Government To Promote A Cashless Economy Drives Mobile Payment Technologies Market At A Growth Rate Of 30% Through 2025

The Business Research Company’s Mobile Payment Technologies Global Market Report 2021: COVID-19 Growth And Change To 2030

LONDON, GREATER LONDON, UK, April 22, 2021 /EINPresswire.com/ -- Our reports have been revised for market size, forecasts, and strategies to take on 2021 after the COVID-19 impact: https://www.thebusinessresearchcompany.com/global-market-reports

The initiatives taken by governments to promote a cashless economy is a major driver for the growth of the mobile payment technologies market. A cashless economy is the one in which financial transactions are not done with banknotes or physical currency but via digital modes of payment. In this regard, government across the world along with the central banks are taking several initiatives to move towards a cashless economy, which ultimately leads to the growth of the global mobile payment market. According to a study conducted by MasterCard in 2019, the UAE has one of the fastest changing payment ecosystems because of a strong government leadership to promote electronic payments. For example, in May 2019, the Dubai Department of Finance launched a new digital payment wallet which is specially designed to pay government fees. This digital payment wallet facilitates smooth transfer of funds and promotes mobile payment technologies.

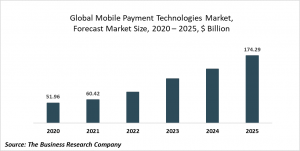

The global mobile payment technologies market size is expected to grow from $51.96 billion in 2020 to $60.42 billion in 2021 at a compound annual growth rate (CAGR) of 16.3%. The growth is mainly due to the companies resuming their operations and adapting to the new normal while recovering from the COVID-19 impact, which had earlier led to restrictive containment measures involving social distancing, remote working, and the closure of commercial activities that resulted in operational challenges. The mobile payment technologies market is expected to reach $174.29 billion in 2025 at a CAGR of 30.3%.

Read More On The Global Mobile Payment Technologies Market Report:

https://www.thebusinessresearchcompany.com/report/mobile-payment-technologies-global-market-report

The mobile payment technologies market covered in this report is segmented by solutions into point-of sale (PoS), in-store payments, remote payments. The mobile payment technologies market is also segmented by application into retail & E-commerce, healthcare, BFSI, enterprise, by PoS solutions into near-field communication (NFC) payments, sound-wave based payments, magnetic secure transmission (MST) payments, by in-store payments solutions into mobile wallets, quick response (QR) code payments, and by remote payments into internet payments, SMS payments, direct carrier billing, mobile banking.

Major players in the mobile payment technologies industry are PayPal, Inc., MasterCard, Bharti Airtel, Google, Inc. and Apple Inc.

Mobile Payment Technologies Global Market Report 2021: COVID-19 Growth And Change To 2030 is one of a series of new reports from The Business Research Company that provides mobile payment technologies market overview, forecast mobile payment technologies market size and growth for the whole market, mobile payment technologies market segments, and geographies, mobile payment technologies market trends, mobile payment technologies market drivers, restraints, leading competitors’ revenues, profiles, and market shares.

Request For A Sample Of The Global Mobile Payment Technologies Market Report:

https://www.thebusinessresearchcompany.com/sample.aspx?id=2523&type=smp

Here Is A List Of Similar Reports By The Business Research Company:

Digital Payments Global Market Report 2021: COVID-19 Growth And Change To 2030

https://www.thebusinessresearchcompany.com/report/digital-payments-global-market-report-2020-30-covid-19-implications-and-growth

Fintech Market - By Type Of Service (Payments, Wealth Management, Insurance, Personal Loans, Personal Finance, Fund Transfer, Others), By Technology (Mobile Commerce And Transfers, Robotic Process Automation, Data Analytics, Others), By Service Provider (Payment Processors, Securities Brokerages And Investment Firms, Banks, Non-Banking Financial Companies And Others), And By Region, Opportunities And Strategies – Global Forecast To 2030

https://www.thebusinessresearchcompany.com/report/fintech-market

Cards And Payments Market - By Type Of Product (Cards And Payments), By Type Of Cards (Credit, Debit, Charge And Prepaid Card), By End-User (B2B, B2C, C2B And C2C), By Type Of Institution (Banking And Non-Banking Institutions), And By Region, Opportunities And Strategies – Global Forecast To 2023

https://www.thebusinessresearchcompany.com/report/cards-and-payments-market

Interested to know more about The Business Research Company?

Read more about us at https://www.thebusinessresearchcompany.com/about-the-business-research-company.aspx

The Business Research Company is a market research and intelligence firm that excels in company, market, and consumer research. It has over 200 research professionals at its offices in India, the UK and the US, as well a network of trained researchers globally. It has specialist consultants in a wide range of industries including manufacturing, healthcare, financial services and technology.

Call us now for personal assistance with your purchase:

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Oliver Guirdham

The Business Research Company

+44 20 7193 0708

info@tbrc.info

Visit us on social media:

Facebook

Twitter

LinkedIn