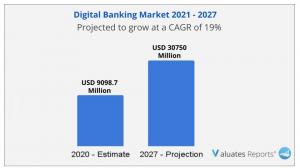

Digital Banking Market Size to Reach USD 30750 Million by 2027 at a CAGR of 19% | Valuates Reports

United States is the largest countries of digital banking in the world in the past few years and it will keep increasing in the next few years.

BANGALORE, KARNATAKA, INDIA, January 10, 2022 /EINPresswire.com/ -- Digital Banking MarketThe global Digital Banking market size is projected to reach US$ 30750 million by 2027, from US$ 9098.7 million in 2020, at a CAGR of 19.0% during 2021-2027.

Get Detailed Analysis of COVID-19 Impact on Digital Banking Market: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking_Market

Digital banking is a move to online banking, where banking services are provided over the Internet.Over the years, the market for digital channel platforms has evolved from online and mobile specific banking solutions to digital banking platforms that are not related to channels.

Digital banking platform vendors are now developing smart and smart banking platforms to meet the needs of Banks and customers. This includes the need for channel integration support and dynamic customer experience to make core banking easier to implement, as well as the devices customers want to use or are interested in and affordable.

Digital Banking Market Trends

• Digital banking also lets banks keep up-to-date systems and have improved customer experience and updated services at a low cost.

• Due to the global internet penetration & smartphones rises, banking institutes turn to digital platforms to offer their services. These institutes are working with fintech firms to develop more customer-centric products and offer a better customer experience. This, in turn, is expected to increase the digital banking market size.

• The rising threat of cyber-attacks is hampering digital banking adoption. Fending off cyber-attacks is one of the main obstacles banks across the globe face, given the delicate nature of the consumer details they possess. As more sophisticated and regular attacks are conducted by cybercriminals, the number of major data breaches is expected to rise over time.

• Digital banking allows banks to better understand their customers' needs and preferences through insights into the data. Now banks do not need to confine themselves to simple profiles of risk-based, demographic, and product ownership. They can access data on the psychographic and lifestyle, purchase data, geo-location data, and insights on platform preferences and use of social media. Advanced analytics helps banks to use data insights to assess not only purchase preferences but also the anticipated time of need. This digital banking feature is expected to heighten adoption.

• With their ever-changing preferences, customers, particularly the younger populace who are hyper-connected, conscious of choice, and have digital literacy, are swiftly inclined towards technology-oriented services. Those customers' adoption of digital banking services is boosting the overall growth of market size.

Digital Banking Market Share

• North America had a 37 percent market share in 2018, followed by Europe with 38 percent.The asia-pacific consumer market is growing even faster, however, with a market share of only 20 percent in 2018.

• In the rest of Asia Pacific, the Australian market is developing relatively well.In 2018, pc-based digital banking accounted for about 67% of the market share, and most of the products of the market belong to pc-based digital banking.

• In 2018, the market share of mobile digital banking was 33%. It is expected that the number of mobile digital banking will increase significantly in the next few years. Small and medium-sized enterprises (smes) are still the main application group in the market, accounting for about 59% of the market share in 2018.

• The development of digital Banks in China is relatively backward compared with that in Europe and the United States. Many large enterprises are still in the financing stage, and the market is expected to develop rapidly in the next few years.

• United States is the largest countries of digital banking in the world in the past few years and it will keep increasing in the next few years. North America market took up about 48.73% the global market in 2017, while Europe and Asia-Pacific were about 30.22%, 16.54%.

Browse The Table Of Contents And List Of Figures At: https://reports.valuates.com/market-reports/QYRE-Auto-4N473/global-digital-banking

Companies Covered

Major enterprises include SAP, Misys, Q2, Kony, Infosys, etc., with the top three accounting for about 45%

.

• SAP

With the Intelligent Enterprise framework, SAP provides integrated applications, intelligent technologies, and a digital platform to enable banks to better serve current customers and reach the underbanked to support financial inclusion.

• Q2

Q2 is a leading provider of secure, cloud-based digital solutions that ... finance and leasing companies (Alt-FIs), and financial technology companies (FinTechs)

• Urban FT

• Backbase

• Technisys

• Digiliti Money

• Innofis

• Mobilearth

• D3 Banking Technology

• Alkami

• Others.

Digital Banking Market Segmentation

By Type

• PC

• Mobile.

By Application

• Individual

• SME Digital Banking

• Corporate Digital Banking.

The development rate of SMEs is faster than that of large enterprises. By 2025, the market share of SMEs will expand to 60%.

By Region

• United States

• Europe

• China

• Japan

• Southeast Asia

• India

• Central & South America.

Inquire for Customised Data: https://reports.valuates.com/request/customisation/QYRE-Auto-4N473/Global_Digital_Banking_Market

Similar Reports:

1. Trade Surveillance Systems Market: https://reports.valuates.com/reports/ALLI-Manu-0Q70/trade-surveillance-systems

2. Payments Market: https://reports.valuates.com/market-reports/QYRE-Othe-1F198/global-payments

3. Contactless Payments Market: https://reports.valuates.com/market-reports/QYRE-Auto-39D2532/covid-19-impact-on-contactless-payments

4. Payment Processing Solutions Market: https://reports.valuates.com/market-reports/QYRE-Auto-25J944/global-payment-processing-solutions

5. Digital Banking Multichannel Integration Solutions Market: https://reports.valuates.com/market-reports/QYRE-Auto-27C2132/global-digital-banking-multichannel-integration-solutions

5. Mobile Digital Banking Market: https://reports.valuates.com/market-reports/QYRE-Othe-2G422/global-mobile-digital-banking

Valuates Sales

Valuates Reports

+1 425-388-2538

email us here

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.