Dominant Cycles in Investment Managers’ Exposure to U.S. Equity Markets Indicate Impending Turnaround

Report Identifies Cycles that Have Accurately Predicted Major Market Turning Points Over the Last 15 Years

My cycles analysis shows that we have reached the composite cycle high, which suggests that a trend reversal in U.S. equity markets is imminent.”

FLOYDE, VA, USA, February 12, 2021 /EINPresswire.com/ -- The Foundation for the Study of Cycles (FSC) released a paper on February 1 suggesting that the current state of dominant cycles in the National Association of Active Investment Managers (NAAIM) Exposure Index indicate a possible reversal for U.S. equity markets.— Lars von Thienen, Board Member Foundation for the Study of Cycles

“The importance of analyzing sentiment cycles of active money managers plays a critical role in assessing financial risk,” said Lars von Thienen, author of the paper and FSC Board Member. “I have identified dominant cycles in the NAAIM Exposure Index over the past 15 years.”

A developer of algorithms and software for cycles recognition, von Thienen uses datasets that track moods or attitudes about financial assets and cyclic tools that decipher and track dominant cycles to analyze market trends. He incorporates this analysis into a larger risk management strategy.

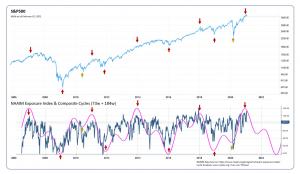

Tracking the NAAIM Exposure Index over the last 15 years, he found two dominant cycles. When combined the composite cycle indicated several key market turning points, including the 2007-2009, 17-month bear market, the 2009 bear market low, the end of a boom in early 2018, the start of the next market upswing beginning in early 2019, among others.

“My cycles analysis shows that we have reached the composite cycle high,” von Thienen said. “Which suggests that a trend reversal in U.S. equity markets is imminent.”

The report is available to read and download on the FSC blog.

About the FSC

Founded in 1941, the Foundation for the Study of Cycles (cycles.org) is a fellowship of scholars, scientists and nonprofessional investigators who share a passion for better understanding cycles and how they can be used to make the world a better place. In addition to identifying thousands of verified natural, social and financial cycles, the FSC has published Cycles Magazine since 1950, holds conferences, publishes reports, funds research and has developed software that has revolutionized the study of cycles. An international not-for-profit, the Foundation curates one of the world’s most extensive collections of research and statistical data.

Liz Gilbert

Foundation for the Study of Cycles

+1 415-269-8107

email us here

Visit us on social media:

Facebook

Twitter

LinkedIn