Jianpu Technology (NYSE:JT) Survey: Impact of the New Round of Tightening Regulation on Real Estate Market is Spreading

Jianpu Technology (NYSE:JT)

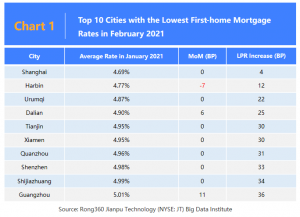

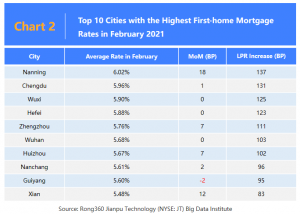

BEIJING, CHINA, March 7, 2021 /EINPresswire.com/ -- Ranking: Nanning regained the No.1 with first home mortgage rate being back over 6%In February 2021, the list for China’s top 10 cities with the lowest first-home mortgage rates remained unchanged. Among the top 10 cities with the highest first-home mortgage rate, Nanning regained the No.1 with first home mortgage rate back over 6%.

With a new round of regulations triggered, the mortgage rate is expected to rise further

Beginning in late January, a number of cities released signals of tightening mortgage markets. January is typically a month with sufficient mortgage loans for many banks. While this January, along with the rising mortgage rate, mortgage loans for these banks have been tightened and some even have to suspend their loan business, demonstrating the power of the concentrated regulation. For certain other regions where the mortgage rate and loan amount were not impacted, people working at banks stated the mortgage rate might increase near term.

The new round of regulations on home mortgages and increased mortgage rates had little relation to the adjustment of 5-year LPR. On February 20, The People’s Bank of China announced the latest LPR remains unchanged, while the impact of the regulation is spreading and there may be more regions to follow the rise in mortgage interest rates in the future.

Media Contact

Jianpu Technology

+86 10 8262 5755

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn